Financial Accounting Intro Concepts Meth/Uses

14th Edition

ISBN: 9781285595047

Author: Weil

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

help mw out here forl problems

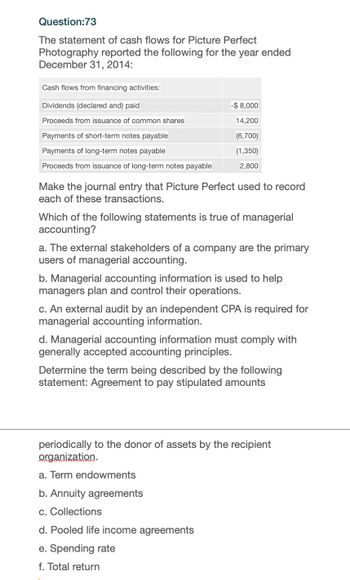

Transcribed Image Text:Question:73

The statement of cash flows for Picture Perfect

Photography reported the following for the year ended

December 31, 2014:

Cash flows from financing activities:

Dividends (declared and) paid

-$8,000

Proceeds from issuance of common shares

14,200

Payments of short-term notes payable

(6,700)

(1,350)

2,800

Payments of long-term notes payable

Proceeds from issuance of long-term notes payable

Make the journal entry that Picture Perfect used to record

each of these transactions.

Which of the following statements is true of managerial

accounting?

a. The external stakeholders of a company are the primary

users of managerial accounting.

b. Managerial accounting information is used to help

managers plan and control their operations.

c. An external audit by an independent CPA is required for

managerial accounting information.

d. Managerial accounting information must comply with

generally accepted accounting principles.

Determine the term being described by the following

statement: Agreement to pay stipulated amounts

periodically to the donor of assets by the recipient

organization.

a. Term endowments

b. Annuity agreements

c. Collections

d. Pooled life income agreements

e. Spending rate

f. Total return

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- solve all this problen=arrow_forwardchoose wisely and give correct answer for all questionarrow_forwardUse the following information for questions 2-9 Category Accounts payable Accounts receivable Accruals 2016 2017 34,500 37,500 96,000 102,000 13,500 11,250 Additional paid in capital Cash Common Stock@par value COGS Depreciation expense 187,500 204,000 6,000 16,800 10,500 11,550 109,500 144,000 18.000 19,500 Interest expense 13,500 13,800 Inventories 93,000 96,000 Long-term debt 112,500 116,250 Net fixed assets 315,000 ??? Notes payable 49,500 54,000 Operating expenses (excl. depr.) 42,000 52,500 Retained earnings Sales Taxes Net fixed assets in 2017 were $ 1) 331,750 2) 332,750 102,000 114,000 213,000 282,000 8,250 15,750 3) 333,750 4) 344,750 5) 345,750arrow_forward

- What is the firm's cash flow from financing?arrow_forwardThe following is an extract from the financial statements of Pompeii at 31 October: 20X7 20X6 $00 $000 Equity and liabilities: Share capital 120 80 Share premium 60 40 Retained earnings 85 68 265 188 Non-current liabilities: Bank loan 100 150 365 338 What Pompeii's net cash inflow or outflow from financing activities to include in the statement of cash flows for the year ended 31 October 20X7?arrow_forwardRequired information Skip to question [The following information applies to the questions displayed below.] In preparation for developing its statement of cash flows for the year ended December 31, 2024, D-Krug Solutions, Incorporated collected the following information: ($ in millions)Payment for the early extinguishments of long-term notes (book value: $62.0 million)$ 66.0Sale of common shares208.0Retirement of common shares130.0Loss on sale of equipment2.8Proceeds from sale of equipment11.2Issuance of short-term note payable for cash18.0Acquisition of building for cash11.0Purchase of marketable securities (not a cash equivalent)13.0Purchase of marketable securities (considered a cash equivalent)9.0Cash payment for 3-year insurance policy11.0Collection of note receivable with interest (principal amount, $19)21.0Declaration of cash dividends48.0Distribution of cash dividends declared in 202345.0 2. In D-Krug’s statement of cash flows, what were net cash inflows (or outflows)…arrow_forward

- Given the data in the following table, what was net cash flow from investing activities for 2023?arrow_forwardSTATEMENT OF CASH FLOW EXAMPLE Kerby Company has prepared the following Balance Sheets for 2023 and 2022. Cash 12/31/23 $ 56 12/31/22 $ 40 Accounts receivable 41 42 Fixed assets 579 465 Accumulated depreciation (170) (140) $506 $407 Accounts payable Mortgage payable Preferred stock $ 74 $ 60 20 181 Additional Paid-In Capital - preferred 70 Common stock Retained earnings 100 61 ២៩៩៩88 100 100 $506 $407 1. On 8/1/23, Kerby sold a fixed asset with a cost of $91 and book value of $66 for $67. 2. Retained Earnings was adjusted by dividends and net income only. 3. Net Income in 2023 was $80. a. Net Cash Provided by Operations is $ b. Net Cash Used by Investments is $ c. Net Cash Provided by Financing is $arrow_forwardDetermining Cash Flows from Financing Activities Nichols Inc. reported the following amounts on its balance sheet for equity: Common stock Retained earnings Required: Jan. 1 $105,000 376,750 Dec. 31 $162,000 455,490 Assume that, for the current year, Nichols did not retire any stock, it reported $94,300 of net income for 2019, and any dividends declared were paid in cash. Determine the amounts Nichols would report in the financing section of the statement of cash flows. Issuance of common stock Payment of cash dividendsarrow_forward

- Measures of liquidity, Solvency, and Profitability The comparative financial statements of Marshall Inc. are as follows. The market price of Marshall common stock was $ 70 on December 31, 2012. Marshall Inc. Comparative Retained Earnings Statement For the Years Ended December 31, 20Y2 and 20Y1 Retained earnings, January 1 Net income Dividends: On preferred stock On common stock Retained earnings, December 31 20Y2 $3,329,700 790,400 20Y1 $2,805,000 574,500 (9,800) (40,000) $4,070,300 (9,800) (40,000) $3,329,700 Marshall Inc. Comparative Income Statement For the Years Ended December 31, 2012 and 20Y1 Sales Cost of merchandise sold Gross profit Selling expenses Administrative expenses Total operating expenses Income from operations Other revenue and expense: 20Y2 20Y1 $5,340,680 $4,920,640 1,737,400 1,598,410 $3,603,280 $1,292,110 1,100,680 $3,322,230 $1,583,590 930,050 $2,392,790 $2,513,640 $1,210,490 $808,590 Other revenue 63,710 51,610 Other expense (interest) (376,000) (207,200)…arrow_forwardBrief Exercise 11-31 (Algorithmic) Determining Net Cash Flow from Financing Activities Madison Company reported the following information: Notes payable Common stock Retained earnings 12/31/2019 12/31/2018 $95,000 $75,000 120,000 20,000 80,000 36,000 Madison reported net income of $28,000 for the year ended December 31, 2019. In addition, Madison repaid $63,000 of the notes payable during 2019. Required: Compute net cash flow from financing activities. Use a minus sign to indicate negative cash flows (outflows).arrow_forwardCategory Prior Year Current Year Accounts payable ??? Accounts receivable 320,715 397,400 Accruals 40,500 33,750 Additional paid in capital 500,000 541,650 Cash 17,500 47,500 Common Stock 94,000 105,000 COGS 328,500 431,516.41 Current portion long-term debt 33,750 35,000 Depreciation expense 54,000 55,946.66 Interest expense 40,500 41,874.31 Inventories 279,000 288,000 Long-term debt 336,467.85 401,942.46 Net fixed assets 946,535 999,000 Notes payable 148,500 162,000 Operating expenses (excl. depr.) 126,000 161,499.58 Retained earnings 306,000 342,000 Sales 639,000 854,554.01 Taxes 24,750 48,384.56 ??? What is the current year's return on equity (ROE)? Submit Answer format: Percentage Round to: 2 decimal places (Example: 9.24%, % sign re rounded to 4 decimal places (ex: 0.0924))arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...

Accounting

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning