FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

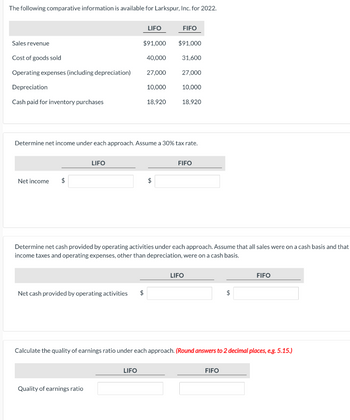

Transcribed Image Text:The following comparative information is available for Larkspur, Inc. for 2022.

LIFO

FIFO

Sales revenue

$91,000

$91,000

Cost of goods sold

40,000

31,600

Operating expenses (including depreciation)

27,000

27,000

Depreciation

10,000

10,000

Cash paid for inventory purchases

18,920

18,920

Determine net income under each approach. Assume a 30% tax rate.

Net income $

LIFO

FIFO

Determine net cash provided by operating activities under each approach. Assume that all sales were on a cash basis and that

income taxes and operating expenses, other than depreciation, were on a cash basis.

Net cash provided by operating activities

LIFO

FIFO

$

Calculate the quality of earnings ratio under each approach. (Round answers to 2 decimal places, e.g. 5.15.)

LIFO

Quality of earnings ratio

FIFO

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step 1: Define Net Income

VIEW Step 2: Calculation of the net income under each approach, as follows:

VIEW Step 3: Determination of the net cash provided by operating activities under each approach, as follows:

VIEW Step 4: Calculation of the quality of earnings ratio, as follows:

VIEW Solution

VIEW Step by stepSolved in 5 steps with 6 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Please show work in Excel.arrow_forwardThe following comparative information is available for Wildhorse Company for 2025. Sales revenue Cost of goods sold Operating expenses (including depreciation) Depreciation Cash paid for inventory purchases Your answer is partially correct. Net income $ eTextbook and Media * Your answer is incorrect. LIFO eTextbook and Media Net cash provided by operating activities * Your answer is incorrect. Determine net income under each approach. Assume a 30% tax rate. 18,200 Quality of earnings ratio Touthook and Media LIFO $92,000 35,000 26,000 LIFO 9,000 14,705 FIFO $92,000 Determine net cash provided by operating activities under each approach. Assume that all sales were on a cash basis and that income taxes and operating expenses, other than depreciation, were on a cash basis. 31,800 26,000 9,000 2.14 14,705 FIFO 23,940 LIFO Calculate the quality of earnings ratio under each approach. (Round answers to 2 decimal places, e.g. 5.15.) 39,005 FIFO FIFO 0.95 22,750arrow_forwardPrepare a common size income statement given the following information: Revenues = $100,000 COGS = $43,000 SG&A = $22,000 Depreciation = $10,000 Interest Owed = $5,000 Tax Rate = 40%arrow_forward

- Want Answerarrow_forwardOakdale Fashions, Inc.’s, 2021 income statement is reported below. (Use corporate tax rate of 21 percent for your calculations.) Oakdale Fashions, Inc., Income Statement for 2021 Net sales (all credit) $ 580,000 Less: Cost of goods sold 221,000 Gross profits $ 359,000 Less: Other operating expenses 96,000 EBITDA $ 263,000 Less: Depreciation and amortization 15,600 EBIT $ 247,400 Less: Interest 81,500 EBT $ 165,900 Less: Taxes Net income $ Determine the firm's 2021 tax liability. Tax liabilityarrow_forwardThe following table shows an abbreviated income statement and balance sheet for Quick Burger Corporation for 2022. INCOME STATEMENT OF QUICK BURGER CORPORATION, 2022 Net sales Costs Depreciation (Figures in $ millions) Earnings before interest and taxes (EBIT) Interest expense Pretax income $ 27,572 17,574 1,407 $ 8,591 522 8,069 Federal taxes (@ 21%) Net income 1,694 $ 6,375 BALANCE SHEET OF QUICK BURGER CORPORATION, 2022 (Figures in $ millions) Assets Current assets Cash and marketable securities Receivables Inventories Other current assets Total current assets Fixed assets Property, plant, and equipment Intangible assets (goodwill) Other long-term assets Total assets 2022 2021 Liabilities and Shareholders' Equity Current liabilities 2022 2021 $ 2,341 $ 2,341 Debt due for repayment 1,380 127 1,094 $ 4,942 1,340 Accounts payable 122 Total current liabilities $ 3,408 $ 3,408 $ 382 3,148 $ 3,530 621 $ 4,424 Long-term debt $ 24,682 2,809 2,988 $ 22,840 Other long-term liabilities 2,658…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education