FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

None

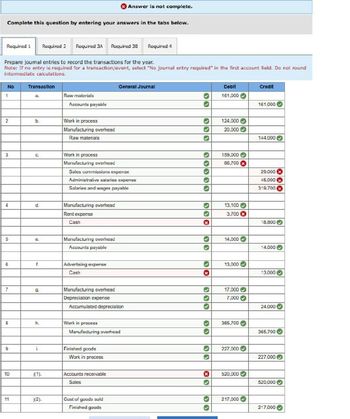

Transcribed Image Text:Answer is not complete.

Complete this question by entering your answers in the tabs below.

Required 1

Required 2 Required 3A Required 38

Required 4

Prepare journal entries to record the transactions for the year.

Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Do not round

intermediate calculations.

No

1

Transaction

Raw materials

Accounts payable

2

b.

3

C

4

d

Work in process

Manufacturing overhead

Raw materials

General Journal

Work in process

Manufacturing overhead

Sales commissions expense

Administrative salaries expense

Salaries and wages payable

Manufacturing overhead

Rent expense

Cash

c.

Manufacturing overhead

Accounts payable

f.

Advertising expence

Cash

|60|0

00000

Debit

161,000

Credit

161,000

124.000

20,000

144,000

159,000

66,700

29,000

45,000

319,700

13.100

3,700

*

18,800

00

08

14,000

14,000

13,000

13.000

7

g

Manufacturing overhead

G

17,000-

Depreciation expense

7,000 -

Accumulated depreciation

0

24,000

h.

Work in process

60

365,700

365,700

9

i

Manufacturing overhead

Finished goods

Work in process

30

227,000

227.000

10

j(1).

Accounts receivable

Sales

*

520,000

520,000

11

j(2).

Cost of goods sold

Finished goods

217,000

217,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- don't give answer in imarrow_forwardI need req. 3 And 5 Please Solve with Explanation and Do not give image formatarrow_forwardThe following are selected accounts and balances for Mergaronite Company and Hill, Inc., as of December 31, 2021. Several of Mergaronite's accounts have been omitted. Credit balances are indicated by parentheses. Dividends were declared and paid in the same period. Revenues Cost of goods sold Depreciation expense Investment income Retained earnings, 1/1/21 Dividends declared Current assets Land Buildings (net) Equipment (net) es Liabilities Common stock Additional paid-in capital Mergaronite Hill $ (594,000) $ (246,000) 266,000 104,000 NA 106,000 44,000 NA (888,000) (598,000) 140,000 36,000 210,000 696,000 316,000 94,000 510,000 142,000 212,000 240,000 (396,000) (310,000) (292,000) (38,000) (46,000) (922,000) Assume that Mergaronite acquired Hill on January 1, 2017, by issuing 6,600 shares of common stock having a par value of $10 per share but a fair value of $100 each. On January 1, 2017, Hill's land was undervalued by $20,000, its buildings were overvalued by $31,000, and equipment…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education