FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

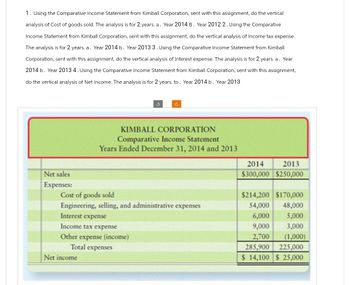

Transcribed Image Text:1. Using the Comparative Income Statement from Kimball Corporation, sent with this assignment, do the vertical

analysis of Cost of goods sold. The analysis is for 2 years. a. Year 2014 B. Year 2012 2. Using the Comparative

Income Statement from Kimball Corporation, sent with this assignment, do the vertical analysis of Income tax expense.

The analysis is for 2 years. a. Year 2014 b. Year 2013 3. Using the Comparative Income Statement from Kimball

Corporation, sent with this assignment, do the vertical analysis of Interest expense. The analysis is for 2 years. a. Year

2014 b. Year 2013 4. Using the Comparative Income Statement from Kimball Corporation, sent with this assignment,

do the vertical analysis of Net Income. The analysis is for 2 years. to. Year 2014 b. Year 2013

Net sales

Expenses:

3

Interest expense

Income tax expense

Other expense (income)

Total expenses

Net income

C

KIMBALL CORPORATION

Comparative Income Statement

Years Ended December 31, 2014 and 2013

Cost of goods sold

Engineering, selling, and administrative expenses

2014 2013

$300,000 $250,000

$214,200 $170,000

54,000

48,000

6,000 5,000

9,000

3,000

2,700

(1,000)

285,900

225,000

$ 14,100 $ 25,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Complete the comparative income statement and balance sheet for Logic Company. Note: Input all answers as positive values except decrease answers which should be indicated by a minus sign. Round your "percent" answers to the nearest hundredth percent.arrow_forwardThe Lancaster Corporation's income statement is given below. Sales Cost of goods sold Gross profit Fixed charges (other than interest) Income before interest and taxes Interest Income before taxes Taxes (35%) Income after taxes LANCASTER CORPORATION a. What is the times-interest-earned ratio? Note: Round your answer to 2 decimal places. Times interest earned Fixed charge coverage times b. What would be the fixed-charge-coverage ratio? Note: Round your answer to 2 decimal places. times $ 223,000 155,000 $ 68,000 33,100 $ 34,900 13,400 $ 21,500 7,525 $ 13,975arrow_forwardcalculate the fixed and variable components of the selling and administrative expenses by dividing the change in cost of the selling and administrative expenses between 2009 and 2010 to change in sales between 2009 and 2010 and use it to determine the fixed and variable components of the cost of the selling and administrative expenses . Saunders Corporation (amounts in millions of dollars) 2009 2010 Sales 8,296 8,871 Cost of Goods Sold (5,890) (6,290) Selling and Administrative Expenses (1,788) (1,714) Operating Income before Income Taxes 618 867arrow_forward

- please answer within the format by providing formula the detailed workingPlease provide answer in text (Without image)Please provide answer in text (Without image)Please provide answer in text (Without image)arrow_forwardPlease answer everything asap. I really need helparrow_forwardPlease provide correct answerarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education