Auditing: A Risk Based-Approach to Conducting a Quality Audit

10th Edition

ISBN: 9781305080577

Author: Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher: South-Western College Pub

expand_more

expand_more

format_list_bulleted

Question

Don't use AI

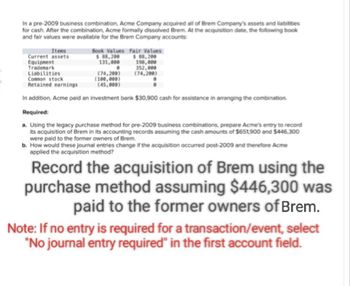

Transcribed Image Text:In a pre-2009 business combination, Acme Company acquired all of Brem Company's assets and liabilities

for cash. After the combination, Acme formally dissolved Brem. At the acquisition date, the following book

and fair values were available for the Brem Company accounts:

Items

Book Values Fair Values

Current assets

$ 88,200

$88,200

Equipment

131,000

198,000

Trademark

Liabilities

352,000

(74,200)

(74,200)

(100,000)

(45,000)

Common stock

Retained earnings

In addition, Acme paid an investment bank $30,900 cash for assistance in arranging the combination.

Required:

a. Using the legacy purchase method for pre-2009 business combinations, prepare Acme's entry to record

its acquisition of Brem in its accounting records assuming the cash amounts of $651,900 and $446,300

were paid to the former owners of Brem

b. How would these journal entries change if the acquisition occurred post-2009 and therefore Acme

applied the acquisition method?

Record the acquisition of Brem using the

purchase method assuming $446,300 was

paid to the former owners of Brem.

Note: If no entry is required for a transaction/event, select

"No journal entry required" in the first account field.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- In a pre-2009 business combination, Acme Company acquired all of Brem Company's assets and liabilities for cash. After the combination, Acme formally dissolved Brem. At the acquisition date, the following book and fair values were available for the Brem Company accounts: Items Current assets Equipment Trademark Liabilities View transaction list Book Values $ 88,400 131,000 Common stock Retained earnings In addition, Acme paid an investment bank $29,200 cash for assistance in arranging the combination. (74,400) (100,000) (45,000) Required: a. Using the legacy purchase method for pre-2009 business combinations, prepare Acme's entry to record its acquisition of Brem in its accounting records assuming the cash amounts of $668,400 and $457,400 were paid to the former owners of Brem. b. How would these journal entries change if the acquisition occurred post-2009 and therefore Acme applied the acquisition method? Note: If no entry is required for a transaction/event, select "No Journal entry…arrow_forwardIn a pre-2009 business combination, Acme Company acquired all of Brem Company’s assets and liabilities for cash. After the combination Acme formally dissolved Brem. At the acquisition date, the following book and fair values were available for the Brem Company accounts:In addition, Acme paid an investment bank $25,000 cash for assistance in arranging the combination.a. Using the legacy purchase method for pre-2009 business combinations, prepare Acme’s entry to record its acquisition of Brem in its accounting records assuming the following cash amounts were paid to the former owners of Brem:1. $610,000.2. $425,000.b. How would these journal entries change if the acquisition occurred post-2009 and therefore Acme applied the acquisition method?arrow_forwardAllerton Company acquires all of Deluxe Company’s assets and liabilities for cash on January 1, 2018, and subsequently formally dissolves Deluxe. At the acquisition date, the following book and fair values were available for the Deluxe Company accounts:Prepare Allerton’s entry to record its acquisition of Deluxe in its accounting records assuming the following cash exchange amounts:1. $145,000.2. $110,000.arrow_forward

- On July 1, 2022 the ABC Company acquired the net assets of XYZ Company for P8,000,000. The recorded assets and liabilities of XYZ Corporation on July 1, 2022, immediately before the acquisition are as follows: Cash P 800,000 Inventory 2,400,000 Property and equipment, net 4,800,000 Liabilities 1,800,000 On July 1, 2022 it was determined that the inventory of XYZ had a fair value of P1,900,000, and the property and equipment, net had a fair value of P5,600,000. What is the amount of goodwill (gain on bargain purchase) that will be reported in the books of ABC?arrow_forwardOn 1/1/2020, X Company acquired 100% of Y Company's Net assets for $150,000 cash. The Book value of Y's Net assets was equal to the fair value of Y Company's net assets at the date of acquisition except for Land (included in fixed assets) its market value was less than the book value by $1,000, the balance sheet data at 1/1/2020, are as follows: item X co Y co cash 404,000 150,000 Fixed assets 100,000 66,000 Liabilities 144,000 72,000 Common stock 120,000 60,000 Retained earning 240,000 84,000 required: if the acquisition are merger record the journal entries and prepare x balance sheet after the mergerarrow_forwardPritano Company acquired all the net assets of Succo Company on December 31, 2013, for $2,185,400 cash. The balance sheet of Succo Company immediately prior to the acquisition showed: Book value Fair value Current assets $ 871,440 $871,440 Plant and equipment 1,025,090 1,437,590 Total $1,896,530 $2,309,030 Liabilities $194,060 $207,670 Common stock 484,800 Other contributed capital 632,900 Retained earnings 584,770 Total $1,896,530 As part of the negotiations, Pritano agreed to pay the stockholders of Succo $356,690 cash if the post-combination earnings of Pritano averaged $2,185,400 or more per year over the next two years. The estimated fair value of the contingent consideration was $143,480 on the date of the acquisition. (a) Prepare the journal entry on the books of Pritano to record the acquisition on December 31, 2013. (If no entry is required, select…arrow_forward

- Pritano Company acquired all the net assets of Succo Company on December 31, 2013, for $2,234,440 cash. The balance sheet of Succo Company immediately prior to the acquisition showed: Book value Fair value Current assets $ 962,320 $962,320 Plant and equipment 1,186,440 1,337,450 Total $2,148,760 $2,299,770 Liabilities $191,390 $214,050 Common stock 471,160 Other contributed capital 584,100 Retained earnings 902,110 Total $2,148,760 As part of the negotiations, Pritano agreed to pay the stockholders of Succo $385,210 cash if the post-combination earnings of Pritano averaged $2,234,440 or more per year over the next two years. The estimated fair value of the contingent consideration was $148,740 on the date of the acquisition. (a) Prepare the journal entry on the books of Pritano to record the acquisition on December 31, 2013. (If no entry is required, select…arrow_forwardAllerton Company acquires all of Deluxe Company’s assets and liabilities for cash on January 1, 2018, and subsequently formally dissolves Deluxe. At the acquisition date, the following book and fair values were available for the Deluxe Company accounts: BookValues FairValues Current assets $ 20,250 $ 20,250 Building 110,250 65,150 Land 17,250 28,550 Trademark 0 34,600 Goodwill 37,500 ? Liabilities (50,250 ) (50,250 ) Common stock (100,000 ) Retained earnings (35,000 ) 1&2. Prepare Allerton’s entry to record its acquisition of Deluxe in its accounting records assuming the following cash exchange amounts: $132,000 and $86,000. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.)arrow_forwardPritano Company acquired all the net assets of Succo Company on December 31, 2013, for $2,145,600 cash. The balance sheet of Succo Company immediately prior to the acquisition showed: Book value Fair value Current assets $ 995,110 $995,110 Plant and equipment 979,390 1,375,740 Total $1,974,500 $2,370,850 Liabilities $187,040 $235,560 Common stock 524,720 Other contributed capital 588,400 Retained earnings 674,340 Total $1,974,500 As part of the negotiations, Pritano Company agreed to issue 9,230 additional shares of its $10 par value common stock to the stockholders of Succo if the average postcombination earnings over the next three years equaled or exceeded $2,481,300. The fair value of the contingent consideration on the date of acquisition was estimated to be $219,700. The contingent consideration (earnout) was classified as equity rather than as a liability.…arrow_forward

- Allerton Company acquires all of Deluxe Company's assets and liabilities for cash on January 1, 2024, and subsequently formally dissolves Deluxe. At the acquisition date, the following book and fair values were available for the Deluxe Company accounts: Items Current assets Building Land Book Values Fair Values $ 53,500 93,750 $ 53,500 47,750 24,250 41,250 Trademark 0 39,300 Goodwill 20,000 ? Liabilities (56,500) (56,500) Common stock (100,000) Retained earnings (35,000) 0 0 Required: a. and b. Prepare Allerton's journal entry to record its acquisition of Deluxe in its accounting records assuming the following cash exchange amounts: $167,000 and $104,500. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field.arrow_forwardPreston Company acquired the assets (except for cash) and assumed the liabilities of Saville Company. Immediately prior to the acquisition, Saville Company’s balance sheet was as follows: Book Value Fair Value Cash $122,900 $122,900 Receivables (net) 207,560 232,240 Inventory 361,510 389,840 Plant and equipment (net) 459,200 573,420 Land 417,050 617,650 Total assets $1,568,220 $1,936,050 Current Liabilities $526,250 $596,650 Common stock ($5 par value) 477,680 Other contributed capital 126,920 Retained earnings 437,370 Total equities $1,568,220 (a) Prepare the journal entries on the books of Preston Company to record the purchase of the assets and assumption of the liabilities of Saville Company if the amount paid was $1,567,060 in cash. (If no entry is required, select "No Entry" for the account titles and enter 0 for the…arrow_forwardAssume that ayisiyiniwiwinak Corp. paid $19 million to purchase 10-Trees Inc. Below is a summary of the balance sheet of 10-Trees Inc. at the time of the ayisiyiniwiwinak Corp. acquisition (amounts are given in million $). The fair value of 10-Tree Inc.'s non-current assets was higher than the book value and amounted to $24 at that time. Assets Current assets Non-current assets Total assets 6 18 24 Liabilities Current liabilities Non-current liabilities Total liabilities Shareholders' equity Common shares Retained earnings Total shareholders' equity Total liabilities and shareholders' equity 8 10 18 2 4 6 24 Requirement 1: Based on the information provided above, fill Blanks 1 and 2. Blank #1: What is the goodwill resulting from this transaction? Enter your response as a plain number (no $-signs or decimals).arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Auditing: A Risk Based-Approach to Conducting a Q...AccountingISBN:9781305080577Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:South-Western College Pub

Auditing: A Risk Based-Approach to Conducting a Q...AccountingISBN:9781305080577Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:South-Western College Pub Auditing: A Risk Based-Approach (MindTap Course L...AccountingISBN:9781337619455Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:Cengage Learning

Auditing: A Risk Based-Approach (MindTap Course L...AccountingISBN:9781337619455Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:Cengage Learning

Auditing: A Risk Based-Approach to Conducting a Q...

Accounting

ISBN:9781305080577

Author:Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:South-Western College Pub

Auditing: A Risk Based-Approach (MindTap Course L...

Accounting

ISBN:9781337619455

Author:Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:Cengage Learning