FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:33

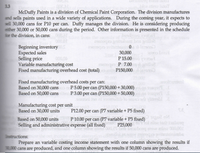

McDuffy Paints is a division of Chemical Paint Corporation. The division manufactures

and sells paints used in a wide variety of applications. During the coming year, it expects to

ell 30,000 cans for P10 per can. Duffy manages the division. He is considering producing

ether 30,000 or 50,000 cans during the period. Other information is presented in the schedule

fr the division, in cans:

000.01

Beginning inventory

Expected sales

Selling price

Variable manufacturing cost

Fixed manufacturing overhead cost (total)

o to

30,000

P 15.00

000,0

P 7.00

P150,000

nillse

Fixed manufacturing overhead costs per can:

Based on 30,000 cans

Based on 50,000 cans ie P3.00 per can (P150,000 + 50,000)

anobouent

P5.00 per can (P150,000 + 30,000)

Manufacturing cost per unit

Based on 30,000 units

P12.00 per can (P7 variable + P5 fixed)

Based on 50,000 units

Selling and administrative expense (all fixed)

P10.00 per can (P7 variable + P3 fixed)

alloe

P25,000

00,00

nstructions:

Prepare an variable costing income statement with one column showing the results if

3000 cans are produced, and one column showing the results if 50,000 cans are produced.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Office Products Inc. manufactures and sells various high-tech office automation products. Two divisions of Office products Inc. are the Computer Chip Division and the Computer Division. The Computer Chip Division manufactures one product, a "super chip," that can be used by both the Computer Division and other external customers. The following information is available on this month's operations in the Computer Chip Division: Selling price per chip Variable cost per chip Fixed production cost Fixed SG & A costs Monthly capacity External sales Internal sales $50 $20 $60,000 $90,000 $50 $45 $20 10,000 chips 6,000 chips 0 chips Presently the Computer Division purchases no chips from the Computer Chip Division, but instead pays $45 to an external supplier for the 4,000 chips it needs each month. Assume that next month's costs and levels of operation in the Computer and the Computer Chip Divisions are similar to this month. What is the minimum of the transfer price range for a possible…arrow_forwardBram Co makes a breakfast product, the Fruit-bram, and uses throughput accounting. The bottleneck resource is machine hours and 7,000 machine hours are available per year. The following information relates to a batch of Fruit-bram: $30.00 0.35 hours $88.57 Throughput contribution Time on bottleneck resource Cost per factory hour Indicate, by clicking on the relevant boxes in the table below, whether each statement is true or false. The throughput accounting ratio (TPAR) for the Fruit-bram is 1.03 The total factory cost per year is $619,990 TRUE TRUE FALSE FALSEarrow_forwardHigh Country, Incorporated, produces and sells many recreational products. The company just opened a new plant to produce a folding camp cot that will be marketed throughout the United States. The following cost and revenue data relate to May, the first month of the plant's operation: Beginning inventory Units produced Units sold Selling price per unit Selling and administrative expenses: Variable per unit Fixed (per month) Manufacturing costs: Direct materials cost per unit Direct labor cost per unit Variable manufacturing overhead cost per unit Fixed manufacturing overhead cost (per month) Required: 1. Assume the company uses absorption costing. a. Calculate the camp cot's unit product cost. b. Prepare an income statement for May. 2. Assume the company uses variable costing. a. Calculate the camp cot's unit product cost. b. Prepare a contribution format income statement for May. 0 46,000 41,000 $83 $4 $ 565,000 $ 16 $ 8 $1 $ 782,000 Complete this question by entering your answers in…arrow_forward

- Rowe Tool and Die (RTD) produces metal fittings as a supplier to various manufacturing firms in the area. The following is the forecasted income statement for the next quarter, which is the typical planning horizon used at RTD. RTD expects to sell 47,000 units during the quarter. RTD carries no inventories. Sales revenue Costs of fitting produced Gross profit Administrative costs Operating profit Amount $ 1,250, 200 958, 800 $ 291,400 220,900 $ 70,500 Per Unit $ 26,60 20.40 $6.20 4.70 $ 1.50 Fixed costs included in this income statement are $305,500 for depreciation on plant and machinery and miscellaneous factory operations and $95,500 for administrative costs. RTD has received a request for 10,000 fittings to be produced in the next quarter from Endicott Manufacturing. Endicott has never purchased from RTD, although they have been a local company for many years. Endicott has offered to pay $20.20 per unit. RTD can easily produce the 10,000 units with its existing capacity. Production…arrow_forwardSubject:- Accountarrow_forwardPlease help me. Thankyou.arrow_forward

- Comfort Ride manufactures seats for airplanes. The company has the capacity to produce 100,000 seats per year, but currently produces and sells 75,000 seats per year. The following informatio relates to current production of seats: Sale price per unit Variable costs per unit: Manufacturing $400 $230 Marketing and administrative $60 Total fixed costs: Manufacturing $790,000 Marketing and administrative $210,000 A. Increase by $49,000 B. Increase by $60,000 OC. Decrease by $49,000 OD. Increase by $229,000arrow_forward[The following information applies to the questions displayed below] Diego Company manufactures one product that is sold for $80 per unit in two geographic regions-the East and West regions. The following information pertains to the company's first year of operations in which it produced 40,000 units and sold 35,000 units. Variable costs per unit: Manufacturing: Direct materials Direct labor Variable manufacturing overhead Variable selling and administrative Fixed costs per year: Fixed manufacturing overhead Fixed selling and administrative expense $24 $14 $2 $4 $ 800,000 $ 496,000 The company sold 25,000 units in the East region and 10,000 units in the West region. It determined that $250,000 of its fixed selling and administrative expense is traceable to the West region, $150,000 is traceable to the East region, and the remaining $96,000 is a common fixed expense. The company will continue to incur the total amount of its fixed manufacturing overhead costs as long as it continues to…arrow_forwardHello Company makes three different products. Due to the constraints of their manufacturing equipment and warehouse facility, the company is only able to produce, store, and sell a total of 50,000 units each month. The production of Products A and B varies each month; however, Product C is a special order for one customer who purchases the same number of units every month. Pete Davila, the CEO, has |provided the following data from last month for each product. Income Statement Product A Product B Product C Мax Cарacity 5,000 8.00 $ 2.00 $ Units 43,000 10.00 $ 3.00 $ 20,000 $ 2,000 50,000 Price per unit Variable expense per unit $ $ $ 50.00 15.00 $ 20.00 Total Fixed Costs 40,000 $ 10,000 Product Sales $ 430,000 $ 40,000 $ 100,000 $ 570,000 (169,000) 401,000 (70,000) 331,000 Variable Costs (129,000) (10,000) 30,000 $ (30,000) 70,000 $ Contribution Margin $ 301,000 $ Fixed Costs (20,000) 281,000 (40,000) (10,000) (10,000) 60,000 $ Operating income (loss) Required Using the Data Table…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education