FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

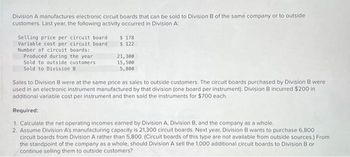

Transcribed Image Text:Division A manufactures electronic circuit boards that can be sold to Division B of the same company or to outside

customers. Last year, the following activity occurred in Division A:

Selling price per circuit board

Variable cost per circuit board

Number of circuit boards:

Produced during the year

Sold to outside customers

Sold to Division B

$ 178

$ 122

21,300

15,500

5,800

Sales to Division B were at the same price as sales to outside customers. The circuit boards purchased by Division B were

used in an electronic instrument manufactured by that division (one board per instrument). Division B incurred $200 in

additional variable cost per instrument and then sold the instruments for $700 each.

Required:

1. Calculate the net operating incomes earned by Division A, Division B, and the company as a whole.

2. Assume Division A's manufacturing capacity is 21,300 circuit boards. Next year, Division B wants to purchase 6,800

circuit boards from Division A rather than 5,800. (Circuit boards of this type are not available from outside sources.) From

the standpoint of the company as a whole, should Division A sell the 1,000 additional circuit boards to Division B or

continue selling them to outside customers?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Required information [The following information applies to the questions displayed below.] Henna Company produces and sells two products, Carvings and Mementos. It manufactures these products in separate factories and markets them through different channels. They have no shared costs. This year, the company sold 53,000 units of each product. Income statements for each product follow. Sales Variable costs Contribution margin Fixed costs Income 3. Assume that the company expects sales of each product to increase to 67,000 units next year with no change in unit selling price. Prepare a contribution margin income statement for the next year (as shown above with columns for each of the two products). (Round "per unit" answers to 2 decimal places.) Sales Variable cost Contribution margin Fixed costs Income (loss) Mementos $ 863,900 Carvings $ 863,900 604,730 259, 170 116,170 86,390 777,510 634,510 $ 143,000 $ 143,000 HENNA COMPANY Contribution Margin Income Statement Carvings Units 67,000…arrow_forwardKenzi, a manufacturer of kayaks, began operations this year. During this year, the company produced 1,000 kayaks and sold 750 at a price of $1,000 each. At year-end, the company reported the following income statement information using absorption costing. Sales (750 x $1,000) Cost of goods sold (750 x $425) Gross profit Selling and administrative expenses Income Additional Information $ 750,000 318,750 431,250 240,000 $ 191,250 a. Product cost per kayak under absorption costing totals $425, which consists of $325 in direct materials, direct labor, and variable overhead costs and $100 in fixed overhead cost. Fixed overhead of $100 per unit is based on $100,000 of fixed overhead per year divided by 1,000 kayaks produced. b. The $240,000 in selling and administrative expenses consists of $95,000 that is variable and $145,000 that is fixed. Prepare an income statement for the current year under variable costing. Income KENZI Income Statement (Variable Costing)arrow_forward[The following information applies to the questions displayed below.] Henna Company produces and sells two products, Carvings and Mementos. It manufactures these products in separate factories and markets them through different channels. They have no shared costs. This year, the company sold 44,000 units of each product. Income statements for each product follow. Sales Variable costs Contribution margin Fixed costs Income 3. Assume that the company expects sales of each product to increase to 58,000 units next year with no change in unit selling price. Prepare a contribution margin income statement for the next year (as shown above with columns for each of the two products). (Round "per unit" answers to 2 decimal places.) Contribution margin Income (loss) Carvings $ 774,400 464, 640 309,760 Mementos $ 774,400 154,880 619,520 187,760 497,520 $ 122,000 $ 122,000 HENNA COMPANY Contribution Margin Income Statement Carvings Units $ Per unit Total Mementos $ Per unit Total Totalarrow_forward

- Sheridan Optics manufactures two products: microscopes and telescopes. Information for each product is as follows. Microscopes Telescopes Sales price $ 34 53 Sales volume 406,565 178,500 Variable cost per unit 15 20 Annual traceable fixed expenses $ 3,003,300 $ 3,505,100 Annual allocated common fixed expenses $ 2,009,500 $ 2,006,700 Prepare a segment margin income statement for Sheridan Optics that provides detail on both the product lines and the company as a whole. (If the amount is negative then enter with a negative sign preceding the number, e.g. -5,125 or parenthesis, e.g. (5,125).) Microscopes Telescopes Total LA $ LA $ LA LAarrow_forward[The following information applies to the questions displayed below] Diego Company manufactures one product that is sold for $80 per unit in two geographic regions-the East and West regions. The following information pertains to the company's first year of operations in which it produced 40,000 units and sold 35,000 units. Variable costs per unit: Manufacturing: Direct materials Direct labor Variable manufacturing overhead Variable selling and administrative Fixed costs per year: Fixed manufacturing overhead Fixed selling and administrative expense $24 $14 $2 $4 $ 800,000 $ 496,000 The company sold 25,000 units in the East region and 10,000 units in the West region. It determined that $250,000 of its fixed selling and administrative expense is traceable to the West region, $150,000 is traceable to the East region, and the remaining $96,000 is a common fixed expense. The company will continue to incur the total amount of its fixed manufacturing overhead costs as long as it continues to…arrow_forwardEaston Company makes and sells scooters. Easton incurred the following costs in its most recent fiscal year: Cost Items Appearing on the Income Statement Materials cost ($10 per unit) Company president's salary Depreciation on manufacturing equipment Salaries of administrative personnel Labor cost ($4 per unit) Advertising costs (150,000 per year) Shipping and handling ($500 per year) Research and development costs Real estate taxes on factory Inspection costs Easton can currently purchase the scooters it makes from Weston Company. If the company purchases the scooters, Easton would still continue to use its own logo, sales staff, and advertising programs. If Easton outsources the scooters to Weston, which of the following costs would be relevant to the outsourcing decision? Multiple Choice X Materials cost Shipping and handling Inspection costs All of these answers are correct.arrow_forward

- am. 116.arrow_forwardIndigo Chance Co. sells computers and video game systems. The business is divided into two divisions along product lines. Variable costing income statements for the current year are presented below: Computers VG Systems Total Sales $720,000 $480,000 $1,200,000 Variable costs 504,000 384,000 888,000 Contribution margin $216,000 $96,000 312,000 Fixed costs 255,060 Net income $56,940 (a) Determine the sales mix and contribution margin ratio for each division. Sales mix Computers VG Systemsarrow_forwardThe Carlsbad Corporation produces and markets two types of electronic calculators: Model 4A and Model 5A. The following data were gathered on activities during the third quarter: Sales in units Sales price per unit Variable production costs per unit Traceable fixed production costs Variable selling expenses per unit Traceable fixed selling expenses Allocated portion of corporate expenses Sales Variable expenses Contribution margin Traceable fixed production costs Traceable fixed expenses Segment margin Common fixed expenses Net operating income (loss) Required: Prepare a segmented income statement for last quarter. The statement should provide sufficient detail to allow the company to evaluate the performance of the manager of each product line. X Answer is complete but not entirely correct. Model 4A 876,000 240,000 X 636,000 $ $ Model 4A 6,000 $ 146 $ 40 $ 210,000 $20 $ 15,000 $ 136,000 $ Total Company 1,926,000 485,000 X 1,441,000 520,000 35,000 886,000 276,000 610,000 $ 210,000…arrow_forward

- ssarrow_forwardDivision A of SLG Company produces a part it sells to other companies. Sales and cost data for the part are as follows: Capacity in units 60,000 units Selling price per unit O $27 per unit O $39 per unit O $36 per unit O $41 per unit Variable cost per unit O None of the above. Fixed cost per unit at capacity Division B, another division of SLG Company, would like to buy this part from Division A. Division B is currently purchasing the part from an outside source at $38 per unit. If Division A sells to Division B, then $1 in Division A's variable costs can be avoided. Assume Division A has enough idle capacity to handle all of Division B's needs without any increase in fixed costs and without interfering with outside sales. According to the transfer pricing guidelines, what is the lowest acceptable transfer price from the perspective of Division A? $40 per unit $28 per unit $9 per unitarrow_forwardOriole produces and sells two products-aluminum and vinyl. Each of these products is made in a dedicated manufacturing facility, and the product line managers are evaluated based on the product line's return on investment. The following data is from the most recent year of operations, Aluminum Vinyl Sales $4,000,000 $4,350,000 Variable costs 2,050,000 2,403,750 Direct fixed costs 1,520,000 1,533,000 Average assets 2,000,000 1,500,000 (31) Your answer is correct. Calculate the margin and asset turnover for each product line. (Round answers to 2 decimal places, eg. 5.12 and 5,12%) Aluminum Vinyl Margin 10.75 % 9.50 % 2.00 2.90 Your answer is correct. Calculate return on investment for each product line. (Round ROI to 2 decimal places, e.g. 5.12 %) Aluminum Vinyl ROI 21.50 % 27.55 % eTextbook and Media Attempts: unlimited Both product line managers would like to improve their respective returns on investment, and each manager has a different idea about how to accomplish this. If the…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education