FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

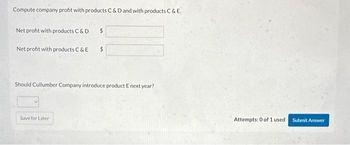

Transcribed Image Text:Compute company profit with products C & D and with products C & E.

Net profit with products C & D

Net profit with products C & E

$

Save for Later

$

Should Cullumber Company introduce product E next year?

Attempts: 0 of 1 used. Submit Answer

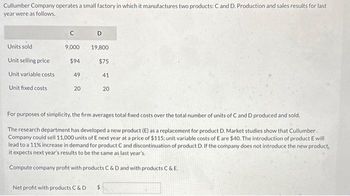

Transcribed Image Text:Cullumber Company operates a small factory in which it manufactures two products: C and D. Production and sales results for last

year were as follows.

Units sold

Unit selling price

Unit variable costs

Unit fixed costs

C

9,000 19,800

$94

$75

49

20

D

Net profit with products C & D

41

For purposes of simplicity, the firm averages total fixed costs over the total number of units of C and D produced and sold.

The research department has developed a new product (E) as a replacement for product D. Market studies show that Cullumber

Company could sell 11,000 units of E next year at a price of $115; unit variable costs of E are $40. The introduction of product E will

lead to a 11% increase in demand for product C and discontinuation of product D. If the company does not introduce the new product,

it expects next year's results to be the same as last year's.

Compute company profit with products C & D and with products C & E.

$

20

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Similar questions

- Chovanec Corporation produces and sells a single product. Data concerning that product appear below: Per Unit Percent of Sales Selling price $ 170 100% Variable expenses 68 40% Contribution margin $ 102 60% Fixed expenses are $521,000 per month. The company is currently selling 7,000 units per month. Management is considering using a new component that would increase the unit variable cost by $6. Since the new component would increase the features of the company's product, the marketing manager predicts that monthly sales would increase by 500 units. What should be the overall effect on the company's monthly net operating income of this change? Multiple Choice increase of $6,000 decrease of $6,000 decrease of $48,000 increase of $48,000arrow_forwardMajesty Company uses target costing to ensure that its products are profitable. Assume Majesty is planning to introduce a new product with the following estimates: Estimated market price $ 1,500 Annual demand 86,000 units Life cycle 7 years Target profit 26 % return on sales Required: 1. Compute the target cost of this product. 2. Compute the target cost if Majesty wants a 36 percent return on sales. 3. Compute the target cost if Majesty wants a 7 percent return on sales.arrow_forwardQ.1 ChemCo has developed a new product, and has consulted with its marketing department, who have determined that the market share will be 20,000 units, and have recommended that a selling price of $60.00 per unit would be app- ropriate. ChemCo has been able to keep the cost per unit at $50.00. The company has spent a total of $900,000 to design and develop this product. Required: Use the above information to compute as follows: 1. Compute the expected margin for ChemCo 2. Compute the expected turnover 3. Compute the ROI Explain why it is necessary to do the above computations, and show how management can use this information for managing operationsarrow_forward

- Gadubhaiarrow_forwardPatriot Company manufactures flags in two sizes, small and large. The company has total fixed costs of $260,000 per year. Additional data follow. Sales price per unit Variable costs per unit Sales mix percent Small $ 26 $ 13 80% Large $33 $ 20 20% The company is considering buying new equipment that would increase total fixed costs by $51,500 per year and reduce the variable costs of each type of flag by $1 per unit. Break-even point in units Break-even point - Small Break-even point - Large Required: 1. Compute the weighted-average contribution margin without the new equipment. 2. Assume the new equipment is not purchased. Determine the break-even point in total sales units and the break-even point in units for each product. 3. Assume the new equipment is purchased. Compute the break-even point in total sales units and the number of units to sell for each product. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Assume the new…arrow_forwardThe following information is available for Division X of Meisels, Inc.: Fixed cost per unit (based on capacity) Variable cost per unit Capacity in units Selling price to outside customers $5.25 $32 24,000 $41 Division Y would like to purchase 6,000 units each year from Division X. Division X has enough excess capacity to handle all of Division Y's needs. Division Y now purchases from an outside supplier at a price of $39 and insists that it should be charged that same price by Division X. If Division X refuses to accept the $39 price for transfers to Division Y, what effect would this have on the total annual profit of Meisels, Inc.?arrow_forward

- Naumann Corporation produces and sells a single product. Data concerning that product appear below: Percent of Sales 100% 18% 82% Selling price Variable expenses Contribution margin Per Unit $ 200 36 $164 Fixed expenses are $130,000 per month. The company is currently selling 1,200 units per month. Required: Management is considering using a new component that would increase the unit variable cost by $46. Since the new component would improve the company's product, the marketing manager predicts that monthly sales would increase by 400 units. What should be the overall effect on the company's monthly net operating income of this change if fixed expenses are unaffected? Note: Negative amounts should be indicated by a minus sign. Change in net operating incomearrow_forwardi need the answer quicklyarrow_forwardBenson Company, which produces and sells a small digital clock, bases its pricing strategy on a 25 percent markup on total cost. Based on annual production costs for 10,000 units of product, computations for the sales price per clock follow. Unit-level costs $150,000 50,000 200,000 50,000 $250,000 Fixed costs Total cost (a) Markup (a x 0.25) Total sales (b) Sales price per unit (b ÷ 10,000) 25 Required a. Benson has excess capacity and receives a special order for 7,000 clocks for $21 each. Calculate the contribution margin per unit. Based on this, should Benson accept the special order? b. Prepare a contribution margin income statement for the special order. Complete this question by entering your answers in the tabs below. Required A Required B Benson has excess capacity and receives a special order for 7,000 clocks for $21 each. Calculate the contribution margin per unit. Based on this, should Benson accept the special order? Contribution margin per unit Should Benson accept the…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education