CONCEPTS IN FED.TAX.,2020-W/ACCESS

20th Edition

ISBN: 9780357110362

Author: Murphy

Publisher: CENGAGE L

expand_more

expand_more

format_list_bulleted

Question

niki.2

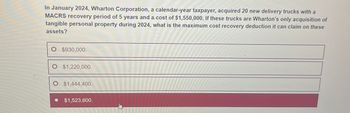

Transcribed Image Text:In January 2024, Wharton Corporation, a calendar-year taxpayer, acquired 20 new delivery trucks with a

MACRS recovery period of 5 years and a. cost of $1,550,000. If these trucks are Wharton's only acquisition of

tangible personal property during 2024, what is the maximum cost recovery deduction it can claim on these

assets?

○ $930,000.

O $1,220,000.

O $1,444,400.

$1,523,600.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- In March 2019, Helen Carlon acquired used equipment for her business at a cost of 300,000. The equipment is five-year property for regular tax depreciation purposes. a. If Helen depreciates the equipment using the method that will produce the greatest deduction for 2019 for regular income tax purposes, what is the amount of the AMT adjustment? b. Draft a letter to Helen regarding the choice of depreciation methods. Helens address is 500 Monticello Avenue, Glendale, AZ 85306.arrow_forwardIn 2019, Mary sells for $24,000 a machine used in her business. The machine was purchased on May 1,2017, at a cost of $22,000. Mary has deducted depreciation on the machine of $6,000. What is the amount and nature of Mary's gain as a result of the sale of the machine? $2,000 Section 1231 gain $8,000 ordinary income under Section 1245 $6,000 ordinary income and $2,000 Section 1231 gain $6,000 Section 1231 gain and $2,000 ordinary income under Section 1245 None of the abovearrow_forwardHi there, Need help with attached question, thanks kindly!arrow_forward

- SINCO Ltd. purchased a piece of equipment in the year 2018 for the sum of $ 200,000. The company is subject to a tax depreciation rate of 25%. According to the following table, what is the depreciation allowance that this company can claim in 2020? (in the following picture : Année is year)arrow_forwardHanshabenarrow_forwardMemanarrow_forward

- Pearl Limited purchased an asset at a cost of $20,000 on March 1, 2023. The asset has a useful life of seven years and an estimated residual value of $2,200. For tax purposes, the asset belongs in CCA Class 8, with a rate of 20%. (a) Calculate the CCA for each year, 2023 to 2026, assuming Pearl's asset is eligible for the Accelerated Investment Incentive, and that this is the only asset in Class 8. 2023 2024 2025 2026 2024 2025 CCA 2026 $ TA (b) How would the calculation for each year from 2024 to 2026 change if the asset had been purchased in 2024? $ $ $ tA tA $ CCAarrow_forwardPearl Limited purchased an asset at a cost of $20,000 on March 1, 2023. The asset has a useful life of seven years and an estimated residual value of $2,200. For tax purposes, the asset belongs in CCA Class 8, with a rate of 20%. (a) Calculate the CCA for each year, 2023 to 2026, assuming Pearl's asset is eligible for the Accelerated Investment Incentive, and that this is the only asset in Class 8. 2023 2024 2025 2026 2024 2025 CCA 2026 $ (b) How would the calculation for each year from 2024 to 2026 change if the asset had been purchased in 2024? 50 3560 CCA 2848 2278.40 1822.72 3560 2848 2278.40arrow_forwardK1.arrow_forward

- Dinesh Bhaiarrow_forward5arrow_forwardOn March 13, 2022, Dr. Gerald Steinman acquired a dental practice for $1,200,000 cash. The market value of the equipment and fixtures he received was $650,000, and he assumed $ 80,000 in debt secured by the equipment. How much will Dr. Steinman's 2022 deductible amortization expense be for this acquisition? (Round answer to the nearest dollar) Group of answer choices $550,000 Not enough Information to determine $3,500 $0, because goodwill isn't amortized for tax purposes, but instead tested for impairment $35,000 $30, 555arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:9780357109731

Author:Hoffman

Publisher:CENGAGE LEARNING - CONSIGNMENT