FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

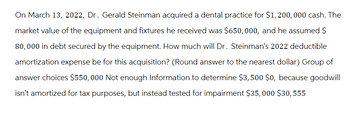

Transcribed Image Text:On March 13, 2022, Dr. Gerald Steinman acquired a dental practice for $1,200,000 cash. The

market value of the equipment and fixtures he received was $650,000, and he assumed $

80,000 in debt secured by the equipment. How much will Dr. Steinman's 2022 deductible

amortization expense be for this acquisition? (Round answer to the nearest dollar) Group of

answer choices $550,000 Not enough Information to determine $3,500 $0, because goodwill

isn't amortized for tax purposes, but instead tested for impairment $35,000 $30, 555

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Sandhill Corp. purchased a piece of equipment on September 30 for $27200. It cost $500 to ship the equipment to the company's facilities and another $1700 to install the equipment. After the equipment was installed, the company had to pay an additional $1100 for increased insurance. The capitalized cost of the equipment was O $30500. O $30000. O $27700. O $29400. Save for Later Attempts: 0 of 1 used Submit Answerarrow_forwardGarrow_forward18) On July 1, 2022, Jenks Company purchased the copyright to Jackson Computer tutorials for $216,000. It is estimated that the copyright will have a useful life of 5 years with an estimated salvage value of $16,000. The amount of Amortization Expense recognized for the year 2022 would be?arrow_forward

- ! Required information [The following information applies to the questions displayed below.] Russell Corporation sold a parcel of land valued at $400,000. Its basis in the land was $275,000. For the land, Russell received $50,000 in cash in year 0 and a note providing that Russell will receive $175,000 in year 1 and $175,000 in year 2 from the buyer. (Do not round intermediate calculations. Round your final answers to the nearest whole dollar amount.) a. What is Russell's realized gain on the transaction? Realized gainarrow_forwardOn March 1, 2025, Blossom Supply Company acquired real estate, on which it planned to construct a small office buildingby paying $ 80,000 in cashAn old warehouse on the property was demolished at a cost of $8,000; the salvaged materials were sold for $2,000. Additional expenditures before construction began included $1,400 attorney's fee for work concerning the land purchase, $5,400 real estate broker's fee$9,000 architect's fee, and $15,000 to put in driveways and a parking lot.arrow_forwardIn 2021, Peter Quill had a 5 179 deduction carryover of $40,000. In 2022, Peter elected 5 179 for an asset acquired at a cost of $120,000. Peter's $ 179 business income imitation for 2022 is $130.000. Determine Peter's § 179 deduction for 2022 O a $25,000 Ob $115,000 Oc$130,000 Od $140,000arrow_forward

- Which of the following assets will NOT attract any capital gains tax? Select one: All of the options will attract CGT Canoe acquired for $12,000 and sold for $15,000 Rare coin acquired for $550 and sold for $1,000 Sale of the tax payer's main residence Shares acquired in October 1985 and sold for profit in 2020arrow_forwardArmando Corporation incurred the following expenses: 2022 2023 Salaries 515,000 614,000 Materials 90,000 70,000 Insurance and utilities 14,000 19,000 Promotion expense 11,000 18,000 Advertising -0- 20,000 Cost of market survey 8,000 -0- The new product will be available for sale July 1, 2024. The company would like to capitalize and amortize the expenditures. Calculate the amount of research and experimental expenditures for: a. 2022 b. 2023 Calculate the deduction for R&D expenses for: C. 2022 d. 2023 e. 2024 If the answer is 0, just type a 0. Use commas as appropriate, ie 55,000. Round answers to the nearest dollar.arrow_forwardOn January 1, 2021, LMT Inc. acquired a piece of land to construct a new office building. You have the following information about this transaction: Price of land $180,000 Tax on purchase of land 5% of price Legal fees to transfer property of land to LMT $4,500 Cost of demolishing old building on land 5,600 Income from sale of windows of old building demolished 500 Cost of new office building foundation 23,400 Cost of office building construction 460,000 Cost of insurance during construction 2,000 Cost to repair a piece of equipment used in the office building’s construction 1,000 Cost of annual insurance on office building after the construction is finished 6,000 LMT management decided to allocate the following amounts to the parts of the office building, and estimated the corresponding useful lives and residual values as follows: Allocated cost Useful life Residual value Windows $50,000 10 years…arrow_forward

- Need Help with this Questionarrow_forwardCan you please answer the empty boxes for Amortization and Franchises. Thank you!arrow_forward1. A special manufacturing and handling device was purchased by Alfonso Manufacturing for $200,000 and is depreciated over MACRS. CFBT is estimated to amount to $800,000 for the first 2 years followed by $600,000 thereafter until the asset is retained. The effective tax rate, Te is 35% and interest is 10% per year. In present worth dollars determine the CFAT and determine if it was a viable purchase. (Note answer must be in a tabular format)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education