Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN: 9781337788281

Author: James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

Meman

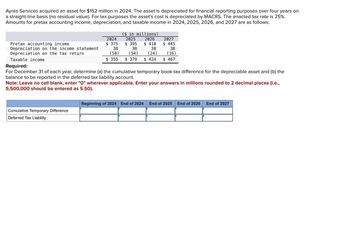

Transcribed Image Text:Ayres Services acquired an asset for $152 million in 2024. The asset is depreciated for financial reporting purposes over four years on

a straight-line basis (no residual value). For tax purposes the asset's cost is depreciated by MACRS. The enacted tax rate is 25%.

Amounts for pretax accounting income, depreciation, and taxable income in 2024, 2025, 2026, and 2027 are as follows:

($ in millions)

Pretax accounting income

2024

$ 375

2025

$ 395

2026

$ 410

2027

$ 445

Depreciation on the income statement

38

Depreciation on the tax return.

(58)

$ 355

38

(54)

38

(24)

38

(16)

$ 379

$ 424

$ 467

Taxable income

Required:

For December 31 of each year, determine (a) the cumulative temporary book-tax difference for the depreciable asset and (b) the

balance to be reported in the deferred tax liability account.

Note: Leave no cell blank, enter "O" wherever applicable. Enter your answers in millions rounded to 2 decimal places (i.e.,

5,500,000 should be entered as 5.50).

Cumulative Temporary Difference

Deferred Tax Liability

Beginning of 2024 End of 2024 End of 2025 End of 2026 End of 2027

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- At the beginning of 2019, Conley Company purchased an asset at a cost of 10,000. For financial reporting purposes, the asset has a 4-year life with no residual value and is depreciated by the straight-line method beginning in 2019. For tax purposes, the asset is depreciated under MACRS using a 5-year recovery period. Prior to 2019, Conley had no deferred tax liability or asset. The difference between depreciation for financial reporting purposes and income tax purposes is the only temporary difference between pretax financial income and taxable income. The current income tax rate is 30%, and no change in the tax rate has been enacted for future years. In 2019 and 2020, taxable income will be higher or lower than financial income by what amount?arrow_forwardPrior to and during 2019, Shadrach Company reported tax depreciation at an amount higher than the amount of financial depreciation, resulting in a book value of the depreciable assets of 24,500 for financial reporting purposes and of 20,000 for tax purposes at the end of 2019. In addition, Shadrach recognized a 3,500 estimated liability for legal expenses in the financial statements during 2019; it expects to pay this liability (and deduct it for tax purposes) in 2023. The current tax rate is 30%, no change in the tax rate has been enacted, and the company expects to be profitable in future years. What is the amount of the net deferred tax liability at the end of 2019? a. 300 b. 450 c. 1,050 d. 1,350arrow_forwardTurnip Company purchased an asset at a cost of 10,000 with a 10-year life during the current year. Turnip uses differing depreciation methods for financial reporting and income tax purposes. The depreciation expense during the current year for financial reporting is 1,000 and for income tax purposes is 2,000. Turnip is subject to a 30% enacted future tax rate. Prepare a schedule to compute Turnips (a) ending future taxable amount, (b) ending deferred tax liability, and (c) change in deferred tax liability (deferred tax expense) for the current year.arrow_forward

- Ayres Services acquired an asset for $80 million in 2024. The asset is depreciated for financial reporting purposes over four years on a straight-line basis (no residual value). For tax purposes the asset's cost is depreciated by MACRS. The enacted tax rate is 25%. Amounts for pretax accounting income, depreciation, and taxable income in 2024, 2025, 2026, and 2027 are as follows: Pretax accounting income Depreciation on the income statement Depreciation on the tax return Taxable income Required: 2024 $ 330 20 (25) $325 Cumulative Temporary Difference Deferred Tax Liability ($ in millions) 2025 $350 20 (33) $337 2026 $365 20 (15) $370 $413 Beginning of 2024 2027 $ 400 For December 31 of each year, determine (a) the cumulative temporary book-tax difference for the depreciable asset and (b) the balance to be reported in the deferred tax liability account. Note: Leave no cell blank, enter "0" wherever applicable. Enter your answers in millions rounded to 2 decimal places (i.e., 5,500,000…arrow_forwardAyres Services acquired an asset for $144 million in 2021. The asset is depreciated for financial reporting purposes over four years on a straight-line basis (no residual value). For tax purposes the asset/s cost is depreciated by MACRS. The enacted tax rate is 25%. Amounts for pretax accounting income, depreciation, and taxable income in 2021, 2022, 2023, and 2024 are as follows: _ ($ in millions) ____________ 2021 2022 2023 2024 Pretax accounting income $370 $390 $405 $440 Depreciation on the income statement 36 36 36 36 Depreciation on the tax return (57) (49) (23) (15) Taxable income…arrow_forwardaccarrow_forward

- Ayres Services acquired an asset for $200 million in 2021. The asset is depreciated for financial reporting purposes over four years on a straight-line basis (no residual value). For tax purposes the asset's cost is depreciated by MACRS. The enacted tax rate is 25%. Amounts for pretax accounting income, depreciation, and taxable income in 2021, 2022, 2023, and 2024 are as follows: 2021 $405 $425 ($ in millions) 2022 2023 2024 $440 Pretax accounting income Depreciation on the income statement Depreciation on the tax return $475 50 50 50 50 (64) (84) (30) (22) Taxable income $391 $391 $460 $503 Required: For December 31 of each year, determine (a) the cumulative temporary book-tax difference for the depreciable asset and (b) the balance to be reported in the deferred tax liability account. (Leave no cell blank, enter "O" wherever applicable. Enter your answers in millions rounded to 2 decimal place (i.e., 5,500,000 should be entered as 5.50).) Beginning of End of 2021 End of End of End…arrow_forwardAyres Services acquired an asset for $168 million in 2021. The asset is depreciated for financial reporting purposes over four years on a straight-line basis (no residual value). For tax purposes the asset’s cost is depreciated by MACRS. The enacted tax rate is 25%. Amounts for pretax accounting income, depreciation, and taxable income in 2021, 2022, 2023, and 2024 are as follows: ($ in millions) 2021 2022 2023 2024 Pretax accounting income $ 385 $ 405 $ 420 $ 455 Depreciation on the income statement 42 42 42 42 Depreciation on the tax return (60 ) (64 ) (26 ) (18 ) Taxable income $ 367 $ 383 $ 436 $ 479 Required:For December 31 of each year, determine (a) the cumulative temporary book-tax difference for the depreciable asset and (b) the balance to be reported in the deferred tax liability account. Beginning of 2021 End of 2021 End of 2022 End of 2023 End of 2024 Cumulative…arrow_forwardAyres Services acquired an asset for $128 million in 2021. The asset is depreciated for financial reporting purposes over four years on a straight-line basis (no residual value). For tax purposes the asset’s cost is depreciated by MACRS. The enacted tax rate is 25%. Amounts for pretax accounting income, depreciation, and taxable income in 2021, 2022, 2023, and 2024 are as follows: ($ in millions) 2021 2022 2023 2024 Pretax accounting income $ 360 $ 380 $ 395 $ 430 Depreciation on the income statement 32 32 32 32 Depreciation on the tax return (55 ) (39 ) (21 ) (13 ) Taxable income $ 337 $ 373 $ 406 $ 449 Required:For December 31 of each year, determine (a) the cumulative temporary book-tax difference for the depreciable asset and (b) the balance to be reported in the deferred tax liability account. (Leave no cell blank, enter "0" wherever applicable. Enter your answers in millions…arrow_forward

- Hanshabenarrow_forwardA company acquired an asset for $1,200,000 in 2024. The asset is depreciated for financial reporting purposes over four years on a straight-line basis (no residual value). For tax purposes the asset's cost is depreciated by MACRS. The enacted tax rate is 19%. Amounts for pretax accounting income, depreciation, and taxable income in 2024, 2025, 2026, and 2027 are as follows: Asset's Cost Useful life Enacted tax rate Pretax accounting income Depreciation on the income statement Depreciation on the tax return Taxable income Required: Cumulative Temporary Difference Deferred Tax Liability Jan. 1, 2024 $1,200,000 $0 0 4 years 19% 2024 $3,700,000 300,000 (399,960) $3,600,040 2025 $4,100,000 300,000 (533,400) $3,866,600 For December 31 of each year, determine (a) the cumulative temporary book-tax difference for the depreciable asset and (b) the balance to be reported in the deferred tax liability account. Each cell requires a formula, even if the result is $0. 2026 $4,400,000 300,000…arrow_forwardAyres Services acquired an asset for $82 million in 2018. The asset is depreciated for financial reporting purposes over four years on a straight-line basis (no residual value). For tax purposes the asset's cost is depreciated by MACRS. The enacted tax rate is 40%. Amounts for pretax accounting income, depreciation, and taxable income in 2018, 2019, 2020, and 2021 are as follows: Pretax accounting income Depreciation on the income statement Depreciation on the tax return. Taxable income. ($ in millions) 2019 355 $ 20.5 (33.5) Temporary Difference Deferred Tax Liability 2018 $ 335 $ 20.5 (25.5) $ 330 $ 342 $ 375 2020 2021 370 $ 405 20.5 20.5 (15.5) (7.5) $ 418 Required: Determine (a) the temporary book-tax difference for the depreciable asset and (b) the balance to be reported in the deferred tax liability account. (Leave no cell blank, enter "0" wherever applicable. Show all amounts as positive amounts. Enter your answers in millions rounded to 1 decimal place (i.e., 5,500,000 should…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning