EBK CONTEMPORARY FINANCIAL MANAGEMENT

14th Edition

ISBN: 9781337514835

Author: MOYER

Publisher: CENGAGE LEARNING - CONSIGNMENT

expand_more

expand_more

format_list_bulleted

Question

None

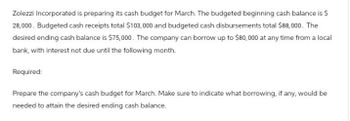

Transcribed Image Text:Zolezzi Incorporated is preparing its cash budget for March. The budgeted beginning cash balance is $

28,000. Budgeted cash receipts total $103,000 and budgeted cash disbursements total $88,000. The

desired ending cash balance is $75,000. The company can borrow up to $80,000 at any time from a local

bank, with interest not due until the following month.

Required:

Prepare the company's cash budget for March. Make sure to indicate what borrowing, if any, would be

needed to attain the desired ending cash balance.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Cash budget The controller of Bridgeport Housewares Inc. instructs you to prepare a monthly cash budget for the next three months. You are presented with the following budget information: The company expects to sell about 10% of its merchandise for cash. Of sales on account, 70% are expected to be collected in the month following the sale and the remainder the following month (second month following sale). Depreciation, insurance, and property tax expense represent 50,000 of the estimated monthly manufacturing costs. The annual insurance premium is paid in January, and the annual property taxes are paid in December. Of the remainder of the manufacturing costs, 80% are expected to be paid in the month in which they are incurred and the balance in the following month. Current assets as of September 1 include cash of 40,000, marketable securities of 75,000, and accounts receivable of 300,000 (60,000 from July sales and 240,000 from August sales). Sales on account for July and August were 200,000 and 240,000, respectively. Current liabilities as of September 1 include 40,000 of accounts payable incurred in August for manufacturing costs. All selling and administrative expenses are paid in cash in the period they are incurred. An estimated income tax payment of 55,000 will be made in October. Bridgeports regular quarterly dividend of 25,000 is expected to be declared in October and paid in November. Management desires to maintain a minimum cash balance of 50,000. Instructions Prepare a monthly cash budget and supporting schedules for September, October, and November. On the basis of the cash budget prepared in part (1), what recommendation should be made to the controller?arrow_forwardCash budget The controller of Mercury Shoes Inc. instructs you to prepare a monthly cash budget for the next three months. You are presented with the following budget information: The company expects to sell about 10% of its merchandise for cash. Of sales on account, 60% are expected to be collected in the month following the sale and the remainder the following month (second month after sale). Depreciation, insurance, and property tax expense represent 12,000 of the estimated monthly manufacturing costs. The annual insurance premium is paid in February, and the annual property taxes are paid in November. Of the remainder of the manufacturing costs, 80% are expected to be paid in the month in which they are incurred and the balance in the following month. Current assets as of June 1 include cash of 42,000, marketable securities of 25,000, and accounts receivable of 198,000 (150,000 from May sales and 48,000 from April sales). Sales on account in April and May were 120,000 and 150,000, respectively. Current liabilities as of June 1 include 13,000 of accounts payable incurred in May for manufacturing costs. All selling and administrative expenses are paid in cash in the period they are incurred. An estimated income tax payment of 24,000 will be made in July. Mercury Shoes regular quarterly dividend of 15,000 is expected to be declared in July and paid in August. Management desires to maintain a minimum cash balance of 40,000. Instructions Prepare a monthly cash budget and supporting schedules for June, July, and August. On the basis of the cash budget prepared in part (1), what recommendation should be made to the controller?arrow_forwardEcho Amplifiers prepared the following sales budget for the first quarter of 2018: It also has this additional information related to its expenses: Prepare a sales and administrative expense budget for each month in the quarter ending March 31, 2018.arrow_forward

- CASH BUDGETING Helen Bowers, owner of Helens Fashion Designs, is planning to request a line of credit from her bank. She has estimated the following sales forecasts for the firm for parts of 2019 and 2020: Estimates regarding payments obtained from the credit department are as follows: collected within the month of sale, 10%; collected the month following the sale, 75%; collected the second month following the sale, 15%. Payments for labor and raw materials are made the month after these services were provided. Here are the estimated costs of labor plus raw materials: General and administrative salaries are approximately 27,000 a month. Lease payments under long-term leases are 9,000 a month. Depreciation charges are 36,000 a month. Miscellaneous expenses are 2,700 a month. Income tax payments of 63,000 are due in September and December. A progress payment of 180,000 on a new design studio must be paid in October. Cash on hand on July 1 will be 132,000, and a minimum cash balance of 90,000 should be maintained throughout the cash budget period. a. Prepare a monthly cash budget for the last 6 months of 2019. b. Prepare monthly estimates of the required financing or excess fundsthat is, the amount of money Bowers will need to borrow or will have available to invest. c. Now suppose receipts from sales come in uniformly during the month (that is, cash receipts come in at the rate of 1/30 each day), but all outflows must be paid on the 5th. Will this affect the cash budget? That is, will the cash budget you prepared be valid under these assumptions? If not, what could be done to make a valid estimate of the peak financing requirements? No calculations are required, although if you prefer, you can use calculations to illustrate the effects. d. Bowers sales are seasonal, and her company produces on a seasonal basis, just ahead of sales. Without making any calculations, discuss how the companys current and debt ratios would vary during the year if all financial requirements were met with short-term bank loans. Could changes in these ratios affect the firms ability to obtain bank credit? Explain.arrow_forwardThe following data were obtained from the financial records of Sonicbrush, Inc., for March: Sales are expected to increase each month by 15%. Prepare a budgeted income statement.arrow_forwardAt the beginning of the school year, Craig Kovar decided to prepare a cash budget for the months of September, October, November, and December. The budget must plan for enough cash on December 31 to pay the spring semester tuition, which is the same as the fall tuition. The following information relates to the budget: a. Prepare a cash budget for September, October, November, and December. b. Are the four monthly budgets that are presented prepared as static budgets or flexible budgets? c. What are the budget implications for Craig Kovar?arrow_forward

- Pilsner Inc. purchases raw materials on account for use in production. The direct materials purchases budget shows the following expected purchases on account: Pilsner typically pays 25% on account in the month of billing and 75% the next month. Required: 1. How much cash is required for payments on account in May? 2. How much cash is expected for payments on account in June?arrow_forwardCash budget Pasadena Candle Inc. pays 40% of its purchases on account in the month of the purchase and 60% in the month following the purchase. If purchases are budgeted to be 40,000 for August and 36,000 for September, what are the budgeted cash payments for purchases on account for September?arrow_forwardRelevant data from the Poster Companys operating budgets are: Additional data: Capital assets were sold in January for $10,000 and $4,500 in May. Dividends of $4,500 were paid in February. The beginning cash balance was $60,359 and a required minimum cash balance is $59,000. Use this information to prepare a cash budget for the first two quarters of the yeararrow_forward

- Cash Budget The controller of Feinberg Company is gathering data to prepare the cash budget for July. He plans to develop the budget from the following information: a. Of all sales, 40% are cash sales. b. Of credit sales, 45% are collected within the month of sale. Half of the credit sales collected within the month receive a 2% cash discount (for accounts paid within 10 days). Thirty percent of credit sales are collected in the following month; remaining credit sales are collected the month thereafter. There are virtually no bad debts. c. Sales for the second two quarters of the year follow. (Note: The first 3 months are actual sales, and the last 3 months are estimated sales.) d. The company sells all that it produces each month. The cost of raw materials equals 26% of each sales dollar. The company requires a monthly ending inventory of raw materials equal to the coming months production requirements. Of raw materials purchases, 50% is paid for in the month of purchase. The remaining 50% is paid for in the following month. e. Wages total 105,000 each month and are paid in the month incurred. f. Budgeted monthly operating expenses total 376,000, of which 45,000 is depreciation and 6,000 is expiration of prepaid insurance (the annual premium of 72,000 is paid on January 1). g. Dividends of 130,000, declared on June 30, will be paid on July 15. h. Old equipment will be sold for 25,200 on July 4. i. On July 13, new equipment will be purchased for 173,000. j. The company maintains a minimum cash balance of 20,000. k. The cash balance on July 1 is 27,000. Required: Prepare a cash budget for July. Give a supporting schedule that details the cash collections from sales.arrow_forwardThe sales department of Macro Manufacturing Co. has forecast sales for its single product to be 20,000 units for June, with three-quarters of the sales expected in the East region and one-fourth in the West region. The budgeted selling price is 25 per unit. The desired ending inventory on June 30 is 2,000 units, and the expected beginning inventory on June 1 is 3,000 units. Prepare the following: a. A sales budget for June. b. A production budget for June.arrow_forwardAnalyze Johnson Stores staffing budget for holidays Johnson Stores is planning its staffing for the upcoming holiday season. From past history, the store determines that it needs one additional sales clerk for each 12,000 in daily sales. The average daily sales is anticipated to increase by 96,000 from Black Friday until Christmas Eve, or 27 shopping days. Each additional sales clerk will work an eight-hour shift and will be paid 14 per hour. A. Determine the amount to budget for additional sales clerks for the holiday season. B. If Johnson Stores has an average 40% gross profit on sales, should it add the staff suggested by your answer in (A)? That is, is it profitable to staff for the increased sales in (A)?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College PubPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College PubPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Fundamentals Of Financial Management, Concise Edi...FinanceISBN:9781337902571Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals Of Financial Management, Concise Edi...FinanceISBN:9781337902571Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Fundamentals Of Financial Management, Concise Edi...

Finance

ISBN:9781337902571

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning