Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN: 9781337788281

Author: James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

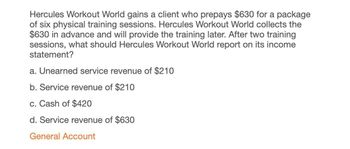

Transcribed Image Text:Hercules Workout World gains a client who prepays $630 for a package

of six physical training sessions. Hercules Workout World collects the

$630 in advance and will provide the training later. After two training

sessions, what should Hercules Workout World report on its income

statement?

a. Unearned service revenue of $210

b. Service revenue of $210

c. Cash of $420

d. Service revenue of $630

General Account

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Lucido Products markets two computer games: Claimjumper and Makeover. A contribution format incomestatement for a recent month for the two games appears below:Claimjumper Makeover TotalSales ............................................ $30,000 $70,000 $100,000Variable expenses ...................... 20,000 50,000 70,000Contribution margin ..................... $10,000 $20,000 30,000Fixed expenses .......................... 24,000Net operating income .................. $ 6,000Required:1. Compute the overall contribution margin (CM) ratio for the company.2. Compute the overall break-even point for the company in sales dollars.3. Verify the overall break-even point for the company by constructing a contribution format incomestatement showing the appropriate levels of sales for the two products.arrow_forwardVolleyElite runs a volleyball program consisting of camps, tournaments, and specialized coaching. VolleyElite charges customers 500 per year for access to its facilities and programs. In addition, VolleyElite charges each customer a 100 registration fee. The fee is not refundable and must be paid at the initiation of the contract. Should the registration fee be considered a separate performance obligation from the yearly dues?arrow_forwardAllocating Transaction Price to Performance Obligations and Recording Sales Maximum Inc. (retailer) has a loyalty program that rewards its customers one point per $1 spent. Points are redeemable for $0.20 off future purchases. A customer purchases products (cost of $280) for cash at the usual selling price of $400 and earns 400 points redeemable for $80 off future purchases of goods or services. The retailer expects redemption of 360 points or 90% of points earned. a. How should the transaction price be allocated among the performance obligation(s)?Note: Round each allocated transaction price in the table below to the nearest dollar. Performance Obligations TransactionPriceas Stated StandaloneSellingPrice AllocatedTransaction Price(rounded) Product purchase Answer Answer Answer Loyalty rewards Answer Answer Answer Answer Answer Answer b. Prepare Maximum’s journal entry to record the $400 sale to the customer where the customer earned 400…arrow_forward

- Purrfect Pets, Inc. provides animal daycare for $ 28 per day. Customers buy three month packages, which provide 15 days of care per month. In January they received cash payments from 12 customers. For the month of January, they will recognize ________ of revenue under the cash basis, and ________ of revenue under the accrual basis. A. $15,120;$5,040 B. $ 420; $1,260 C. $5,040;$5,040 D. $15,120;$15,120arrow_forwardABC company has a contract to sell 200 bikes to a customer for $400 each and the customer has the right to return the bikes within 30 days for a full refund. Based on past experience the entity places the following probabilities on the number of bikes the customer is expected to return: Number of bikes returned Probability of outcome 0 25% 1 20% 2 28% 3 12% 4 15% Using the ‘expected value’ method, calculate the amount of revenue received from customers. Note: Provide all the calculations, do not just write the final answer.arrow_forwardMarin Shed Solutions sells its largest shed for $1,100 plus HST of 13 %. On May 10, 2024, it sold 26 of these sheds. On May 17,2024, the company sold 85 of these sheds. All sales are cash sales. For each day's sales, calculate the HST. May 10, 2024 May 17, 2024 Question Part Score $ Date $ HST payable Prepare a journal entry to record the sales. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. List all debit entries before credit entries. Record journal entries in the order presented in the problem.) Account Titles Debit --/2 Creditarrow_forward

- Allocating Transaction Price to Performance Obligations and Recording Sales Maximum Inc. (retailer) has a loyalty program that rewards its customers one point per $1 spent. Points are redeemable for $0.20 off future purchases. A customer purchases products (cost of $196) for cash at the usual selling price of $280 and earns 280 points redeemable for $56 off future purchases of goods or services. The retailer expects redemption of 252 points or 90% of points earned. Required a. How should the transaction price be allocated among the performance obligation(s)? *Note: Carry all decimals in calculations; round the final answer to the nearest dollar. Performance Obligations Product purchase s Loyalty rewards Total Transaction Price as stated Account Name To record sale of product. 280 ✔ S To record cost of sale of product. 280 S b. Prepare Maximum's journal entry to record the $280 sale to the customer and the cost of that sale where the customer earned 280 loyalty points. *Note: If a…arrow_forwardPacifica Fitness Ltd is marketing a 'fitness package' in which, for $440, it provides customers with a 6-month gym membership (which retails separately for $500, a gym bag (which retails separately for $35) and five free zumba classes (which retail separately for 65). You are required to determine: a) Separate performance obligations and how much of the transaction price to allocate to each performance obligation.arrow_forward- please answer in excel and show work please The manager of Steve's Audio has approved Daisy's application for 24 months of credit with maximum monthly payments of $65. If the annual percentage rate (APR) is 15.8 percent, what is the maximum initial purchase that Daisy can buy on credit? Multiple Choice $1538.25 $1,330.12 $ 890.99 $980.99 $1, 434.67arrow_forward

- CASE BACKGROUND: Digiview, Inc. is a company that offers video streaming of entertainment content for an annual fee of $125. To promote its service, the company places a display advertisement on an entertainment magazine web site called E-Monthly. The E-Monthly web site offers two choices for placement of the ad. Option A: Cost-Per-Thousand (CPM) is $4.00 per 1000 impressions. Option B: Cost-Per-Click (CPC) is $0.25 per click Of the 650,000 people who viewed the ad that Digiview placed on the E-Monthly web site, 10,400 people clicked the advertisement and were directed to the web site of Digiview. Of the 10,400 people who visited the web site of Digiview, 676 people completed on online form requesting more information on the video streaming service. Of the 10,400 people who visited the web site of Digiview, 2288 people left the site after viewing only one page If Digiview chose to place the ad on a CPC basis, what was the cost of the ad? (Show your calculations and final answer…arrow_forwardAllocating Transaction Price to Performance Obligations and Recording Sales Value Dealership Inc. markets and sells the vehicles to retail customers. Along with a new vehicle purchase, a customer will receive a free annual maintenance contract for one year from the date of purchase. The standalone selling price of a vehicle is $30,000 and the standalone selling price for the annual maintenance contract is $400. During October 2020, Value Dealership Inc. sold 30 vehicles for $30,250 per vehicle, each with a free annual maintenance contract. When answering the following questions: Round each allocated transaction price to the nearest dollar. If a journal entry (or a line of the journal entry) isn't required for the transaction, select "N/A" as the account name and leave the Dr. and Cr. answers blank (zero). a. Ignoring the cost entries, record the journal entry in October 2020 for Value Dealership’s sale of vehicles with the associated maintenance contracts to customers.…arrow_forwardHow do I fill out this table below based on the info provided above?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning