Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN: 9781337395083

Author: Eugene F. Brigham, Phillip R. Daves

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

The cost per period of the trade credit extended to Free Spirit, rounded to two decimal places, is (4.00%, 4.17%, 3.67%, 3.50%)

Free Spirit’s trade credit has a nominal annual cost of , assuming a 365-day year. (Note: Round all intermediate calculations to four decimal places, and your final answer to two decimal places.) (28.07%, 33.82%, 33.14%, 30.44%)

The effective annual rate (EAR) of the supplier’s trade credit is (35.36%, 39.29%, 32.61%, 36.93%)

If Free Spirit Industries Inc.’s supplier shortens its discount period to five days, this will the cost of the trade credit. (increase, decrease)

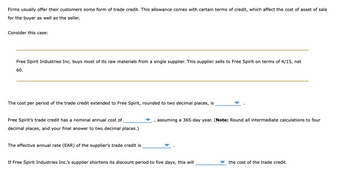

Transcribed Image Text:Firms usually offer their customers some form of trade credit. This allowance comes with certain terms of credit, which affect the cost of asset of sale

for the buyer as well as the seller.

Consider this case:

Free Spirit Industries Inc. buys most of its raw materials from a single supplier. This supplier sells to Free Spirit on terms of 4/15, net

60.

The cost per period of the trade credit extended to Free Spirit, rounded to two decimal places, is

Free Spirit's trade credit has a nominal annual cost of

decimal places, and your final answer to two decimal places.)

The effective annual rate (EAR) of the supplier's trade credit is

assuming a 365-day year. (Note: Round all intermediate calculations to four

If Free Spirit Industries Inc.'s supplier shortens its discount period to five days, this will

the cost of the trade credit.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Firms usually offer their customers some form of trade credit. This allowance comes with certain terms of credit, which affect the cost of asset of sale for the buyer as well as the seller. Consider this case: Free Spirit Industries Inc. buys on terms of 1/20, net 45 from its chief supplier. If Free Spirit receives an invoice for $1,254.98, what would be the true price of this invoice? (Note: Round all intermediate calculations to four decimal places, and your final answer to two decimal places.) O $1,304.55 $1,056.07 $1,242.43 O $1,118.19 The nominal annual cost of the trade credit extended by the supplier is , assuming a 365-day year. (Note: Round all intermediate calculations to four decimal places, and your final answer to two decimal places.) Suppose Free Spirit does not take advantage of the discount and then chooses to pay its supplier late-so that on average, Free Spirit will pay its by paying late. (Note: supplier on the 50th day after the sale. As a result, Free Spirit can…arrow_forwardFirms usually offer their customers some form of trade credit. This allowance comes with certain terms of credit, which affect the cost of asset of sale for the buyer as well as the seller. Consider this case: Purple Turtle Group buys on terms of 3/10, net 30 from its chief supplier. If Purple Turtle receives an invoice for $856.75, what would be the true price of this invoice? $1,163.47 $1,038.81 $706.39 $831.05 The nominal annual cost of the trade credit extended by the supplier is (Note: Assume there are 365 days in a year.) The effective annual rate of interest on trade credit is Suppose Purple Turtle does not take advantage of the discount and then chooses to pay its supplier late-so that on average, Purple Turtle will pay its supplier on the 35th day after the sale. As a result, Purple Turtle can decrease its nominal cost of trade credit by % by paying late.arrow_forwardOne Corporation has two potentialsuppliers. Both are supplying the items atsimilar list prices and trade,discounts.However, Supplier A.offered a credit term of2/10, n/30 and the.other offered a term of3/10, n/40. Which of the following statementsis true? a. Alpha should choose Supplier A and pay on the 10th day.b. Alpha should choose Supplier B and pay on the 10th day.c. Alpha can choose either supplier and always pay on the 10th day.d. If Alpha chose Supplier B, the former should pay on the 30th day so that it can maximize the trade discountarrow_forward

- Shawnee Corp., a household appliances dealer, purchases its inventories from various suppliers. Shawnee has consistently stated its inventories at FIFO cost. Instructions Shawnee is considering alternate methods of accounting for the cash discounts it takes when paying its suppliers promptly. From a theoretical standpoint, discuss the acceptability of each of the following methods. a. Financial income when payments are made. b. Reduction of cost of goods sold for the period when payments are made. c. Direct reduction of purchase cost.arrow_forwardCullumber Corp. sells its goods with terms of 3/10 EOM, net 45. What is the implicit cost of the trade credit? (Do not round itermediate calculations. Use 365 days for calculation. Round answer to 2 decimal places, e.g. 12.25%.) The implicit cost of the trade credit is My answer was wrong ... can someone help me with this please?arrow_forwardVernon Industries sells merchandise to dealers on a consignment basis. Shipping costs are chargeable toVernon, although in some cases, the dealer pays them, while advertising costs are reimbursable from theconsignor. The selling price of the merchandise averages 40% above cost of merchandise, exclusive offreight. The dealer is paid a 10% commission on the sales price for all sales made. All dealer sales are madeon cash basis. The following consignment sales activities occurred during the current year.Units shipped 100Unit cost P10,000Freight cost incurred:Paid by Vernon 75,000Paid by consignee 25,000Advertising costs paid by consignee 50,000At the end of the month, the consignor receives a notification from the consignee that 80 units were sold andthat the amount due to consigner is enclosed. REQUIRED:3. Value of inventory in the hands of the consignee ____________4. Net income to be reported by the consignor ____________5. Amount remitted to the consignorarrow_forward

- Hillz sells its goods with terms of 1/16 EOM, net 30. What is the implicit cost of the trade credit? (Do not round intermediate calculations. Use 365 days for calculation. Round answer to 2 decimal places, e.g. 12.25%.)arrow_forwardRoton Inc. purchases merchandise on terms of 2/15, net 40, and its gross purchases (i.e., purchases before taking off the discount) are $525,000 per year. What is the maximum dollar amount of costly trade credit the firm could get, assuming it abides by the supplier's credit terms? (Assume a 365-day year.) Do not round intermediate calculations. Select one:arrow_forwardGive true solution for this general accounting questionarrow_forward

- Bell Corporation sold merchandise on account with a list price of $18,000 and a cost of $10,000. Payment terms were 1/10, n/30. Bell shipped the goods FOB destination and paid $600 in freight costs. Prior to payment of the invoice, the customer returned merchandise with a list price of $1,800 and a $1,000 cost. The customer paid the amount due within the discount period. What is Bell Corporation's net sales amount as a result of these transactions?arrow_forwardThey sold $50,000 worth of goods on credit, with terms 3/10, n/20, on 2/1/2021. Record this journal entry using both the net and gross methods. Record the journal entry if the customer pays off this account on 2/5/2021. Record the journal entry if the customer pays off this account on 3/1/2021.arrow_forwardThe company sells goods to Jason. The company agreed to send the goods to London with an additional transportation fee (freight fee) PAID BY Jason AS BUYER (not the company paying this fee but the buyer) of $5,000. Record the shipping costs in the Buyer's book and the Seller's book.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT