College Accounting, Chapters 1-27

23rd Edition

ISBN: 9781337794756

Author: HEINTZ, James A.

Publisher: Cengage Learning,

expand_more

expand_more

format_list_bulleted

Question

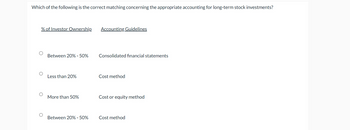

Transcribed Image Text:Which of the following is the correct matching concerning the appropriate accounting for long-term stock investments?

% of Investor Ownership Accounting Guidelines

Between 20% - 50%

Consolidated financial statements

Less than 20%

Cost method

More than 50%

Cost or equity method

Between 20% - 50%

Cost method

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Calculate the following ratios based on the balance sheet, income statement and cash flow prepared in question ROE Return on Capital Employed (post-tax) Net Profit Margin EBITDA Margin Effective Tax Rate Operating Cost Ratio Gross Profit Margin Total Asset Turnover Ratio Fixed Asset Turnover Ratio Receivables Turnover Ratio Leverage Ratio [Avg. Total Assets / Avg. Total Equity] FCF / EBITDA Interest Coverage Ratio Debt Service Coverage Ratio Basic EPS (Assume Face Value of each share is INR 10) Debt : Equity Ratio Income Statement (INR Cr) Units Mar/14 Saleable Units 4,570 Revenues Gross Revenues INR Cr 2,116 Less: Environment Cess INR Cr 5 Net Revenues INR Cr 2,121 Growth (%) -1.9% Expenses O&M Expenses (% of Project Costs) INR Cr 146 YoY Escalation 5.72% EBITDA INR Cr 1,974 Margin (%) 93.1% Book Depreciation INR Cr 439 Interest Expenses INR…arrow_forwardEquity method: Beginning investment + (Ownership percentage x Investee net income) - _________ = Ending Investment Question 1 options: Common Stock Stockholder's Equity Cash Dividendsarrow_forwardStockholders' equity consists of which of the following? Multiple Choice Paid-in (or contributed) capital and retained earnings. Retained earnings and cash. Long-term assets. Paid-in (or contributed) capital and par value. Premiums and discounts. karrow_forward

- Ratio Analysis Consider the following information. Required: Calculate the stockholder payout ratios. (Note: Round answers to two decimal places.) Calculate the stockholder profitability ratios. (Note: Round answers to two decimal places.)arrow_forwardDefine each of the following terms: Weighted average cost of capital, WACC; after-tax cost of debt, rd(1 – T); after-tax cost of short-term debt, rstd(1 – T) Cost of preferred stock, rps; cost of common equity (or cost of common stock), rs Target capital structure Flotation cost, F; cost of new external common equity, rearrow_forwardStockholder Payout Ratios The following information pertains to Milo Mindbender Corporation: Required: Calculate the dividend yield, dividend payout, and total payout. (Note: Round answers to two decimal places.)arrow_forward

- Ratio Analysis Consider the following information taken from the stockholders equity section: How do you interpret the companys payout and profitability performance? Required: 1. Calculate the following for 2020. (Note. Round answers to two decimal places.) 2. CONCEPTUAL CONNECTION Assume 2019 ratios were: and the current year industry averages are: How do you interpret the companys payout and profitability performance?arrow_forwardThe equity method of accounting for investments requires a.the investment to be increased by the reported net income of the investee b.the investment to be reported at its original cost c.a year-end adjustment to revalue the stock to lower of cost or market d.the investment to be increased by the dividends paid by the investeearrow_forwardBhaarrow_forward

- Requirement 1. Compute the following ratios for both companies for the current year, and decide which company’s stock better fits your investment strategy. a. Acid-test ratio b. Inventory turnover c. Days’ sales in receivables d. Debt ratio e. Earnings per share of common stock f. Price/earnings ratio g. Dividend payoutarrow_forwardSubject: acountingarrow_forwardIndicate the effects of each of the following transactions on Assets, Liabilities, Share Capital and Retained Earnings. Use + for increase, - for decrease, and 0 for no effect. Share Retained Assets Liabilities Capital Earnings 1. Declaration of cash dividends 2. Payment of cash dividends 3. Declaration of share dividends 4. Issuance of share dividends 5. A share split 6. Cash purchase of treasury stock 7. Sale of treasury stock below costarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:9781337679503

Author:Gilbertson

Publisher:Cengage

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...

Finance

ISBN:9781285190907

Author:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:Cengage Learning