Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN: 9781337395083

Author: Eugene F. Brigham, Phillip R. Daves

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

General Finance Question Solution

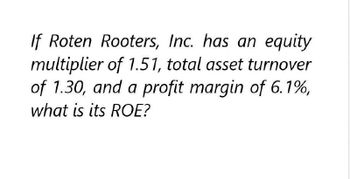

Transcribed Image Text:If Roten Rooters, Inc. has an equity

multiplier of 1.51, total asset turnover

of 1.30, and a profit margin of 6.1%,

what is its ROE?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- If Roten Rooters, Inc., has an equity multiplier of 1.27, total asset turnover of 1.20, and a profit margin of 3.5 percent, what is its ROE?arrow_forwardIf Rooters, Inc., has an equity multiplier of 1.90, total asset turnover of 1.20, and a profit margin of 8 percent, what is its ROE?arrow_forwardWhat is the profit margin ?arrow_forward

- Please give me answer accounting.....arrow_forwardNeed answer with this accounting questionarrow_forwardIf Roten Rooters, Inc., has an equity multiplier of 1.32, total asset turnover of 1.34, and a profit margin of 7.50 percent. What is its ROE? a. 11.94% b. 13.27% c. 14.59% d. -3.22% e. 12.74% :arrow_forward

- If Roten Rooters, Inc., has an equity multiplier of 1.32, total asset turnover of 1.32, and a profit margin of 6.50 percent. What is its ROE? Multiple Choice -2.75% 10.19% 11.33% 12.46% 10.87%arrow_forwardIf Epic, Inc. has an ROE of 25%, an equity multiplier of 4, and a profit margin of 12%, what is the total asset turnover ratio? a. 0.0833 b. 0.192 c. 0.5208 d. 0.75arrow_forwardIf we know that a firm has a net profit margin of 4.5 % total asset turnover of 0.65, and a financial leverage multiplier of 1.47, what is its ROE? What is the advantage to using the DuPont system to calculate ROE over the direct calculation of earnings available for common stockholders divided by common stock equity?arrow_forward

- Red Fire has an equity multiplier of 1.6, a return on assets of 10.35 percent, and an asset turnover of .9. What is its ROE?arrow_forwardHigh mountain foods has an equity multiplier of 1.72 a total asset turnover of 1.16 and a profit margin of 4.5 percent. What is the return on assets?arrow_forwardIf Roten Rooters, Inc., has an equity multiplier of 2.46, total asset turnover of 1.63, current ratio of 2.20, and profit margin of 11.6 percent, then its ROE is _______%. Round it to two decimal places.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT