Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN: 9781337395083

Author: Eugene F. Brigham, Phillip R. Daves

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

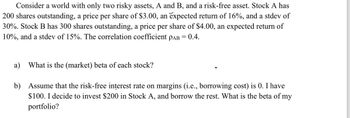

Transcribed Image Text:Consider a world with only two risky assets, A and B, and a risk-free asset. Stock A has

200 shares outstanding, a price per share of $3.00, an expected return of 16%, and a stdev of

30%. Stock B has 300 shares outstanding, a price per share of $4.00, an expected return of

10%, and a stdev of 15%. The correlation coefficient PAB = 0.4.

a) What is the (market) beta of each stock?

b) Assume that the risk-free interest rate on margins (i.e., borrowing cost) is 0. I have

$100. I decide to invest $200 in Stock A, and borrow the rest. What is the beta of my

portfolio?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Give typing answer with explanation and conclusion Consider a world with only two risky assets, A and B, and a risk-free asset. Stock A is held at 1/3 at a price per share of $3.00, an expected return of 16% and a σ of 30%. Stock B is held at 2/3 at a price per share of $4.00, an expected return of 10% and a σ of 15%. The correlation between A and B is 0.4 , the covariance of stock A with the market Cov(RA,RM) is 0.042. (a) What is the expected return of the market portfolio? Answer % (b) What is the variance of the market portfolio? Answer (c) What is the beta of each stock? β_Α=Answer β_Β=Answerarrow_forwardConsider an economy with just two assets. The details of these are given below. Number of Shares Price Expected Return Standard Deviation A 100 1.5 15 15 B 150 2 12 9 The correlation coefficient between the returns on the two assets is 1=3 and there is also a risk-free asset. Assume the CAPM model is satisfied. (1) What is the expected rate of return on the market portfolio? (2) What is the standard deviation of the market portfolio? (3) What is the beta of stock A? (4) What is the risk-free rate of return?arrow_forwardAn investor has an opportunity to invest in two risky assets and a risk-free asset. Theexpected return of the two risky assets are μ1 = 0.12, μ2 = 0.15. Their standarddeviations are σ1 = 0.05 and σ2 = 0.1, and the correlation coefficient between theirreturn is 0.2. The risk-free rate is 0.05. Suppose the investor has $1000 and he wantsto hold a portfolio with expected return of 0.1. If the investor is risk averse, how muchshould he invest in the two risky assets and the risk-free asset?arrow_forward

- Assume that you are considering investing in two risky assets, namely PKX and XIY, with the following probability distribution. Assume that short selling is allowed. Stock РКХ XIY State of the world Probability Return (%) Return (%) 1 0.25 18 2 0.30 5 -3 3 0.20 12 15 4 0.10 4 12 0.15 6 1 1. Calculate the expected return and risk for each of these assets. Interpret. 2. Consider a portfolio that contains PKX and XIY. Note that XIY comprises 30% of the portfolio. What is the expected return and risk of this portfolio? 3. How will your answer in (2) change if XIY comprises 20% of the portfolio only? Comment on your findings.arrow_forwardConsider a world with only two risky assets, A and B, and a risk-free asset. Stock Ahas 200 shares outstanding, a price per share of $3.00, an expected return of 16% anda volatility of 30%. Stock B has 300 shares outstanding, a price per share of $4.00, anexpected return of 10% and a volatility of 15%. The correlation coefficient ρAB = 0.4.Assume CAPM holds.(a) What is expected return of the market portfolio?(b) What is volatility of the market portfolio?(c) What is the beta of each stock?(d) What is the risk-free rate?arrow_forwardAssume an economy in which there are three securities: Stock A with rA = 10% and σA = 10%; Stock B with rB = 15% and σB = 20%; and a riskless asset with rRF = 7%. Stocks A and B are uncorrelated (rAB = 0). Which of the following statements is most CORRECT? 1. b. The expected return on the investor’s portfolio will probably have an expected return that is somewhat below 10% and a standard deviation (SD) of approximately 10%. 2. d. The investor’s risk/return indifference curve will be tangent to the CML at a point where the expected return is in the range of 7% to 10%. 3. e. Since the two stocks have a zero correlation coefficient, the investor can form a riskless portfolio whose expected return is in the range of 10% to 15%. 4. a. The expected return on the investor’s portfolio will probably have an expected return that is somewhat above 15% and a standard deviation (SD) of approximately 20%. 5.…arrow_forward

- Security A has an expected rate of return of 6%, a standard deviation of returns of 30%, a correlation coefficient with the market of −0.25, and a beta coefficient of −0.5. Security B has an expected return of 11%, a standard deviation of returns of 10%, a correlation with the market of 0.75, and a beta coefficient of 0.5. Which security is more risky? Why?arrow_forwardConsider a world with only two risky assets, X and Y, and a risk-free asset. Stock X has 200 shares outstanding, a price per share of 3 TL, an expected return of 16% and a standard deviation of 30%. Stock Y has 300 shares outstanding, a price per share of 4 TL, an expected return of 10% and a standard deviation of 15%. The correlation between these two stocks is 40%. Assume CAPM holds. What would be the beta of Stock X and Stock Y.arrow_forwardConsider an economy with a (net) risk-free return r1 = 0:1 and a market portfolio with normally distributed return, with ErM = 0:2 and 2M = 0:02. Suppose investor A has CARA preferences, with risk aversion coe¢ cient equal to 1 and an endowment of 10. a) Write down the maximization problem for the investor. b) Determine the amount invested in the risky portfolio and in the risk-free asset. c) Suppose another investor (B) has a coe¢ cient of absolute risk aversion equal to 2 (and the same endowment 10). Compute his optimal portfolio and compare it to that of investor A. Explain the di§erent results for investors A and B. d) Finally, consider Investor C with mean-variance preferences Ec V ar(c) (and endowment 10). Compute his optimal portfolio and compare it to that of investors A and B (as obtained in questions b and c). Compare your result with those obtained for investors A and B.arrow_forward

- Suppose the CAPM is true. Consider two assets, X and Y, and the market M. Suppose cov(X,M) = .3, cov(Y,M) = .5. %3D (a) Is the expected return higher on X or Y? (b) Suppose var(M) = 1.5, what are the betas of X and Y? (c) Suppose the expected market return is 20% and the risk free rate is 5%, what is the expected returns of X and Y?. (d) Given your analysis in (a)-(c), what type of investor would prefer asset X to asset Y?arrow_forwarda. Calculate the required rate of return for an asset that has a beta of 1.19, given a risk-free rate of 2.7% and a market return of 8.9%. b. If investors have become more risk-averse due to recent geopolitical events, and the market return rises to 12.1%, what is the required rate of return for the same asset?arrow_forwardStock A has expected return of 15% and standard deviation (s.d.) 20%. Stock B has expected return 20% and s.d. 15%. The two stocks have a correlation coefficient of 0.5. 1.Note that Stock A has greater risk (s.d.) that Stock B, but a lower expected return. Explain how is this possible in a world where returns on assets are as predicted by the CAPM. 2. Determine the expected return and the s.d. of portfolio P1, composed by investing 30% in stock A and 70% in stock B. 3. Consider stock C that has expected return 15% and s.d. 15%. Stock C is uncorrelated with either stock A and stock B. Determine the expected return and s.d. of portfolio P2 made by investing 50% in stock C and 50% in portfolio P1.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning