EBK CONTEMPORARY FINANCIAL MANAGEMENT

14th Edition

ISBN: 9781337514835

Author: MOYER

Publisher: CENGAGE LEARNING - CONSIGNMENT

expand_more

expand_more

format_list_bulleted

Question

Accurate answer

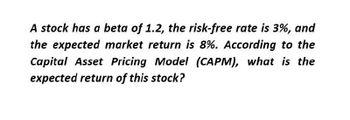

Transcribed Image Text:A stock has a beta of 1.2, the risk-free rate is 3%, and

the expected market return is 8%. According to the

Capital Asset Pricing Model (CAPM), what is the

expected return of this stock?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- How do you find the market risk premium and market expected return given the expected return of stock, beta, and risk free rate? Example: The expected return of a stock with a beta of 1.2 is 16.2%. Calculate the market risk premium and the market expected return, given a risk-free rate of 3%.arrow_forwardThe risk-free rate is 5.6%, the market risk premium is 8.5%, and the stock’s beta is 2.27. What is the required rate of return on the stock, E(Ri)? Use the CAPM equation.arrow_forwardAssume that using the Security Market Line(SML) the required rate of return(RA)on stock A is found to be halfof the required return (RB) on stock B. The risk-free rate (Rf) is one-fourthof the required return on A. Return on market portfolio is denoted by RM. Find the ratioof betaof A(A) tobeta of B(B). Thank you for your help.arrow_forward

- Assume that using the Security Market Line (SML) the required rate of return (RA) on stock A is foundto be half of the required return (RB) on stock B. The risk-free rate (Rf) is one-fourth of the requiredreturn on A. Return on market portfolio is denoted by RM. Find the ratio of beta of A (A) to beta of B(B). d) Assume that the short-term risk-free rate is 3%, the market index S&P500 is expected to payreturns of 15% with the standard deviation equal to 20%. Asset A pays on average 5%, has standarddeviation equal to 20% and is NOT correlated with the S&P500. Asset B pays on average 8%, also hasstandard deviation equal to 20% and has correlation of 0.5 with the S&P500. Determine whetherasset A and B are overvalued or undervalued, and explain why. (Hint: Beta of asset i (??) =???????, where ??,?? are standard deviations of asset i and marketportfolio, ??? is the correlation between asset i and the market portfolio)Question 2. Foreign exchange marketsStatoil, the national…arrow_forwardWhat should be the risk premium and return on a stock with a Beta of zerounder the Capital Asset Pricing Model (CAPM)? What about the risk premiumand return on a stock with a Beta of 1?arrow_forwardc) Assume that using the Security Market Line (SML) the required rate of return (Ra) on stock A is found to be half of the required return (Rs) on stock B. The risk-free rate (R:) is one-fourth of the required return on A. Return on market portfolio is denoted by RM. Find the ratio of beta of A (Ba) to beta of B (B).arrow_forward

- Assume that using the Security Market Line(SML) the required rate of return(RA)on stock A is found to be half of the required return (RB) on stock B. The risk-free rate (Rf) is one-fourthof the required return on A. Return on market portfolio is denoted by RM. Find the ratio of beta of A(A) to beta of B(B).arrow_forwardSuppose Stock A has B = 1 and an expected return of 11%. Stock B has a B = 1.5. The risk- free rate is 5%. Also consider that the covariance between B and the market is 0.135. Assume the CAPM is true. Answer the following questions: a) Calculate the expected return on share B. b) Find the equation of the Capital Market Line (CML). c) Build a portfolio Q with B = 0 using actions A and B. Indicate weights (interpret your result) and expected return of portfolio Q.arrow_forwardAssume that using the Security Market Line (SML) the required rate of return (RA) on stock A is found to be half of the required return (RB) on stock B. The risk-free rate (Rf) is one-fourth of the required return on A. Return on market portfolio is denoted by RM. Find the ratio of beta of A (bA) to beta of B (bB). (please show all workings)arrow_forward

- Assume that using the Security Market Line the required rate of return (RA) on stock A is found to be half of the required return (RB) on stock B. The risk-free rate (Rf) is one-fourth of the required return on A. Return on the market portfolio is denoted by RM. Find the ratio of beta of A (bA) to beta of B (bB).arrow_forwardQuestion: Assume that using the Security Market Line (SML) the required rate of return (RA) on stock A is found to be half of the required return (RB) on stock B. The risk-free rate (Rf) is one-fourth of the required return on A. Return on market portfolio is denoted by RM. Find the ratio of beta of A to beta of B.arrow_forwardAssume that using the Security Market Line (SML) the required rate of return (RA) on stock A is found to be half of the required return (RB) on stock B. The risk-free rate (Rf) is one-fourth of the required return on A. Return on market portfolio is denoted by RM. Find the ratio of beta of A (bA) to beta of B (bB). please show all workings and not merely : Ra = 1/2 rbRf = 1/4 Raarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT