Cornerstones of Financial Accounting

4th Edition

ISBN: 9781337690881

Author: Jay Rich, Jeff Jones

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Find the Common Size Analysis and Trend Analysis for three years for the Income Statement,

Compare both Common Size Analysis and Trend Analysis insights to management of how the Excel Corporation is performing.

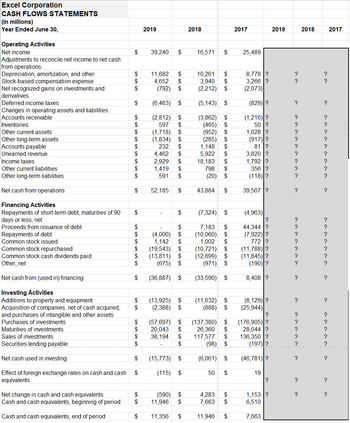

Transcribed Image Text:Excel Corporation

CASH FLOWS STATEMENTS

(In millions)

Year Ended June 30,

2019

2018

2017

2019

2018

2017

Operating Activities

Net income

$

39,240 $

16,571 $

25,489

Adjustments to reconcile net income to net cash

from operations:

Depreciation, amortization, and other

$

11,682 $

10,261 $

8,778 ?

?

?

Stock-based compensation expense

$

4,652 $

3,940 $

3,266 ?

?

?

Net recognized gains on investments and

$

(792) $

(2,212) $

(2,073)

derivatives

Deferred income taxes

$

(6,463) $

(5,143) $

(829)?

?

?

Changes in operating assets and liabilities:

Accounts receivable

$

(2,812) $

(3,862)

$

(1,216)?

?

?

Inventories

$

597 $

(465) $

50 ?

?

?

Other current assets

$

(1,718) $

(952) $

1,028 ?

?

?

Other long-term assets

$

(1,834) $

(285) $

(917)?

?

?

Accounts payable

Unearned revenue

Income taxes

Other current liabilities

Other long-term liabilities

$

232 $

1,148 $

81 ?

?

?

$

4,462

$

5,922 $

3,820 ?

?

?

$

2,929

$

18,183 $

1,792 ?

?

?

$

1,419

$

798 $

356 ?

?

?

$

591

$

(20) $

(118)?

?

?

$

52,185

$

43,884 $

39,507 ?

?

?

Net cash from operations

Financing Activities

Repayments of short-term debt, maturities of 90

$

$

(7,324) $

(4,963)

days or less, net

?

?

?

Proceeds from issuance of debt

$

$

7,183 $

44,344 ?

?

?

Repayments of debt

$

(4,000) $

(10,060) $

(7,922)?

?

?

Common stock issued

$

1,142 $

1,002 $

772?

?

?

Common stock repurchased

$

(19,543) $

(10,721) $

(11,788)?

?

?

Common stock cash dividends paid

$

(13,811) $

(12,699)

$

(11,845)?

?

?

Other, net

$

(675) $

(971)

$

(190)?

?

?

Net cash from (used in) financing

$

(36,887) $

(33,590) $

8,408 ?

?

?

Investing Activities

Additions to property and equipment

$

(13,925) $

(11,632)

Acquisition of companies, net of cash acquired,

$

(2,388) $

$

(888) $

(8,129)?

?

?

(25,944)

and purchases of intangible and other assets

?

?

?

Purchases of investments

$

(57,697) $

(137,380) $

(176,905)?

?

?

Maturities of investments

$

20,043 $

26,360 $

28,044 ?

?

?

Sales of investments

$

38,194 $

117,577

$

136,350 |?

?

?

Securities lending payable

$

$

(98)

$

(197)?

?

?

Net cash used in investing

$

(15,773) $

(6,061) $

(46,781)?

?

?

Effect of foreign exchange rates on cash and cash

equivalents

$

(115) $

50 $

19

?

?

Net change in cash and cash equivalents

$

(590) $

4,283 $

Cash and cash equivalents, beginning of period

$

11,946

$

7,663 $

1,153 ?

6,510

?

?

Cash and cash equivalents, end of period

$

11,356

$

11,946

$

7,663

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Compared to the ROE in 2020, the ROE in 2021 has Improved / 6.65% Improved / 3.43% Worsened / -6.65% Worsened / -3.43% Stayed the same / 0% byarrow_forwardRITTER CORPORATION Income Statement Revenue Expenses Depreciation Net income Dividends 2019 Assets Cash Other current assets Net fixed assets Total assets Liabilities and Equity Accounts payable Long-term debt Stockholders' equity C. RITTER CORPORATION Balance Sheets December 31 Total liabilities and equity $780 580 93 $ 107 $ 87 2018 $ 58 168 373 $599 $ 118 143 338 $599 a. Change in cash b. Change in net working capital Cash flow from assets 2019 $ 71 176 393 $640 $ 131 151 358 a. What is the change in cash during 2019? b. Determine the change in net working capital in 2019. c. Determine the cash flow generated by the firm's assets during 2019. $640 $ $ 13 8arrow_forwardCurrent Assets Cash F Accounts Receivable Inventory Balance Sheet and Income Statement Data December 31, 2021 Total Current Assets Property, Plant, and Equipment Less: Accumulated Depreciation Total Assets Current Liabilities Accounts Payable Notes Payable Income Taxes Payable Total Current Liabilities Bonds Payable Total Liabilities Stockholders' Equity Common Stock Retained Earnings $193,000 383,000 206,000 782,000 1,241,000 (476,000) 765,000 $1.547.000 $155,000 61,000 107.CO 323,000 340,000 663,000 510,000 374,000 884,000 Total Stockholders' Equity Total Liabilities & Stockholders' Equity $1.547.000 Additional Information: 1. Net Income for the year ending December 31, 2021 was $164,000 December 31, 2020 $115,000 316,000 334,000 765,000 1,122,000 (442,000) 680,000 $1.445.000 $102,000 68,000 76,500 246,500 391,000 637,500 467,500 340,000 807,500 $1.445.000 2. During the year, the company sold equipment with an original cost of $147,000 and accumulated depreciation of $119,000. 3.…arrow_forward

- React Corporation Comparative Statements of Financial Position December 31, 2025 and 2024 2025 2024 Assets Current Assets Cash & Cash Equivalent 106,789 102,375 Trade & Other Receivables 327,611 277,467 Inventory 331,863 297,654 Prepaid Expenses 101,565 114,813 Total Current Assets 870,828 792,309 Noncurrent Assets Property, Plant & Equipment Intangibles 135,754 166,481 Total Noncurrent Assets 7,500 7,500 TOTAL ASSETS 143,254 173,981 1,014,082 966,290 Liabilities and Shareholders’ Equity Current Liabilities Trade & Other Payables Unearned Revenues 238,000 208,703 Notes Payables - current 107,508 82,456 Total Current Liabilities 45,000 45,000…arrow_forwardCurrent Assets: Cash Accounts Receivable Inventory Cullumber Enterprises Balance Sheet and Income Statement Data December 31, 2025 Total Current Assets Property. Plant, and Equipment Less: Accumulated Depreciation Total Assets Current Liabilities: Accounts Payable Notes Payable Income Taxes Payable Total Current Liabilities Bonds Payable Total Liabilities Stockholders' Equity: Common Stock $195,840 304,640 500,480 1,000,960 1,588,480 (609,280) $1,980,160 $239,360 65,280 108,800 413,440 435,200 848,640 652,800 December 31, 2024 $152,320 391,680 435,200 979,200 1,436,160 (565,760) $1,849,600 $130,560 87,040 97,920 315,520 500,480 816,000 598,400arrow_forwardWhat is Declan's Designs' 2022 total "Common Stock Issuance" to be reported on its Statement of Cash Flows? Question 29 options: $10,000 $6,000 $2,000 $8,000arrow_forward

- Category Accounts payable Accounts receivable Accruals Additional paid in capital Cash Common Stock COGS Current portion long-term debt Depreciation expense Interest expense Inventories Long-term debt Net fixed assets Notes payable Operating expenses (excl. depr.) Retained earnings Sales Taxes Prior Year Current Year ??? ??? 320,715 397,400 40,500 33,750 500,000 541,650 17,500 47,500 94,000 105,000 328,500 431,876.00 33,750 35,000 54,000 54,402.00 40,500 42,823.00 279,000 288,000 339,660.00 398,369.00 946,535 999,000 148,500 162,000 126,000 162,881.00 306,000 342,000 639,000 847,928.00 24,750 47,224.00 What is the current year's return on assets (ROA)? Submit Answer format: Percentage Round to: 2 decimal places (Example: 9.24%, % sign required. Will accept decimal format rounded to 4 decimal places (ex: 0.0924))arrow_forwardAvery Corporation Balance Sheet For year ending December 31 2019 2020 2021 ssets Cash & securities 17,643.813 132,468.629 22,281.616 115,121.68 27,594.924 ccounts receivable 112,479.309 100,955.129 10,947.986 251,977.349 ventories 78,867.845 90,512.493 10,222.209 239,202.497 repaid expenses 10,426.653 otal current assets 238,342.442 Flant property and equipment Lcumulated depreciation let property plant and equipment 531,554.881 510,906.018 536,451.319 87,197.29 128,069.772 170,985.877 444,357.591 382,836.246 365,465.442 Other assets 10,222.209 15,639.98 16,421.979 otal Assets 693,782.297 636,818.669 633,864.769 iabilities & Shareholders'Equity ccounts payable ank Loan axes Payable ccrued expenses 54,080.808 31,297.644 27,599.965 45,191.687 112,482.797 26,066.634 15,639.98 37,773.252 150,798.301 27,369.965 26,577.744 139,556.161 32,843.958 248,785.476 otal current liabilities 199,381.098 ong term debt 95,000 55,000 30,000 Common stock 300,000 200,000 150,000 Eetained earnings Total…arrow_forwardQuestion No. 1 Cash Flow Statement The comparative balance sheets of Kennewick Inc. are shown below: Balance Sheet December 31 2019 2020 ∆ Cash $ 430,000 $ 300,000 (130,000) Accounts receivable 820,000 900,000 80,000 Inventory 975,000 1,100,000 125,000 Capital assets 5,200,000 5,800,000 600,000 Accumulated amortization (3,825,000) (4,025,000) (200,000) Capital assets-net 1,375,000 1,775,000 400,000 Total assets $ 3,600,000 $ 4,075,000 Accounts payable $ 955,000 $ 900,000 (55,000) Accrued liabilities 145,000 152,000 7,000 Dividend Payable - 8,000 8,000 Bonds payable 1,300,000 1,000,000 (300,000) Mortgage payable 500,000 800,000 300,000 Common stocks 450,000 740,000 290,000 Retained earnings 250,000 475,000 225,000 Total liabilities and stockholders’ equity $ 3,600,000 $…arrow_forward

- The most recent financial statements for Crosby, Incorporated, appear below. Sales for 2022 are projected to grow by 20 percent. Interest expense will remain constant, the tax rate and the dividend payout rate also will remain constant. Costs, other expenses, current assets, fixed assets, and accounts payable increase spontaneously with sales. Sales Costs Other expenses Earnings before interest and taxes Interest expense Taxable income Taxes (24%) CROSBY, INCORPORATED 2021 Income Statement Net income Dividends Addition to retained earnings Current assets Cash Accounts receivable Inventory $31,335 69,745 $ 20,640 43,580 91,960 $747,000 582,000 18,000 FA $147,000 14,000 $ 133,000 31,920 $ 101,080 CROSBY, INCORPORATED Balance Sheet as of December 31, 2021 Assets Seved Liabilities and Owners' Equity Current liabilities Accounts payable Notes payable Total $ 54,800 14,000 $ 68,800 MA000arrow_forwardFind earnings per share 2019arrow_forwardNonearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Fundamentals Of Financial Management, Concise Edi...FinanceISBN:9781337902571Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals Of Financial Management, Concise Edi...FinanceISBN:9781337902571Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Fundamentals Of Financial Management, Concise Edi...

Finance

ISBN:9781337902571

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning