Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN: 9781337395083

Author: Eugene F. Brigham, Phillip R. Daves

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

Please give me answer accounting.....

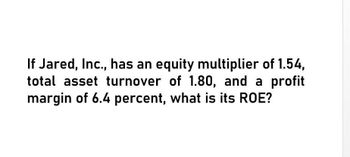

Transcribed Image Text:If Jared, Inc., has an equity multiplier of 1.54,

total asset turnover of 1.80, and a profit

margin of 6.4 percent, what is its ROE?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- If Roten Rooters, Inc., has an equity multiplier of 1.27, total asset turnover of 1.20, and a profit margin of 3.5 percent, what is its ROE?arrow_forwardIf Rooters, Inc., has an equity multiplier of 1.90, total asset turnover of 1.20, and a profit margin of 8 percent, what is its ROE?arrow_forwardjPhone, Inc., has an equity multiplier of 1.44, total asset turnover of 1.73, and a profit margin of 11 percent. What is the company's ROE?arrow_forward

- Need answer with this accounting questionarrow_forwardProvide provided correct answer accounting....arrow_forwardIf we know that a firm has a net profit margin of 4.3 %, total asset turnover of 0.77, and a financial leverage multiplier of 1.36, what is its ROE? What is the advantage to using the DuPont system to calculate ROE over the direct calculation of earnings available for common stockholders divided by common stock equity?arrow_forward

- If we know that a firm has a net profit margin of 4.5 % total asset turnover of 0.65, and a financial leverage multiplier of 1.47, what is its ROE? What is the advantage to using the DuPont system to calculate ROE over the direct calculation of earnings available for common stockholders divided by common stock equity?arrow_forwardRed Fire has a Debt/Equity Ratio of .15, and Equity Multiplier of 1.15, a return on sales of 6.4, and an asset turnover of 1.3. What is its ROE?arrow_forwardRed Fire has an equity multiplier of 1.6, a return on assets of 10.35 percent, and an asset turnover of .9. What is its ROE?arrow_forward

- Solvearrow_forwardO'Brien Inc. has the following data: rRF = 5.00%; RPM = 9.00%; and b = 0.65. What is the firm's cost of equity from retained earnings based on the CAPM?arrow_forwardDefine profitability raitos return on assets and return on equity. According to the following metrics: ROA Return on Assets: 14%; ROE Return on Equity: 305%. What is the profitability the of example company? Why or why not is this company profitable?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning