Quickbooks Online Accounting

3rd Edition

ISBN: 9780357391693

Author: Owen

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:Chrome

File

Edit View History Bookmarks Profiles

Profiles Tab Window Help

M Fwd: You have been registere X

→ (Proctored)- 2025 Campus - X +

capitalone.synap.ac/quiz/a/tRhEWQFFrqU

→

CA

Apps

Split PDF files onli....

2 Cybersecurity Cer... C Structured Plan | C... Log-in to Student... Dashboard Wendys

(Proctored)-2025 Campus - BA Quant Assessment - Cycle 4

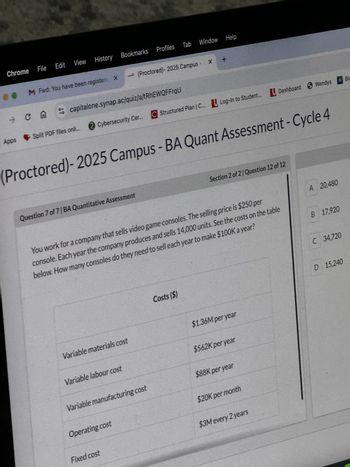

Question 7 of 7|BA Quantitative Assessment

Section 2 of 2 Question 12 of 12

You work for a company that sells video game consoles. The selling price is $250 per

console. Each year the company produces and sells 14,000 units. See the costs on the table

below. How many consoles do they need to sell each year to make $100K a year?

A 20,480

B 17,920

Costs ($)

Variable materials cost

$1.36M per year

Variable labour cost

$562K per year

Variable manufacturing cost

$88K per year

Operating cost

$20K per month

$3M every 2 years

Fixed cost

C 34,720

D 15,240

A Bla

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Similar questions

- ucation.com/ext/map/index.html?_con%3Dcon&external_browser=D0&launchUrl%=https%253A%252F%252Fblackboard.strayer.edu%252Fweb: S A Course in Miradles A New Earth MyNeopost ACTIVE University... E https://secure.times. Guide to forecastin.. ork 1 Saved Required information [The following information applies to the questions displayed below.] Seiko's current salary is $98,500. Her marginal tax rate is 32 percent and she fancies European sports cars. She purchases a new auto each year. Seiko is currently a manager for Idaho Office Supply. Her friend, knowing of her interest in sports cars, tells her about a manager position at the local BMW and Porsche dealer The new position pays only $87100 per year, but it allows employees to purchase one new car per year ata discount of $17,700. This discount qualifies as a nontaxable fringe benefit. In an effort to keep Seiko as an employee, Idaho Office Supply offers her a $12.400 raise. Answer the following questions about this analysis. c. What…arrow_forwardWhat is IRR?arrow_forwardNSPIRON متوقف مؤقتا elearn.squ.edu.om/mod/quiz/review.php?attempt=D16687 G... Obs -Jblicyl .lyI all zihll Go SQU E-LEARNING SYSTEM (ACADEMIC) E-LEARNING SERVICES SQU LIBRARIES SQU PORTALATTENDANCE The correct answer is: OMR 35,200 Question 10 Company XYZ is currently producing AND selling 10,000 units of product A. At this level, the total product cost was $60,000. This included $10,000 direct materials, $20,000 direct labor and $30,000 manufacturing overhead cost, which included 20% variable manufacturing overhead cost. The selling and administrative expenses were $100,000, which included $60,000 variable selling and administrative costs. Assume that the selling price per unit $20, how much was the total contribution margin? Theorrect Mark0.00 out of 2.00 Flag question a. $134,000 b. None of the given answers C. $40,000 d. $104,000 e. $194,000 The correct answer is: $104,000 Windows Finish review ENG II ...arrow_forward

- rive - Google Drive 4 My Drive - Google Drive + Front Desk Operations 2020 - Go X akeAssignment/takeAssignmentMain.do?invoker=&takeAssignmentSessionLocator=D&inprogress%3false ☆ Tp ix 02 TVCC Email P My Math Lab Log In to Canvas EX Mathway | Calculus... N Netflix , Cengage Login Login 国R. Operating Leverage Beck Inc. and Bryant Inc. have the following operating data: Beck Inc. Bryant Inc. Sales $165,000 $505,000 Variable costs 66,200 303,000 Contribution margin $98,800 $202,000 Fixed costs 60,800 101,000 Income from operations $38,000 $101,000 a. Compute the operating leverage for Beck Inc. and Bryant Inc. If required, round to one decimal place. Beck Inc. Bryant Inc. b. How much would income from operations increase for each company if the sales of each increased by 10%? If required, round answers to nearest whole number. Dollars Percentage Beck Inc. $4 % Bryant Inc. c. The difference in the of income from operations is due to the difference in the operating leverages. Beck Inc.'s…arrow_forward- Google Drive X 4 My Drive - Google Drive +Front Desk Operations 2020 - Go X + Assignment/takeAssignmentMain.do?invoker-&takeAssignmentSessionLocator=&inprogress%-false * Tp Ask 0 TVCC Email P My Math Lab Log In to Canvas X Mathway | Calculus.. N Netflix Cengage Login Login Rea Equivalent Units and Related Costs; Cost of Production Report; Entries Dover Chemical Company manufactures specialty chemicals by a series of three processes, all materials being introduced in the Distilling Department. From the Distilling Department, the materials pass through the Reaction and Filling departments, emerging as finished chemicals. The balance in the account Work in Process-Filling was as follows on January 1: Work in Process-Filling Department (3,500 units, 30% completed): Direct materials (3,500 x $10.60) $37,100 Conversion (3,500 x 30% x $6.80) 7,140 $44,240 The following costs were charged to Work in Process-Filling during January: Direct materials transferred from Reaction Department: 45,200…arrow_forwardNWP Assessment Player Ul Applix Google Sheets was/ui/v2/assessment-player/index.html?launchld-907f08b9-4114-4450-a617-650a20ce25f5#/question/13 ess VPN McAfee Security Question 14 of 14 LastPass password... SHAMSHAD TV Geo.TV, Geo News... View Policies Show Attempt History Current Attempt in Progress Direct labor costs Machine hours Setup hours Saddle Inc. has two types of handbags: standard and custom. The controller has decided to use a plantwide overhead rate based on direct labor costs. The president has heard of activity-based costing and wants to see how the results would differ if this system were used. Two activity cost pools were developed: machining and machine setup. Presented below is information related to the company's operations. (a) ×› (383) Chand Sifarish - YouT xa (1) bartleby - Search Standard 1,500 $50,000 $100,000 90 Custom 1,500 Video thumbnail fo... 420 xb Home | bartleby 1.67/5 = : 4 Total estimated overhead costs are $312,000. Overhead cost allocated to the…arrow_forward

- A Desrnos Scientific Caloulator O Dashboard NWP Assessment Player UI Appl x ducation.wiley.com/was/ui/v2/assessment-player/index.html?launchld%-D45890eae-ca08-4075-a619-cdfdc9fe1785#/question/7 ACC201-01 Welcome - Liferay 9 MLA Citation Gener. Goldlink e Google Keep O Dashboard ou Tube Desmos work 8.5/1 Question 8 of 10 > Prepare an income statement for Splish Brothers Inc. for the year ended December 31, 2017. Splish Brothers Inc. Income Statement For the Year Ended December 31, 2017 Net Income / (Loss) Cost of Goods Sold 2$4 24 up %arrow_forwardxrernal_browser%3D0&launchUrl=https%6253A%5vi F%252Fnewconnect.mheducation.com%252F#/activi mheduca nc The... SA Course in Miracles A New Earth MyNeopost ACTIVE University... E https://securetimes.. Guide to forecastin. Assume Inve mework i Saved Help తడండి Required information [The following information applies to the questions displayed below.] Sandra would like to organize BAL as either an LLC (taxed as a sole proprietorship) or a C corporation. In either form, the entity is expected to generate an 8 percent annual before-tax return on a $610.000 investment Sandra's marginal income tax rate is 37 percent and her tax rate on dividends and.capital gains is 23.8 percent (including the 3.8 percent net investment income tax). If Sandra organizes BAL as an LLC, she will be required to pay an additional 2.9 percent for self- employment tax and an additional 0.9 percent for the additional Medicare tax. BAL'S income is not qualified business income (QBI) so Sandra is not allowed to claim the…arrow_forwardle Chrome File Edit View History Bookmarks Profiles Tab Window Help My Inbox (240)-abigailoforiwaa x | M Gmail WiConnect - Home × M Question 12-Mid-Term Exam × + ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fbb.mwcc.edu%252Fwe... C Mid-Term Exam Mc Graw Hill Saved Help S The December 31, 2021, adjusted trial balance of Business Solutions (reflecting its transactions from October through December of 2021) follows. 12 Number Account Title 101 Cash Debit $ 49,842 Credit 106 Accounts receivable. 126 Computer supplies 128 Prepaid insurance Skipped 131 Prepaid rent 6,168 670 1,440 795 163 Office equipment 8,100 164 Accumulated depreciation-office equipment $ 405 167 Computer equipment 22,000 Ask 168 Accumulated depreciation-Computer equipment 201 Accounts payable 210 Wages payable 1,375 1,300 460 236 Unearned computer services revenue 301 S. Rey, Capital 302 S. Rey, Withdrawals 403 Computer services revenue 612 Depreciation expense-Office…arrow_forward

- ezto.mheducation.com/ext/map/index.html?_con%3Dcon&extermal_browser%3D0&launchUrl-https%253A%252F9%252Fblackboard.strayer.edu%252Fwebapps%252Fportal.. SA Course in Miracles A New Earth MyNeopost 1 ACTIVE | University... E https://secure.times... Guide to forecastin... Assume Inventory d.. yHealing The... er 13 Homework 0 Saved Help Save Check my work mode : This shows what is correct or incorrect for the work you have completed so far. It does not indicate completion. Retur Alicia has been working for JMM Corp. for 32 years. Alicia participates in JMM's defined benefit plan. Under the plan. for every year of service for JMM she is to receive 2 percent of the average salary of her three highest years of compensation from JMM. She retired on January 1, 2019. Before retirement, her annual salary was $603,000, S633.000, and S663.000 for 2016, 2017. and 2018. What is the maximum benefit Alicia can receive in 2019? Answer is complete but not entirely correct. Maximum benefit in 2019 $…arrow_forwardon%3Dconcexternal browser%3D08launchUrl=https%253A%252F%6252FBlackboard.strayer.edu%252Fwebapps%252Fr The... S A Course in Miracles A New Earth MyNeopost A ACTIVE | University.. E https://secure.times.. Guide to forecastin.. . Assurne Inver Check my work mode : This shows what is correct or incorrect for the work you have completed so far. It does not indicate compler Required information [The following information applies to the questions displayed below. Michael is single and 35 years old. He is a participant in his employer's sponsored retirement plan. How much can Michael contribute to a Roth IRA in 2019 in each of the following alternative situations? (Leave no answer blank. Enter zero if applicable.) c. Michael's AGI is $128,000 before any IRA contributions. Answer is complete but not entirely correct. Contribution to Roth IRAarrow_forwardO Dashboard w NWP Assessment Player UI Appl x BA Desmos | Scientific Calculator //education.wiley.com/was/ui/v2/assessment-player/index.html? launchld=45890eae-ca08-4075-a619-cdfdc9fe1785#/question/4 YouTube Desmos Goldlink Google Keep O Dashboard Welcome - Liferay S MLA Citation Gener. w ACC201-01 mework Question 5 of 10 > -/8 Match the word or phrase with the best description of it. An expression about whether financial statements conform with generally accepted (a) accounting principles. (b) Corporation A business that raises money by issuing shares of stock. (c) The portion of stockholders' equity that results from receiving cash from investors. (d) Obligations to suppliers of goods. (e) Amounts due from customers. (f) A party to whom a business owes money. (g) A party that invests in common stock. (h) Partnership A business that is owned jointly by two or more individuals but does not issue stock. %24 % & 3. 6. 08. 9.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you