SWFT Individual Income Taxes

43rd Edition

ISBN: 9780357391365

Author: YOUNG

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

Please correct answer and don't used hand raiting

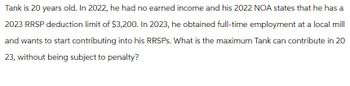

Transcribed Image Text:Tank is 20 years old. In 2022, he had no earned income and his 2022 NOA states that he has a

2023 RRSP deduction limit of $3,200. In 2023, he obtained full-time employment at a local mill

and wants to start contributing into his RRSPs. What is the maximum Tank can contribute in 20

23, without being subject to penalty?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Freda is a cash basis taxpayer. In 2019, she negotiated her salary for 2020. Her employer offered to pay her 21,000 per month in 2020 for a total of 252,000. Freda countered that she would accept 10,000 each month for the 12 months in 2020 and the remaining 132,000 in January 2021. The employer accepted Fredas terms for 2020 and 2021. a. Did Freda actually or constructively receive 252,000 in 2020? b. What could explain Fredas willingness to spread her salary over a longer period of time? c. In December 2020, after Freda had earned the right to collect the 132,000 in 2020, the employer offered 133,000 to Freda at that time, rather than 132,000 in January 2021. The employer wanted to make the early payment so as to deduct the expense in 2020. Freda rejected the employers offer. Was Freda in constructive receipt of the income in 2020? Explain.arrow_forwardZack, a sole proprietor, has earned income of 85,000 in 2019 (after the deduction for one-half of self-employment tax). What is the maximum contribution Zack may make to a defined contribution Keogh plan?arrow_forwardIn 2019, Lou has a salary of $53,300 from her job. She also has interest income of $1,600 and dividend income of $ 400. Lou is single and has no dependents. During the year, Lou sold silver coins held as an investment for a $7,000 loss. Calculate the following amounts for Lou: Adjusted gross income $ ____________________ Standard deduction $ ____________________ Taxable income $ ____________________arrow_forward

- Karen, 28 years old and a single taxpayer, has a salary of $33,000 and rental income of $33,000 for the 2019 calendar tax year. Karen is covered by a pension through her employer. What is the maximum amount that Karen may deduct for contributions to her IRA for 2019? $__________________________ If Karen is a calendar year taxpayer and files her tax return on August 15, what is the last date on which she can make her contribution to the IRA and deduct it for 2019? $__________________________arrow_forwardOn July 20,2019, Kelli purchases office equipment at a cost of $12,000. Kelli elects out of bonus depreciation but makes the election to expense for 2019. She is selfemployed as an attorney, and, in 2019, her business has a net income of $6,000 before considering this election to expense. Kelli has no other income or expenses for the year. What is the maximum amount that Kelli may deduct for 2019 under the election to expense, assuming she elects to expense the entire $12,000 purchase? $24,000 $12,000 $6,000 $3,000 $1,000arrow_forwardAbbe, age 56, is married and has two dependent children, one age 14, and the other a 21 -year-old full-time student. Abbe has one job, and her husband, age 58, is not employed. If she expects to earn wages of $50,000, file jointly, and take the standard deduction, how many allowances should Abbe claim on her Form W-4? 4 5 7 8 9arrow_forward

- Michael is the sole proprietor of a small business. In June 2020, his business income is $8,300 before consideration of any $179 deduction. He spends $215,500 on furniture and equipment in 2020. If Michael elects to take the 5179 deduction and no bonus on a conference table that cost $21,700 (included in the $215,500 total). (Use Table 6A-1 and Table 6A-2) Required: Determine the maximum cost recovery for 2020 with respect to the conference table: (Round your intermediate calculations to the nearest whole dollar amount.) Maximum cost recoveryarrow_forwardShellie, a single individual, received her Bachelor’s degree in 2019, and took a job with a salary of $45,000 per year. In 2020, she paid $1,500 of interest on qualified education loans. Which of the following statements is correct? a. Taxpayers are not allowed a deduction for education loan interest in 2020. b. If her income had been $65,000, the deductible amount would have been phased out. c. The full $1,500 is deductible in arriving at adjusted gross income (AGI). d. If her payment had been $3,000, only $2,000 would have been deductible in arriving at AGI and the $1,000 excess would have been treated as nondeductible consumer interest.arrow_forwardShelley is a self-employed CPA. In 2020, she had gross revenue of $255,000 and expenses of $40,000 so her net self-employment income on Schedule C was $215,000. She files single. What is her self-employment tax? Specify the SS and Medicare amounts. Calculate the amount of surtax, if any, she must pay. How much can she deduct as a FOR AGI deduction?arrow_forward

- What is the total “For AGI” deductions? Paul Turner is single and has two children, Allen and Lee Ann, from his previous marriage. Allen lives with Paul and Paul provides more than half of his support. In the current year, Allen earned $300 of interest income and $5,000 working at a fast-food restaurant. Allen graduated from high-school in December 2019 and was not a registered student during 2020. Lee Ann lives with her mother, Wilma (Lee Ann lived with Wilma for all of the current year). Wilma provides more than half of Lee Ann's support. Paul pays “alimony” of $400 per month to Wilma pursuant to a divorce degree entered into in 2014. The payments are to continue until Lee Ann reaches age 18, when they will be reduced to $250. Paul uses the cash method of accounting and a calendar year for reporting. Paul's birthday is May 31, 1979. Allen's birthday is October 5, 2002. Lee Ann's birthday is December 1, 2006. Paul prefers to report any “kiddie tax” on his tax return.…arrow_forwardMabel is 45 and earned $30,000 in 2018. If she contributed $6,000 to her traditional IRA, what would be her excise penalty? . Hannah, age 56, earned $58,000 in 2018. She is also a participant in a qualified plan to which she contributed $18,500. How much can she contribute to a traditional IRA in 2018? $6,500 b. $5,500 c. $0 she is ineligible d. $7,000 In question 3 above, would her contribution to a traditional IRA be tax-deductible? Yes b. No If you own a Roth IRA, are you subject to Required Minimum Distributions? Yes b. No Bernice is age 54 and her granddaughter, age 18, will be attending UMSL in the Fall 2018. Bernice would like to withdraw $15,000 from her traditional IRA to pay for some of her granddaughter’s college expenses. She asks if this withdrawal can be made without a 10% penalty. You tell her: No way b. no 10% penalty c. tax on withdrawal and 10% penalty d. none of these answers. Gus is 72 and works part-time earning $16,000 per year. He asks you whether he…arrow_forwardFred is a 22-year-old full-time college student. During 2022, he earned $2,550 from a part-time job and $1,150 in interest income. Required: If Fred is a dependent of his parents, what is his standard deduction amount? If Fred supports himself and is not a dependent of someone else, what is his standard deduction amount?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:9780357109731

Author:Hoffman

Publisher:CENGAGE LEARNING - CONSIGNMENT