Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

mni.3

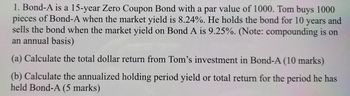

Transcribed Image Text:1. Bond-A is a 15-year Zero Coupon Bond with a par value of 1000. Tom buys 1000

pieces of Bond-A when the market yield is 8.24%. He holds the bond for 10 years and

sells the bond when the market yield on Bond A is 9.25%. (Note: compounding is on

an annual basis)

(a) Calculate the total dollar return from Tom's investment in Bond-A (10 marks)

(b) Calculate the annualized holding period yield or total return for the period he has

held Bond-A (5 marks)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- An investor just purchased a 10-year, $1,000 par value bond. The coupon rate on this bond is 5 percent with interest being paid semiannually. If the investor expects to earn an 8 percent rate of return on this bond, how much should she pay for it? A. $950.75 OB.$1,003.42 OC. $875.38 OD. $1,122.87 E.$796.15arrow_forward$15,000 is deposited for 4 years in an account earning 8% interest. Calculate the future value of the investment if interest is compounded semiannually. ANS.$20,528.54 2.A bond with an $8000 face value has a 3.5% coupon and a 3-year maturity. What is the total of the interest payments paid to the bondholder? ANS.$840 ANSWERS ARE GIVEN. I JUST NEED TO KNOW THE SOLUTION. THANKSarrow_forwardPlease use finance calculator An issue of bonds with par of $1,000 matures in 8 years and pays 9% p.a. interestsemi-annually. The market price of the bonds is $955 and your required rate of returnis 8%.(a) Calculate the bonds expected rate of return.(b) Calculate the value of the bond to you, given your required rate of return.(c) Should you purchase the bond? (State the reason for your decision.)arrow_forward

- You purchase a 3 - year corporate bond, which has a coupon rate of 8%, paid annually. Its par value is $ 1,000. If the YTM is 6%, what is the duration of the bond? A. 2.83 years B. 2.92 years C. 2.67 years D. 2.79 yearsarrow_forwardLogan bought a bond that matures in 10 years and pays 6% interest. The bond had a face value of $10 000. He received 10 annual payments of $1358.68. This bond was . a. mortgage bond b. zero-coupon bond c. Eurobond d. an amortising bondarrow_forwardMar’s Corporation bonds with par of $1,000 mature in 15 years and pays 6.5% coupon interest. The market price of the bonds is $990 and your required rate of return is 8%. (a) Calculate the bond’s expected rate of return. (b) Calculate the value of the bond to you, given your required rate of return. (c) Should you purchase the bond? (State a reason for your answer.)arrow_forward

- a) What is the value of a 10 year, 8.2% coupon bond with semiannual coupons.Assume the par value of the bond is $100 and it is redeemable at par. The interest rate (nominal, converted semiannually) is 10.6%. b) An investor purchased a bond that pays $5 coupons annually at the end of everyyear for five years. The purchase price was $100 and it was redeemed at par after fiveyears. If the annual effective inflation rate over the time period was 3%, calculate the realrate of return earned by the investor on this bond.arrow_forward(Bond valuation) You own a 10-year, $1,000 par value bond paying 8 percent interest annually. The market price of the bond is $825, and your required rate of return is 12 percent. a. Compute the bond's expected rate of return. b. Determine the value of the bond to you, given your required rate of return. c. Should you sell the bond or continue to own it? ... a. What is the expected rate of return of the 10-year, $1,000 par value bond paying 8 percent interest annually if its market price is $825? % (Round to two decimal places.)arrow_forwardAn investor buys a $1000 face value bond paying a semi-annual coupon at 9% APR compounded semi-annually for $1500. Four years later, just after receiving his 8th coupon payment, the investor sells the bond for $924.00. What realized yield did the investor earn, stated as an APR with semi-annual compounding?arrow_forward

- the following features: • Coupon rate of interest (paid annually): 10 percent • Principal: $1,000 • Term to maturity: 8 years a. What will the holder receive when the bond matures? |-Select- b. If the current rate of interest on comparable debt is 7 percent, what should be the price of this bond? Assume that the bond pays interest annually. Use Appendix B and Appendix D to answer the question. Round your answer to the nearest dollar. Would you expect the firm to call this bond? Why? -Select- v, since the bond is selling for a-Select- v. c. If the bond has a sinking fund that requires the firm to set aside annually with a trustee sufficient funds to retire the entire issue at maturity, how much must the firm remit each year for eight years if the funds earn 7 percent annually and there is $80 million outstanding? Use Appendix C to answer the question. Round your answer to the nearest dollar.arrow_forwardHelp me pleasearrow_forwardSuppose the investor sells his bonds before maturity and uses some of the proceeds to purchase a zero-coupon T-Bill with a $100 face value and 6-month maturity. What is the effective annual rate (EAR) if it was purchased for $95.52?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education