Essentials Of Business Analytics

1st Edition

ISBN: 9781285187273

Author: Camm, Jeff.

Publisher: Cengage Learning,

expand_more

expand_more

format_list_bulleted

Question

None

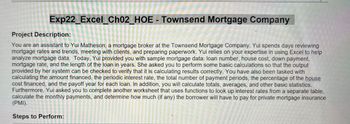

Transcribed Image Text:Exp22_Excel_Ch02_HOE - Townsend Mortgage Company

Project Description:

You are an assistant to Yui Matheson, a mortgage broker at the Townsend Mortgage Company. Yui spends days reviewing

mortgage rates and trends, meeting with clients, and preparing paperwork. Yui relies on your expertise in using Excel to help

analyze mortgage data. Today, Yui provided you with sample mortgage data: loan number, house cost, down payment,

mortgage rate, and the length of the loan in years. She asked you to perform some basic calculations so that the output

provided by her system can be checked to verify that it is calculating results correctly. You have also been tasked with

calculating the amount financed, the periodic interest rate, the total number of payment periods, the percentage of the house

cost financed, and the payoff year for each loan. In addition, you will calculate totals, averages, and other basic statistics.

Furthermore, Yui asked you to complete another worksheet that uses functions to look up interest rates from a separate table,

calculate the monthly payments, and determine how much (if any) the borrower will have to pay for private mortgage insurance

(PMI).

Steps to Perform:

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- What should an investment analyst look into before recommending an investment to clients? How should a commercial loan officer analyze a loan application that includes 3 years' worth of financial statements?arrow_forwardCalculation need to be done in "Excel format"arrow_forwardProblem: You are a mortgage broker at your local bank. Your cousin submitted an application for a mortgage with a monthly PITI of $1,319. His financial other obligations total $744.50. Your cousin earns a gross income of $5,005. (a) What is your cousin's expense ratio? (b) What is his total obligations ratio? (c) According to the Lending Ratio Guidelines in your textbook (Chapter 14, section II), for type of mortgage would Bool qualify, if any? Explain. (d) If your cousin decided to get a part-time job so he can qualify for conventional mortgage, how much additional monthly income would he need? (Set up an equation and solve it.)arrow_forward

- A borrower has two alternatives for a loan: (1) issue a $360,000, 75-day, 6% note or (2) issue a $360,000, 75-day note that the creditor discounts at 6%. Assume a 360-day year. This information has been collected in the Microsoft Excel Online file. Open the spreadsheet, perform the required analysis, and input your answers in the questions below. Calculate the amount of the interest expense for each option. Round your answer to the nearest dollar. $ ________________________ Determine the proceeds received by the borrower in each alternative. Round your answers to the nearest dollar. (1) $360,000, 75-day, 6% interest-bearing note: $___________________________ (2) $360,000, 75-day note discounted at 6%: $ _________________________arrow_forwardJamison is looking at the historical prepayment for a passthrough security. He finds the following: mortgage balance in month 42 = $260,000,000 scheduled principal payment in month 42 = $1,000,000 prepayment in month 42 = $2,450,000 What is the SMM for month 42? How should Mr. Jamison interpret the SMM computed? What is the CPR for month 42?arrow_forwardGoal To use recursive sequence to determine the amount money owed on a loan after months Role You are a loan officer at a mortgage company. Audience Jim and Joan Miller are customers applying for a mortgage. Situation Jim and Joan Miller are borrowing $120,000 at 6.5% per annum compounded monthly for 30 years (360 months) to purchase a home. Their monthly payment is determined to be $758.48. Performance Task You need to present Jim and Joan with a report detailing the following: • Arecursive formula for their balance after each monthly payment has been made. • To do this, use the formula: a, = an-1 (1+r) – 758.48 A determination of Jim and Joan's balance after the first payment. Don't forget the interest affecting their payment! • Use a spreadsheet or graphing utility to create a table showing their balance after each monthly payment. • Determine when the balance will be below $75,000. • Determine when the balance will be paid off. • Determine the interest expense when the loan is…arrow_forward

- A borrower has two alternatives for a loan: (1) issue a $420,000, 30-day, 6% note or (2) issue a $420,000, 30-day note that the creditor discounts at 6%. Assume a 360-day year. This information has been collected in the Microsoft Excel Online file. Open the spreadsheet, perform the required analysis, and input your answers in the questions below. Calculate the amount of the interest expense for each option. Round your answer to the nearest dollar. $ fill in the blank 2 for each alternative. Determine the proceeds received by the borrower in each alternative. Round your answers to the nearest dollar. (1) $420,000, 30-day, 6% interest-bearing note: $ fill in the blank 3 (2) $420,000, 30-day note discounted at 6%: $ fill in the blank 4 Alternative 1 is more favorable to the borrower because the borrower receives more cash .arrow_forwardWrite an appropriate word in the blank so that the resulting statement is true. A monthly mortgage payment is used to repay the principal plus interest. In addition, lending institutions can require monthly deposits into an account, an account used by the lender to pay real estate taxes and insurance.arrow_forwardFirst-time homeowners often use FHA loans to finance their home. Go to fha-home-loans.com and find out the current requirements to qualify for an FHA loan. They may differ slightly from that described in the book because the underwriting requirements frequently change. Summarize the types of loans that are currently available. What is the highest loan-to-value ratio that you could obtain?arrow_forward

- Please help me get right answerarrow_forwardAnnie's mortgage statement shows a total payment of $603.66 with $532.99 paid toward principal and interest and $70.67 paid for taxes and insurance. Taxes and insurance for three months were collected at closing. Now, after six months of payments, she is curious about the total in her escrow account. Calculate the amount for her, and explain the account. Question content area bottom Part 1 Calculate the amount for her and explain the account. (Select the best answer below.) A. Assuming no monthly, quarterly or semi-annual tax or insurance withdrawals from the account, the account should total $636.03. An escrow account is a special reserve account used to accumulate the annual property (real estate) tax payments and homeowner's insurance premiums for the homeowner. B. Assuming no monthly, quarterly or semi-annual tax or insurance withdrawals from the account, the account should total $212.01. An escrow account is a special reserve account used to accumulate the…arrow_forwardThe accompanying Homeownership spreadsheet contains a partially completed spreadsheet model for computing the monthly costs of home ownership. Complete the spreadsheet model by Inserting the formulas for monthly mortgage payment (B12), monthly property tax (813), monthly homeowner insurance premium (B14), monthly maintenance costs (B15), and total (B16) in the appropriate cells. Click here for the Excel Data File a. Is this a deterministic or stochastic model? Is this a deterministic or stochastic model?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of Business AnalyticsStatisticsISBN:9781285187273Author:Camm, Jeff.Publisher:Cengage Learning,

Essentials Of Business AnalyticsStatisticsISBN:9781285187273Author:Camm, Jeff.Publisher:Cengage Learning, Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning Pfin (with Mindtap, 1 Term Printed Access Card) (...FinanceISBN:9780357033609Author:Randall Billingsley, Lawrence J. Gitman, Michael D. JoehnkPublisher:Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (...FinanceISBN:9780357033609Author:Randall Billingsley, Lawrence J. Gitman, Michael D. JoehnkPublisher:Cengage Learning

Essentials Of Business Analytics

Statistics

ISBN:9781285187273

Author:Camm, Jeff.

Publisher:Cengage Learning,

Excel Applications for Accounting Principles

Accounting

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (...

Finance

ISBN:9780357033609

Author:Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:Cengage Learning