SWFT Comprehensive Volume 2019

42nd Edition

ISBN: 9780357233306

Author: Maloney

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

None

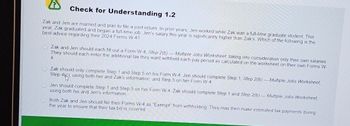

Transcribed Image Text:Check for Understanding 1.2

Zak and Jen are married and plan to file a joint return. In prior years, Jen worked while Zak was a full-time graduate student. This

year, Zak graduated and began a full-time job. Jen's salary this year is significantly higher than Zak's. Which of the following is the

best advice regarding their 2024 Forms W-4?

Zak and Jen should each fill out a Form W-4, Step 2(b)- Multiple Jobs Worksheet, taking into consideration only their own salaries.

They should each enter the additional tax they want withheld each pay period as calculated on the worksheet on their own Forms W-

4.

Zak should only complete Step 1 and Step 5 on his Form W-4 Jen should complete Step 1, Step 2(b) - Multiple Jobs Worksheet,

Step 4(c), using both her and Zak's information, and Step 5 on her Form W-4

Jen should complete Step 1 and Step 5 on her Form W-4. Zak should complete Step 1 and Step 2(b)- Multiple Jobs Worksheet,

using both his and Jen's information.

Both Zak and Jen should file their Forms W-4 as "Exempt" from withholding. They may then make estimated tax payments during

the year to ensure that their tax bill is covered

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Required information [The following information applies to the questions displayed below] In 2023, Amanda and Jaxon Stuart have a daughter who is 1 year old. The Stuarts are full-time students and are both 23 years old. Their only sources of income are gains from stock they held for three years before selling and wages from part-time jobs. What is their earned income credit in the following alternative scenarios if they file jointly? Use Exhibit 8-10. Note: Leave no answer blank. Enter zero if applicable. Check my work c. Their AGI is $30,000, consisting of $23,000 of wages and $7,000 of lottery winnings (unearned income) Note: Round your intermediate calculations to the nearest whole dollar amount. Earned income creditarrow_forwardRequired information [The following information applies to the questions displayed below.] In 2023, Amanda and Jaxon Stuart have a daughter who is 1 year old. The Stuarts are full-time students and are both 23 years old. Their only sources of income are gains from stock they held for three years before selling and wages from part- time jobs. What is their earned income credit in the following alternative scenarios if they file jointly? Use Exhibit 8-10. Note: Leave no answer blank. Enter zero if applicable. b. Their AGI is $18,200, consisting of $10,000 of lottery winnings (unearned income) and $8,200 of wages. Earned income credit $ 3,400arrow_forwardIn 2020, Amanda and Jaxon Stuart have a daughter who is 1 year old. The Stuarts are full-time students and they are both 23 years old. Their only sources of income are gains from stock they held for three years before selling and wages from part-time jobs.What is their earned income credit in the following alternative scenarios if they file jointly? Use Exhibit 8-10(https://ezto-cf-media.mheducation.com/Media/Connect_Production/bne/accounting/spilker_12e/exhibit_8_10_new.htm). a. Their AGI is $15,000, consisting of $5,000 of capital gains and $10,000 of wages. Q: what is earned income credit?arrow_forward

- 3arrow_forwardSusan and Derick finalized an adoption in 2020. Their adoption fees totaled $10,000. They have AGI of $238,520 for 2020. What is their adoption credit? a. $4,000 b. $10,000 c. $7,263 d. $14,300arrow_forwardJoan, a single mother, has AGI of $61,500 in 2019. In September 2019 , she pays $5,000 in qualified tuition for her dependent son who just started at Big University. What is Joan's American Opportunity credit for 2019? $0 $1,250 $2,125 $2,500 Some other amountarrow_forward

- Tax Drill - Earned Income Credit Samuel and Annamaria are married, file a joint return, and have three qualifying children. In 2023, they earn wages of $34, 000 and no other income. Round your intermediate computations to two decimal places and your final answer to the nearest dollar. Click here to access the Earned Income Credit and Phaseout Percentages Table. The earned income credit is $fill in the blank 1. Tax Drill - Earned Income Credit Samuel and Annamaria are married, file a joint return, and have three qualifying children. In 2023, they earn wages of $34,000 and no other income. Round your intermediate computations to two decimal places and your final answer to the nearest dollar. Click here to access the Earned Income Credit and Phaseout Percentages Table. The earned income credit is $fill in the blank 1.arrow_forwardPlease help mearrow_forwardGodoarrow_forward

- Hi can someone help me with this question?arrow_forwardIn 2022, Jeremy and Celeste, who file a joint return, paid the following amounts for their daughter, Alyssa, to attend the University of Colorado during academic year 2022-2023. Alyssa was in her first year of college and attended full-time. Tuition and fees (for fall semester 2022) Tuition and fees (for spring semester 2023) Required books Room and board $2,270 1,195 1,480 1,650 The spring semester at the University of Colorado begins in January. In addition to the above, Alyssa's uncle Devin sent $550 for her tuition directly to the University. Jeremy and Celeste have modified AGI of $170,000. Required: What is the amount of qualifying expenses for the purposes of the American Opportunity Tax credit (AOTC) in tax year 2022? What is the amount of qualifying expenses and the amount of AOTC that Jeremy and Celeste can claim based on their AGI? Qualifying expenses for the AOTC AOTC claimable Amountsarrow_forwardharrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you