Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

i need help with this problem i know the answer is 5.86 i just need help on how to do it step by step

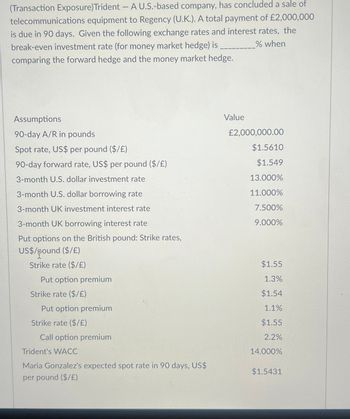

Transcribed Image Text:(Transaction Exposure)Trident - A U.S.-based company, has concluded a sale of

telecommunications equipment to Regency (U.K.). A total payment of £2,000,000

is due in 90 days. Given the following exchange rates and interest rates, the

break-even investment rate (for money market hedge) is

comparing the forward hedge and the money market hedge.

% when

Assumptions

90-day A/R in pounds

Value

£2,000,000.00

Spot rate, US$ per pound ($/£)

$1.5610

90-day forward rate, US$ per pound ($/£)

$1.549

3-month U.S. dollar investment rate

13.000%

3-month U.S. dollar borrowing rate

11.000%

3-month UK investment interest rate

7.500%

3-month UK borrowing interest rate

9.000%

Put options on the British pound: Strike rates,

US$/pound ($/£)

Strike rate ($/£)

$1.55

Put option premium

1.3%

Strike rate ($/£)

$1.54

Put option premium

1.1%

Strike rate ($/£)

$1.55

Call option premium

2.2%

Trident's WACC

14.000%

Maria Gonzalez's expected spot rate in 90 days, US$

$1.5431

per pound ($/£)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- What I dont understand from this question is the incorrect answers that I have in the picture which are 3700 and 66000 then what I sould put therearrow_forwardHow are realized income, gross income and taxable income similar, and how are they different? I am not able to find my textbook here. I am not finding this site useful at all. I will have many more than 30 questions per month as I am really struggling with this class. But I cannot find anyone to help me figure out HOW to use the site successfully.arrow_forwardI need help with B, C, D on the attached assignmentarrow_forward

- Give me right solution urgent pleasearrow_forwardPlease answer ASAP if you can please. Thank you! Please Please write expression or formula used Set up expression initially with functional notation (e.g.,(P/F,I,n))arrow_forwardHi I need help, it says my answer is wrong but I read over and over and over. Please helparrow_forward

- Zara wants to export her estimates report into an Excel spreadsheet. Once Zara exports the report, what limitation will she have? Select an answer: She will not be able to export the Excel spreadsheet back into QuickBooks. She will not be able to save the Excel spreadsheet to her computer. She will not be able to make any additions to the Excel spreadsheet.arrow_forwardOh no! Our expert couldn't answer your question. Don't worry! We won't leave you hanging. Plus, we're giving you back one question for the inconvenience. Here's what the expert had to say: Hi and thanks for your question! It looks like you're asking for help with using the site. You can reach our support team at the Contact Bartleby link at the bottom of the page. We've credited a question back to your account. Apologies for the inconvenience. Ask Your Question Again 13 of 30 questions left until Nov 14, 2021 Question complete a horizontal analysis for brown company. (negative answers should be indicated by a minus sign. leave no cells blank - be certain to enter "0" wherever required. round the "percent" answers to the nearest hundredth percent.) Current assets: 2020 2019 Increase (decrease) amount? Percent? Cash $14,150 $9,300 ?? Accounts receivable 16,950 12,800 ?? Merchandise inventory 18,050 21,450 ?? Prepaid advertising 52,600…arrow_forwardes Exercise 4-8A (Static) Which of the following is true about fringe benefits? (You may select more than one answer. Single click the box with the question mark to produce a check mark for a correct answer and double click the box with the question mark to empty the box for a wro answer. Any boxes left with a question mark will be automatically graded as incorrect.) ?They are only available for employees and their families. ? The amount of the fringe benefit is never subject to income tax. ?They represent additional cash paid directly to employees. ?They represent additional compensation given for services performed. ‒‒ Q Search Oarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education