Corporate Fin Focused Approach

5th Edition

ISBN: 9781285660516

Author: EHRHARDT

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

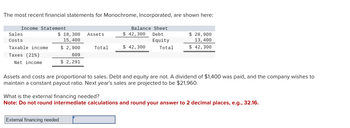

Transcribed Image Text:The most recent financial statements for Monochrome, Incorporated, are shown here:

Income Statement

Sales

Costs

$ 18,300 Assets

15,400

Taxable income

Taxes (21%)

$ 2,900

609

Total

$ 42,300

Balance Sheet

$ 42,300 Debt

Equity

Total

$ 28,900

13,400

$ 42,300

Net income

$ 2,291

Assets and costs are proportional to sales. Debt and equity are not. A dividend of $1,400 was paid, and the company wishes to

maintain a constant payout ratio. Next year's sales are projected to be $21,960.

What is the external financing needed?

Note: Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.

External financing needed

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Assume you are given the following relationships for the Haslam Corporation: Sales/total assets 1.9 Return on assets (ROA) 3% Return on equity (ROE) 5% Calculate Haslam's profit margin and liabilities-to-assets ratio. Do not round intermediate calculations. Round your answers to two decimal places. Profit margin: % Liabilities-to-assets ratio: % Suppose half of its liabilities are in the form of debt. Calculate the debt-to-assets ratio. Do not round intermediate calculations. Round your answer to two decimal places.arrow_forwardThe most recent financial statements for GPS, Inc, are shown here: income statement: sales $23,300, cost 15,700, taxable income $7,600, taxes (40%) 3,040, net income $4,560, assets $112,000, total $112,000 Debt $44,600, equity 68,400, total $112, 000. Assets and cost are proportional to sales. Debt and equity are not. A dividend of $1,540 was paid, and the company wishes to maintain a constant payout ratio. Next years sales are projected to be $28,300. What is the external financing needed?arrow_forwardRATIO CALCULATIONS Assume the following relationships for the Brauer Corp.:Sales/Total assets 1.5xReturn on assets (ROA) 3.0%Return on equity (ROE) 5.0%Calculate Brauer’s profit margin and debt-to-capital ratio assuming the firm uses only debt and common equity, so total assets equal total invested capital.arrow_forward

- Assume you are given the following relationships for the Haslam Corporation:Sales/total assets 1.2Return on assets (ROA) 4%Return on equity (ROE) 7%Calculate Haslam’s profit margin and liabilities-to-assets ratio. Suppose half its liabilities are in the form of debt. Calculate the debt-to-assets ratio.arrow_forwardThe most recent financial statements for Martin, Inc., are shown here: Sales Costs Taxable income Taxes (21%) Net Income Assets Total Income Statement EFN $22,000 -13,200 $61,600 $8,800 -1,848 $6,952 Balance Sheet $61,600 Debt Equity Total $25,000 36,600 $61,600 Assets and costs are proportional to sales. Debt and equity are not. A dividend of $880 was paid, and Martin wishes to maintain a constant payout ratio. Next year's sales are projected to be $25,740. What is the external financing needed? (Do not round intermediate calculations. Round your answer to 2 decimal places.) Answer is complete but not entirely correct. $ 4,972.00arrow_forward1. The Wilson Corporation has the following relationships:Sales/Total assets 2.0Return on assets (ROA) 4.0%Return on equity (ROE) 6.0%What is Wilson’s profit margin and debt ratio?arrow_forward

- Define what a Dividend Payout ratio is. Define what a retention ratio is. Calculate the dividend payout ratio AND the retention ratio based on the data below: (hint: Dividend payout ratio is dividends/net income , Retention ratio is addition to retained earnings/net income) Rosegarten Corporation (income statement) Sales $1,000 Costs 833 Taxable Income $ 167 Taxes (21%) 35 Net Income $ 132 Dividends $44 Addition to Retained Earnings $88 Explain what your ratio's mean.......arrow_forwardThe most recent financial statements for Cardinal, Inc., are shown here: Income Statement Balance Sheet $27,000 17,900 $29,700 35,500 Sales Assets $65,200 Debt Costs Equity Тахable $ 9,100 Total $65,200 Total $65,200 income Taxes (24%) 2,184 Net income $ 6,916 Assets and costs are proportional to sales. Debt and equity are not. A dividend of $2,700 was paid, and the company wishes to maintain a constant payout ratio. Next year's sales are projected to be $31,320. What is the external financing needed? (Do not round intermediate calculations.) External financing neededarrow_forwardssume the following relationships for the Caulder Corp.: Sales/Total assets 1.2\times Return on assets (ROA ) 5.0% Return on equity (ROE) 15.0% Calculate Caulder's profit margin and debt-to-capital ratio assuming the firm uses only debt and common equity, so total assets equal total invested capital. Do not round intermediate calculations. Round your answers to two decimal places.arrow_forward

- The most recent financial statements for Martin, Inc., are shown here: Income Statement: Sales $24, 550 Costs -14,730 Taxable income $9,820 Taxes (21 %) -2,062 Net income $7,758 Balance Sheet: Assets $93, 290 Debt $33,000 Equity 60, 290 Total $93, 290 Total $93, 290 Assets and costs are proportional to sales. Debt and equity are not. A dividend of $ 955 was paid, and Martin wishes to maintain a constant payout ratio. Next year's sales are projected to be $29,951. What is the external financing needed? (Do not round intermediate calculations. Round your answer to 2 decimal places. )arrow_forwardGive typed solutionarrow_forwardParesarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning