Survey of Accounting (Accounting I)

8th Edition

ISBN: 9781305961883

Author: Carl Warren

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

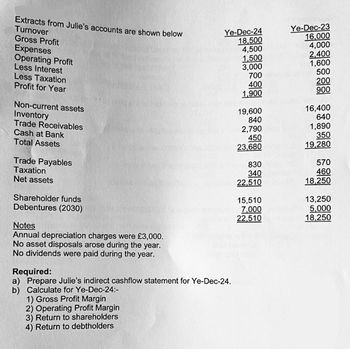

Transcribed Image Text:Turnover

Gross Profit

Extracts from Julie's accounts are shown below

Ye-Dec-24

Ye-Dec-23

18,500

16,000

Expenses

4,500

4,000

Less Interest

Operating Profit

2,400

1,500

3,000

1,600

Less Taxation

500

700

200

Profit for Year

400

1,900

900

Non-current assets

Inventory

19,600

16,400

Trade Receivables

Cash at Bank

840

2,790

640

1,890

Total Assets

Trade Payables

Taxation

Net assets

Shareholder funds

Debentures (2030)

Notes

Annual depreciation charges were £3,000.

No asset disposals arose during the year.

No dividends were paid during the year.

Required:

a) Prepare Julie's indirect cashflow statement for Ye-Dec-24.

b) Calculate for Ye-Dec-24:-

1) Gross Profit Margin

2) Operating Profit Margin

3) Return to shareholders

4) Return to debtholders

450

350

23,680

19,280

830

570

340

460

22,510

18,250

15,510

13,250

7,000

5,000

22,510

18,250

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Accounts Receivable Analysis The following data are taken from the financial statements of Sigmon Inc. Terms of all sales are 2/10, n/45. 20Y3 20Υ2 20Υ1 Accounts receivable, end of year $175,000 $190,000 $204,200 Sales on account 1,003,750 985,500 a. For 20Y2 and 20Y3, determine (1) the accounts receivable turnover and (2) the number of days' sales in receivables. Round answers to one decimal place. Assume a 365-day year. 20Υ3 20Υ2 1. Accounts receivable turnover 2. Number of days' sales in receivables days days b. The collection of accounts receivable has improved v This can be seen in both the increase v in accounts receivable turnover and the decrease in the collection period. Feedback Check My Work a.1. Divide net sales by average accounts receivable. Average Accounts receivable = (Beginning Accounts Receivable + Ending Accounts Receivable) ÷ 2. a.2. Divide average accounts receivable by average daily sales on account. Average Accounts receivable = (Beginning Accounts Receivable +…arrow_forwardBased on this financial data, calculate the Savings Ratio. $7470 Net Worth Liquid Assets $ 4610 Monthly Credit Payments $720 Monthly Savings $ 640 Gross Income Make sure to include zeros and round your answer to 2 decimal places. i.e. 3.55, 1.89, 1.02, 0.09, etc. Do not include a comma or"$" sign in your response. Liabilities Current Liabilities Take-home Pay $ 77300 $2000 $ 3150 $ 4890arrow_forwardAccounts Receivable Analysis The following data are taken from the financial statements of Basinger Inc. Terms of all sales are 2/10, n/45. 20Υ3 20Υ2 20Y1 Accounts receivable, end of year $106,000 $113,000 $120,600 Sales on account 689,850 665,760 a. For 20Y2 and 20Y3, determine (1) the accounts receivable turnover and (2) the number of days' sales in receivables. Round interim calculations to the nearest dollar and final answers to one decimal place. Assume a 365-day year. 20Y3 20Y2 1. Accounts receivable turnover 2. Number of days' sales in receivables days days b. The collection of accounts receivable has This can be seen in both the in accounts receivable turnover and the in the collection period.arrow_forward

- Accounts Receivable Analysis The following data are taken from the financial statements of Basinger Inc. Terms of all sales are 2/10, n/45. 20Y3 20Y2 20Y1 Accounts receivable, end of year $171,400 $179,000 $186,000 Sales on account 1,068,720 1,003,750 a. For 20Y2 and 20Y3, determine (1) the accounts receivable turnover and (2) the number of days' sales in receivables. Round interim calculations to the nearest dollar and final answers to one decimal place. Assume a 365-day year. 20Y3 20Y2 1. Accounts receivable turnover fill in the blank 1 fill in the blank 2 2. Number of days' sales in receivables fill in the blank 3 days fill in the blank 4 days b. The collection of accounts receivable has . This can be seen in both the in accounts receivable turnover and the in the collection period.arrow_forwardAccounts Receivable Analysis The following data are taken from the financial statements of Sigmon Inc. Terms of all sales are 2/10, n/45. 20Y3 20Y2 20Υ1 Accounts receivable, end of year $113,600 $120,000 $128,200 Sales on account 829,280 781,830 a. For 20Y2 and 20Y3, determine (1) the accounts receivable turnover and (2) the number of days' sales in receivables. Round answers to one decimal place. Assume a 365-day year. 20Υ3 20Y2 1. Accounts receivable turnover 2. Number of days' sales in receivables days daysarrow_forwardAccounts Receivable Analysis The following data are taken from the financial statements of Basinger Inc. Terms of all sales are 2/10, n/45. 20Y3 20Y2 20Y1 Accounts receivable, end of year $157,200 $164,000 $171,800 Sales on account 883,300 789,130 a. For 20Y2 and 20Y3, determine (1) the accounts receivable turnover and (2) the number of days' sales in receivables. Round interim calculations to the nearest dollar and final answers to one decimal place. Assume a 365-day year. 20Y3 20Y2 1. Accounts receivable turnover 2. Number of days' sales in receivables days days This can be seen in both the in accounts receivable b. The collection of accounts receivable has turnover and the in the collection period.arrow_forward

- Accounts Receivable Analysis The following data are taken from the financial statements of Basinger Inc. Terms of all sales are 2/10, n/45. 20Y3 20Y2 20Y1 Accounts receivable, end of year $196,800 $212,000 $226,000 Sales on account 1,369,480 1,292,100 a. For 20Y2 and 20Y3, determine (1) the accounts receivable turnover and (2) the number of days' sales in receivables. Round interim calculations to the nearest dollar and final answers to one decimal place. Assume a 365-day year. 20Y3 20Y2 1. Accounts receivable turnover 2. Number of days' sales in receivables days days b. The collection of accounts receivable has improved . This can be seen in both the increase in accounts receivable turnover and the decrease in the collection period.arrow_forwardWhat is it's accounts receivable turnover of this financial accounting question?arrow_forwardtresarrow_forward

- Accounts Receivable Analysis The following data are taken from the financial statements of Sigmon Inc. Terms of all sales are 2/10, n/45. 20Y3 20Y2 20Y1 Accounts receivable, end of year $142,000 $150,000 $156,600 Sales on account 890,600 858,480 a. For 20Y2 and 20Y3, determine (1) the accounts receivable turnover and (2) the number of days' sales in receivables. Round answers to one decimal place. Assume a 365-day year. 20Y3 20Y2 1. Accounts receivable turnover fill in the blank 1 fill in the blank 2 2. Number of days' sales in receivables fill in the blank 3 days fill in the blank 4 daysarrow_forwardCalculate the profit margin (net income or net profit/total sales)for Rock Castle construction for this fiscal year. What’s the percentagearrow_forwardhi expert please provide this general accounting questionarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:9781305961883

Author:Carl Warren

Publisher:Cengage Learning