EBK CONTEMPORARY FINANCIAL MANAGEMENT

14th Edition

ISBN: 9781337514835

Author: MOYER

Publisher: CENGAGE LEARNING - CONSIGNMENT

expand_more

expand_more

format_list_bulleted

Question

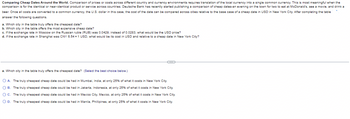

Transcribed Image Text:Comparing Cheap Dates Around the World. Comparison of prices or costs across different country and currency environments requires translation of the local currency into a single common currency. This is most meaningful when the

comparison is for the identical or near-identical product or service across countries. Deutsche Bank has recently started publishing a comparison of cheap dates-an evening on the town for two to eat at McDonald's, see a movie, and drink a

beer. Once all costs are converted to a common currency, the U.S. dollar in this case, the cost of the date can be compared across cities relative to the base case of a cheap date in USD in New York City. After completing the table

answer the following questions.

a. Which city in the table truly offers the cheapest date?

b. Which city in the table offers the most expensive cheap date?

c. If the exchange rate in Moscow on the Russian ruble (RUB) was 0.0429, instead of 0.0283, what would be the USD price?

d. If the exchange rate in Shanghai was CNY 6.54-1 USD, what would be its cost in USD and relative to a cheap date in New York City?

a. Which city in the table truly offers the cheapest date? (Select the best choice below.)

OA. The truly cheapest cheap date could be had in Mumbai, India, at only 25% of what it costs in New York City.

B. The truly cheapest cheap date could be had in Jakarta, Indonesia, at only 25% of what it costs in New York City.

OC. The truly cheapest cheap date could be had in Mexico City, Mexico, at only 25% of what it costs in New York City.

OD. The truly cheapest cheap date could be had in Manila, Phillipines, at only 25% of what it costs in New York City.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Advise BB Limited which project they should undertake, showing your calculations and assumptions tosupport your advice. Use the correct discount rate, rounded to 4 decimalsReport inflows/outflows as appropriate +/-Do not forget to convert the currency so comparison can be doneDetailed assessment and recommendation required.arrow_forwardCan someone please help with this asap? thank you.arrow_forwardProblem 1Comparison of prices or costs across different country and currency environments requires thetranslation of the local currency into a single common currency. This is most meaningful when thecomparison is for the identical or near-identical product or service across countries. Deutsche Bankhas recently started publishing a comparison of cheap dates - and evening on the town for two toeat at McDonald's, see a movie, and drink a beer. Once all costs are converted to a commoncurrency, the U.S. dollar in this case, the cost of the date can be compared across cities relative tothe base case of a cheap date in USD in New York City.After completing the table available in images. answer the following questions:(ALL Tables are also available in the images). a. Which city in the table is truly the cheapest date?b. Which city in the table is the most expensive-cheap date?c. If the exchange rate in Moscow on the Russian ruble (RUB) was 0.04200, instead of 0.0283, whatwould be the USD…arrow_forward

- Choose the best answer to the following question. Explain your reasoning with one or more complete sentences. A person is buying apples while traveling in Europe. How will the price be mostly likely quoted? Choose the correct answer below. OA. The price will be quoted in euros per milliliter because the price has unit of euros per unit of volume. B. The price will be quoted in euros per milliliter because Europeans use the SI unit system. C. The price will be quoted in euros per kilogram because the price is quoted in currency per weight. D. The price will be quoted in euros per kilometer because euros is the currency that is used in Europe. E. The price will be quoted in euros per kilogram because one apple in Europe weighs one kilogram. OF. The price will be quoted in euros per kilometer because because Europe is very large, so everything is quoted in kilometers.arrow_forwardYou are trying to decide between two job offers. One consulting firm offers USD 150,000 per year to work in its New York Office. A second consulting firm wants you to work in its London office and offers you GBP 100,000 per year. The price levrels in the US and UK are USD 1,400 and GBP 1,000 respectively and the current exchange rate is USD 1.65/GBP. Which offer shoul1 vou take, and why? (Assume you are indifferent between working in the two cities if the purchasing power of your salary is the same). (a) youarrow_forwardA small parts manufacturer has just engineered a new product for the automotive industry. In order to produce the part the company can expand existing facilities, acquire a competitor, or subcontract production. The company believes the product will either experience (1) increasing exchange rates; (2) stable exchange rates; and (3) decreasing exchange rates. The business believes that the probability for increasing, stable and decreasing exchange rates are 0.6, 0.3, and 0.1, respectively. The following payoff table depicts the costs for each decision alternative under different states of nature. Table 3 Decision State of Nature Increasing exchange Stable exchange Decreasing rates (0.6) rates (0.3) exchange rates (0.1) Expand existing $800.000 $650,000 $550,000 facilities Acquire a competitor 500,000 300,000 200,000 Subcontract 250,000 250,000 250,000 production Using Table 3, Choose the right pair of best decision alternative and cost using expected value?arrow_forward

- Simply Select the correct option and explain itarrow_forwardPlease help with a discussion on question #2. The base country is Nevis and the countries trading to is Australia, Columbia and Germany. Explain why would it be more profitable to trade in USD rather than XCD and how can the MNC benifit from the trading countries currencies. Use an echange rate table or chart to help strenghten your point You are asked to simulate your own multinational corporation (MNC).You are required to justify the form of their own MNC, based in the Caribbean, which tradeswith three countries outside of the North America region. Students will then examine issues relatedto foreign exchange management within their multinational corporation.This group assignment should address the following:1. The type of MNC, is the exportation of a product soldthrough a distributor2. The main foreign currencies that will be used in the business.3. The foreign exchange exposure of the company and how the company plans to managethis exposure.4. Any current financial issues that…arrow_forwardAny help is appreciated!arrow_forward

- A computer costs $600 in the United States. The same model costs €555 in France. If purchasing power parity holds, what is the spot exchange rate between the euro and the dollar? Do not round intermediate calculations. Round your answer to two decimal places. 1 euro = $arrow_forwardOk If a video game costs $31 in the United States and £28 in the United Kingdom, what is the real "video game" exchange rate? Assume a dollar-pound exchange rate of $1.5126 per pound. Instructions: Enter your response rounded to the nearest two decimal places. The real video game exchange rate is What do you conclude? The video game is cheaper in the United Kingdom thon it is in the United States. The video game is cheaper in the United States than in the United Kingdom.arrow_forwardSing Tao wants to import goods for 2.12 million Australian dollar (A$) and pay to Australian exporter, WA Co., in one year. Sing Tao also wants to minimise its exchange rate risk for the payment of A$2.12 million by taking the money market hedging strategy. Calculate the Chinese yuan (CNY) costs using the money market hedging strategy based on the information in Table 1. (Enter the whole number without sign and symbol). TABLE 1 For Chinese yuan (CNY) Spot rate A$0.3213/CNY One-year forward rate A$0.2381/CNY One-year CNY deposit and borrowing rate 3.21% One-year call options Exercise price = A$0.31 Premium = A$0.02 One-year put options Exercise price = A$0.53 Premium = A$0.03 For Australian dollar (A$) Spot rate CNY3.4201/A$ One-year forward rate CNY1.213/A$ One-year A$ deposit and borrowing rate 2.31% One-year call options Exercise price = CNY2.34 Premium = CNY0.12…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning