The Green Mortgage Company has originated a pool containing 75 ten-year fixed interest rate mortgages with an average balance of $102,200 each. All mortgages in the pool carry a coupon of 12 percent. (For simplicity, assume that all mortgage payments are made annually at 12% interest.) Green would now like to sell the pool to FNMA.

Required:

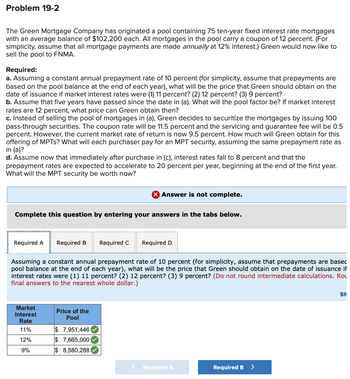

a. Assuming a constant annual prepayment rate of 10 percent (for simplicity, assume that prepayments are based on the pool balance at the end of each year), what will be the price that Green should obtain on the date of issuance if market interest rates were (1) 11 percent? (2) 12 percent? (3) 9 percent?

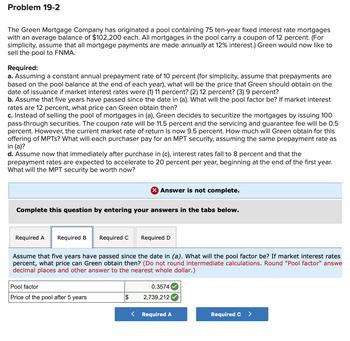

b. Assume that five years have passed since the date in (a). What will the pool factor be? If market interest rates are 12 percent, what price can Green obtain then?

c. Instead of selling the pool of mortgages in (a), Green decides to securitize the mortgages by issuing 100 pass-through securities. The coupon rate will be 11.5 percent and the servicing and guarantee fee will be 0.5 percent. However, the current market

d. Assume now that immediately after purchase in (c), interest rates fall to 8 percent and that the prepayment rates are expected to accelerate to 20 percent per year, beginning at the end of the first year. What will the MPT security be worth now?

Step by stepSolved in 2 steps with 1 images

- The Green Mortgage Company has originated a pool containing 75 ten-year fixed interest rate mortgages with an average balance of $102,400 each. All mortgages in the pool carry a coupon of 12 percent. ( For simplicity, assume that all mortgage payments are made annually at 12% interest.) Green would now like to sell the pool to FNMA. Required: a. Assuming a constant annual prepayment rate of 10 percent (for simplicity, assume that prepayments are based on the pool balance at the end of each year), what will be the price that Green should obtain on the date of issuance if market interest rates were (1) 11 percent? (2) 12 percent? (3) 9 percent? b. Assume that five years have passed since the date in (a). What will the pool factor be? If market interest rates are 12 percent, what price can Green obtain then? c. Instead of selling the pool of mortgages in (a), Green decides to securitize the mortgages by issuing 100 pass-through securities. The coupon rate will be 11.5 percent and the…arrow_forwardYou have decided to get a $5,000,000 balloon mortgage with the following characteristics: 5 years amortization with monthly payments, 10% interest rate, $2,500,00 balloon amount in year 5. What is the monthly payment?arrow_forwardYou have located a warehouse property to purchase at a price of $320,000. You plan to make a 20% downpayment of $64,000. Interest rates are rising quickly, but you’ve managed to secure a fixed-rate commercial mortgage at 4.5%. Commercial mortgages are typically much shorter than consumer mortgages like home loans, so the lender has offered you a 10-year term. What is the ending balance on the mortgage after the first year?arrow_forward

- Secondary Mortgage Purchasing Company (SMPC) wants to buy your mortgage from the local savings and loan. The original balance of your mortgage was $145,000 and was obtained five years ago with monthly payments at 10 percent interest. The loan was to be fully amortized over 30 years. Required: a. What should SMPC pay if it wants an 11 percent return? b. What is the balance of the original loan after five additional years (10 years from origination)? Complete this question by entering your answers in the tabs below. Required A Required B What is the balance of the original loan after five additional years (10 years from origination)? Note: Do not round intermediate calculations. Round your final answer to 2 decimal places. Paymentarrow_forwardIn a 5/1 hybrid adjustable-rate mortgage (ARM), the initial interest rate is fixed for 5 years, then is adjusted annually. (You usually pay points up front at closing in exchange for the rate lock for the first 5 years.) Suppose that you buy a house with a $ 260000, 30 year mortgage with a 5/1 ARM with initial rate of 4.5%; and suppose that five years later, the interest rate goes up to 7.1%. Use the Bankrate amortization schedule online to determine what your monthly payment was, originally, at 4.5%?Monthly Payment = What is your new payment? (Careful: the amount of the loan is no longer $ 260000 and you only have 25 years to pay it off.)New Monthly Payment =arrow_forwardYou have located a warehouse property to purchase at a price of $320,000. You plan to make a 20% downpayment of $64,000. Interest rates are rising quickly, but you’ve managed to secure a fixed-rate commercial mortgage at 4.5%. Commercial mortgages are typically much shorter than consumer mortgages like home loans, so the lender has offered you a 10-year term. What is the total interest paid on this mortgage over the 10 year term?arrow_forward

- A borrower is making a choice between a mortgage with monthly payments or biweekly payments. The loan will be $238,000 at 6 percent interest for 20 years. Required: a. hat would be the maturity period if payments are bi-weekly? How much will the borrower pay in total under each payment option? Which choice would be less costly to the borrower? Hint: Assume 26 total bi-weekly payments per year for the maturity period. b. Assume that the bi-weekly loan was available for 5.75%. What would be the maturity period if payments are bi-weekly? How much will the borrower pay in total under each payment option? Which choice would be less costly for the borrower? Complete this question by entering your answers in the tabs below. Required A Required B hat would be the maturity period if payments are bi-weekly? How much will the borrower pay in total option? Which choice would be less costly to the borrower? Hint: Assume 26 total bi-weekly payments maturity period. Note: (Do not round intermediate…arrow_forwardGCB has offered to grant you GHC50,000 loan with an annual interest of 24% compounded monthly to buy a house, What would be the monthly payment on the loan if the mortgage would be fully amortized in 20 years? b) Find the future and present value of a 5 year GHC1,000.00 annuity if the rate of interest is 12% and the first monthly payment is made now. c) Dividend of a share is forecasted to grow -6% next year, grow super-normally at 30% the next 3 years, and at a constant rate of 7.5% thereafter. What is the value of the stock in question if dividend paid this year is GHC4.50share and the required return is 13%. d) Calkulate the value of a 10-year, 10% S1,00.00 semisannual coupon bond if the prevailing market interest rate is 8%.arrow_forwardSuppose Bank A offers a 201,000, 20 year , 2.1 % fixed rate mortgage with closing costs of 1900 plus 2 points. what is the closing cost associated with this mortgagearrow_forward

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education