Entrepreneurial Finance

6th Edition

ISBN: 9781337635653

Author: Leach

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

None

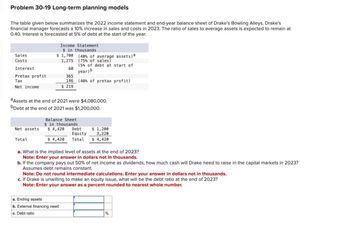

Transcribed Image Text:Problem 30-19 Long-term planning models

The table given below summarizes the 2022 income statement and end-year balance sheet of Drake's Bowling Alleys. Drake's

financial manager forecasts a 10% increase in sales and costs in 2023. The ratio of sales to average assets is expected to remain at

0.40. Interest is forecasted at 5% of debt at the start of the year.

Sales

Costs

Interest

Pretax profit

Tax

Net income

Income Statement

$ in thousands

$ 1,700 (40% of average assets) a

1,275 (75% of sales)

60

365

(5% of debt at start of

year)b

146 (40% of pretax profit)

$ 219

a Assets at the end of 2021 were $4,080,000.

bDebt at the end of 2021 was $1,200,000.

Balance Sheet

$ in thousands

$ 4,420 Debt

Equity

Net assets

$ 1,200

3,220

Total

$ 4,420 Total

$ 4,420

a. What is the implied level of assets at the end of 2023?

Note: Enter your answer in dollars not in thousands.

b. If the company pays out 50% of net income as dividends, how much cash will Drake need to raise in the capital markets in 2023?

Assumes debt remains constant.

Note: Do not round intermediate calculations. Enter your answer in dollars not in thousands.

c. If Drake is unwilling to make an equity issue, what will be the debt ratio at the end of 2023?

Note: Enter your answer as a percent rounded to nearest whole number.

a. Ending assets

b. External financing need

c. Debt ratio

%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Provide answer with calculationarrow_forwardWhich is not an example of a well stated financial objective? Increase sales by 10% this year Reduce costs of good sold for next product launch in January 2022 Double our gross margin % by end of the year. Deliver 15% earnings growth in the 4th quarter of 2021arrow_forwardhelp me teacher this general accounting qoestionarrow_forward

- AFN equation Broussard Skateboard's sales are expected to increase by 25% from $8.4 million in 2019 to $10.50 million in 2020. Its assets totaled $4 million at the end of 2019. Broussard is already at full capacity, so its assets must grow at the same rate as projected sales. At the end of 2019, current liabilities were $1.4 million, consisting of $450,000 of accounts payable, $500,000 of notes payable, and $450,000 of accruals. The after-tax profit margin is forecasted to be 3%, and the forecasted payout ratio is 40%. Use the AFN equation to forecast Broussard's additional funds needed for the coming year. Enter your answer in dollars. For example, an answer of $1.2 million should be entered as $1,200,000. Do not round intermediate calculations. Round your answer to the nearest dollar.arrow_forwardUsing ROI and RI to evaluate investment centers This problem continues the Piedmont Computer Company situation from Chapter 23. Piedmont Computer Company reported 2020 sales of $3,500,000 and Operating income of $183,600. Average total assets during 2020 were $600,000. Piedmont Computer Company’s target rate of return is 16%. Calculate Piedmont Computer Company’s profit margin ratio, asset turnover ratio, ROI, and RI for 2020. Comment on the results.arrow_forwardNeed help with this accounting questionarrow_forward

- Using Table 6–13, what is required in new financing if next year’s salesforecast increases to $400,000, profit margin is 10 percent, and the payoutratio is 90 percent?arrow_forwardAFN EquationBroussard Skateboard’s sales are expected to increase by 15% from $8 millionin 2018 to $9.2 million in 2019. Its assets totaled $5 million at the endof 2018.Broussard is already at full capacity, so its assets must grow at the samerate as projected sales. At the end of 2018, current liabilities were $1.4 million,consisting of $450,000 of accounts payable, $500,000 of notes payable, and$450,000 of accruals. The after-tax profit margin is forecasted to be 6%,and the forecasted payout ratio is 40%. Use the AFN equation to forecastBroussard’s additional funds needed for the coming yeararrow_forwardNeed help with this question solution general accountingarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning