FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

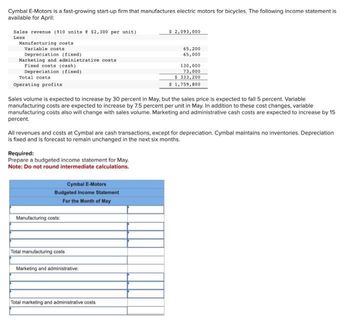

Transcribed Image Text:Cymbal E-Motors is a fast-growing start-up firm that manufactures electric motors for bicycles. The following income statement is

available for April:

Sales revenue (910 units @ $2,300 per unit)

Leas

Manufacturing costs

Variable costs

Depreciation (fixed)

Marketing and administrative costs

Fixed costs (cash)

Depreciation (fixed)

Total costs

Operating profits

Required:

Prepare a budgeted income statement for May

Note: Do not round intermediate calculations.

Sales volume is expected to increase by 30 percent in May, but the sales price is expected to fall 5 percent. Variable

manufacturing costs are expected to increase by 7.5 percent per unit in May. In addition to these cost changes, variable

manufacturing costs also will change with sales volume. Marketing and administrative cash costs are expected to increase by 15

percent.

Cymbal E-Motors

Budgeted Income Statement

For the Month of May

All revenues and costs at Cymbal are cash transactions, except for depreciation. Cymbal maintains no inventories. Depreciation

is fixed and is forecast to remain unchanged in the next six months.

Manufacturing costs:

Total manufacturing costs

$ 2,093,000

Marketing and administrative:

65,200

65,000

Total marketing and administrative costs

130,000

73,000

$333,200

$ 1,759,800

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The Regal Cycle Company manufactures three types of bicycles-a dirt bike, a mountain bike, and a racing bike. Data on sales and expenses for the past quarter follow: Sales Variable manufacturing and selling expenses Contribution margin Fixed expenses: Advertising, traceable Depreciation of special equipment Salaries of product-line managers Allocated common fixed expenses* Total fixed expenses Net operating income (loss) *Allocated on the basis of sales dollars. Total Dirt Bikes $ 920,000 469,000 451,000 $ 266,000 111,000 155,000 Mountain Bikes $ 402,000 200,000 Racing Bikes $ 252,000 158,000 202,000 94,000 69,200 8,400 40,400 20,400 44,000 21,000 7,700 15,300 114,700 40,300 38,600 35,800 184,000 53,200 80,400 50,400 411,900 122,900 167,100 121,900 $ 39,100 $ 32,100 $ 34,900 $ (27,900) Management is considering discontinuing the racing bikes. The special equipment used to produce racing bikes has no resale value and does not wear out. Required: 1. What is the financial advantage…arrow_forwardThe following information relates to Oil Change Company. Oil Change Co. Projected Net Income For a Week Sales (160 cars serviced at $24 per car) Variable Expenses (160 cars at $9 per car) Contribution Margin Fixed Expenses Net Income Calculate the following: (i) Unit Contribution: (ii) Total Contribution: (iii) Break Even Point in Units (iv) Break Even Point in Dollars (v) Net Profit: $3,840 - 1,440 2,400 - 2,400 $ 0arrow_forwardEngberg Company installs lawn sod in home yards. The company’s most recent monthly contribution format income statement follows: Amount Percent of Sales Sales $ 134,000 100 % Variable expenses 53,600 40 % Contribution margin 80,400 60 % Fixed expenses 15,000 Net operating income $ 65,400 Required: 1. What is the company’s degree of operating leverage? 2. Using the degree of operating leverage, estimate the impact on net operating income of a 14% increase in sales. 3. Construct a new contribution format income statement for the company assuming a 14% increase in sales.arrow_forward

- The Regal Cycle Company manufactures three types of bicycles-a dirt bike, a mountain bike, and a racing bike. Data on sales and expenses for the past quarter follow: Sales Variable manufacturing and selling expenses Contribution margin Fixed expenses: Advertising, traceable Depreciation of special equipment Salaries of product-line managers Allocated common fixed expenses* Total fixed expenses Net operating income (loss) *Allocated on the basis of sales dollars. Total $ 917,000 470,000 447,000 70,400 43,500 114,500 183,400 411,800 $ 35,200 Dirt Bikes $ 265,000 116,000 149,000 8,700 20,300 40,100 53,000 122,100 $ 26,900 Mountain Bikes $ 400,000 202,000 198,000 40,800 7,800 38,200 80,000 166,800 $ 31,200 Racing Bikes $ 252,000 152,000 100,000 Required: 1. What is the financial advantage (disadvantage) per quarter of discontinuing the Racing Bikes? 2. Should the production and sale of racing bikes be discontinued? 20,900 15,400 36,200 50,400 122,900 $ (22,900) Management is concerned…arrow_forward1. Aladin Company Manufactures small battery that is used in clocks, toys and some other electronic devices. The last month's income statement of Aladin is given below: Sales (30,000 batteries) Less variable expenses Contribution Margin Fixed expenses Net operating income Total $300,000 $180,000 $120,000 $100,000 $20,000 Per Unit $10 $6 $4 Required: Prepare Aladin's new income statement under each of the following conditions: 1. The sales colume increase by 15%. 2. The selling price decreases by 20% per unit, and the sales volume increase by 30%. 3. The selling price increases by 50% per unit, fixed expenses increase by $20,000 and the sales volume decreases by 5%. 4. Variable expenses increases by 20% per unit, the selling price increase by 12%, and the sales volume decrease by 10%.arrow_forwardThe Regal Cycle Company manufactures three types of bicycles-a dirt bike, a mountain bike, and a racing bike. Data on sales and expenses for the past quarter follow: Sales Variable manufacturing and selling expenses Contribution margin Fixed expenses: Advertising, traceable Depreciation of special equipment Salaries of product-line managers Allocated common fixed expenses* Total fixed expenses Net operating income (loss) *Allocated on the basis of sales dollars. Total $ 935,000 467,000 468,000 69,800 43,800 114,300 187,000 414,900 $ 53,100 Dirt Bikes $ 269,000 115,000 154,000 8,800 20, 300 40, 600 Mountain Bikes $ 408,000 200,000 208,000 40,800 8,000 38,200 53,800 81,600 123,500 168,600 $ 30,500 $ 39,400 Racing Bikes $ 258,000 152,000 106,000 Required: 1. What is the financial advantage (disadvantage) per quarter of discontinuing the Racing Bikes? 2. Should the production and sale of racing bikes be discontinued? 20, 200 15,500 35,500 51,600 122,800 $ (16,800) Management is considering…arrow_forward

- Engberg Company installs lawn sod in home yards. The company's most recent monthly contribution format income statement follows: Amount Percent of Sales Sales $ 86,000 100% Variable expenses 34,400 40% Contribution margin 51,600 60% Fixed expenses 40, 420 Net operating income $ 11,180 Required: 1. What is the company's degree of operating leverage? 2. Using the degree of operating leverage, estimate the impact on net operating income of a 7% increase in unit sales. 3. Construct a new contribution format income statement for the company assuming a 7% increase in unit sales.arrow_forwardTike Industries is an apparel company that makes and sells both casual wear and sportswear. Here are data for the current year: Sales revenue Variable costs Contribution margin Traceable fixed costs Segment margin Common fixed costs Operating income Total $ 1,000,000 745,000 $255.000 (80,000) $175,000 (90,000) $85,000 Casual wear $ 450,000 388,000 $62,000 (25,000) $37,000 (42,000) S(5,000) Sportswear 5 pts $ 550,000 357,000 $193,000 (55,000) $138,000 (48,000) $90,000 Tike's accountant allocated the common fixed costs between the product lines based on sales revenue. Tike plans to discontinue the production of casual wear and use the freed-up capacity to triple the production and sale of sportswear. Although this will eliminate the traceable fixed costs for casual wear, the traceable fixed costs for sportswear will double. If Tike discontinues the casual wear product line, what would be the amount of the increase in Tike's operating income? Round to the nearest whole dollar and do not…arrow_forwardThe Regal Cycle Company manufactures three types of bicycles-a dirt bike, a mountain bike, and a racing bike. Data on sales and expenses for the past quarter follow: Sales Variable manufacturing and selling expenses Contribution margin Fixed expenses: Advertising, traceable Depreciation of special equipment Salaries of product-line managers Allocated common fixed expenses* Total fixed expenses Net operating income (loss) *Allocated on the basis of sales dollars. Total $ 300,000 120,000 180,000 30,000 23,000 35,000 60,000 148,000 $ 32,000 Dirt Bikes $ 90,000 27,000 63,000 Complete this question by entering your answers in the tabs below. Required 1 10,000 6,000 12,000 18,000 46,000 $ 17,000 Mountain Bikes $ 150,000 60,000 90,000 14,000 9,000 13,000 30,000 66,000 $ 24,000 Required 2 Required 3 What is the financial advantage (disadvantage) per quarter of discontinuing the Racing Bikes? Racing Bikes $ 60,000 33,000 27,000 Management is concerned about the continued losses shown by the…arrow_forward

- Engberg Company installs lawn sod in home yards. The company’s most recent monthly contribution format income statement follows: Amount Percent of Sales Sales $ 130,000 100% Variable expenses 52,000 40% Contribution margin 78,000 60% Fixed expenses 20,000 Net operating income $ 58,000 Required: What is the company’s degree of operating leverage? Using the degree of operating leverage, estimate the impact on net operating income of a 25% increase in unit sales. (not able to upload a third image) but I need the correct answer to what is the "net operating income" Construct a new contribution format income statement for the company assuming a 25% increase in unit sales.arrow_forwardThe Carlsbad Corporation produces and markets two types of electronic calculators: Model 4A and Model 5A. The following data were gathered on activities during the third quarter: Sales in units Sales price per unit Variable production costs per unit Traceable fixed production costs Variable selling expenses per unit Traceable fixed selling expenses Allocated portion of corporate expenses Model 4A 5,500 $ 141 $ 30 $ 205,000 Model 5A MAN 3,250 $ 250 $ 55 $ 305,000 $ 15 $ 17 $ 12,500 $ 126,000 $ 17,500 $ 130,000 Required: Prepare a segmented income statement for last quarter. The statement should provide sufficient detail to allow the company to evaluate the performance of the manager of each product line.arrow_forwardA company manufactures three types of bicycles—a dirt bike, a mountain bike, and a racing bike. Data on sales and expenses for the past quarter follow: Total Dirt Bikes Mountain Bikes Racing Bikes Sales $ 917,000 $ 262,000 $ 404,000 $ 251,000 Variable manufacturing and selling expenses 462,000 116,000 194,000 152,000 Contribution margin 455,000 146,000 210,000 99,000 Fixed expenses: Advertising, traceable 69,700 8,500 41,000 20,200 Depreciation of special equipment 44,300 20,900 7,800 15,600 Salaries of product-line managers 116,000 40,100 39,000 36,900 Allocated common fixed expenses* 183,400 52,400 80,800 50,200 Total fixed expenses 413,400 121,900 168,600 122,900 Net operating income (loss) $ 41,600 $ 24,100 $ 41,400 $ (23,900) *Allocated on the basis of sales dollars. Management is considering discontinuing the racing bikes. The special equipment used to produce racing bikes has no resale value and does not wear out. Required: What is the…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education