FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

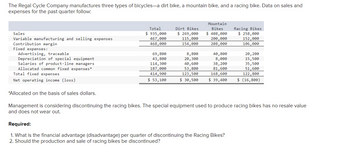

Transcribed Image Text:The Regal Cycle Company manufactures three types of bicycles-a dirt bike, a mountain bike, and a racing bike. Data on sales and

expenses for the past quarter follow:

Sales

Variable manufacturing and selling expenses

Contribution margin

Fixed expenses:

Advertising, traceable

Depreciation of special equipment

Salaries of product-line managers

Allocated common fixed expenses*

Total fixed expenses

Net operating income (loss)

*Allocated on the basis of sales dollars.

Total

$ 935,000

467,000

468,000

69,800

43,800

114,300

187,000

414,900

$ 53,100

Dirt Bikes

$ 269,000

115,000

154,000

8,800

20, 300

40, 600

Mountain

Bikes

$ 408,000

200,000

208,000

40,800

8,000

38,200

53,800

81,600

123,500

168,600

$ 30,500 $ 39,400

Racing Bikes

$ 258,000

152,000

106,000

Required:

1. What is the financial advantage (disadvantage) per quarter of discontinuing the Racing Bikes?

2. Should the production and sale of racing bikes be discontinued?

20, 200

15,500

35,500

51,600

122,800

$ (16,800)

Management is considering discontinuing the racing bikes. The special equipment used to produce racing bikes has no resale value

and does not wear out.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Juno Outdoor Products manufactures four different types of sleeping bags. Last year, Juno generated net operating income of $1,000. The following information was taken from last year's income statement segmented by product (brackets indicate a negative amount): Contribution margin $ Segment margin Arctic Allocated common $ 10,000 fixed expenses O Arctic and Desert (2,000) $ (16,000) Segment margin less $ (26,000) allocated common fixed expenses Arctic O no bags should be discontinued O Arctic and Backyard Arctic Desert, and Backyard Desert $ 45,000 $ 5,000 $ 10,000 $ (5,000) Backyard $ 35,000 $ (8,000) $ 10,000 $ (18,000) Indoor $ 80,000 Juno expects similar operating results for the upcoming year. If Juno wants to maximize its profitability in the upcoming year, which sleeping bag or bags should Juno discontinue? $ 60,000 $ 10,000 $ 50,000arrow_forwardBed & Bath, a retailing company, has two departments-Hardware and Linens. The company's most recent monthly contribution format income statement follows: Sales Variable expenses Contribution margin Fixed expenses Net operating income (loss) Total $ 4,280,000 1,305,000 2,975,000 2,310,000 $ 665,000 Department Hardware $3,130,000 893,000 2,237,000 1,420,000 $ 817,000 Required: What is the financial advantage (disadvantage) of discontinuing the Linens Department? Linens $ 1,150,000 412,000 738,000 890,000 $ (152,000) A study indicates that $379,000 of the fixed expenses being charged to Linens are sunk costs or allocated costs that will continue even if the Linens Department is dropped. In addition, the elimination of the Linens Department will result in a 14% decrease in the sales of the Hardware Department.arrow_forwardA cement manufacturer has supplied the following data: Tons of cement produced and sold Sales revenue Variable manufacturing expense Fixed manufacturing expense Variable selling and administrative expense Fixed selling and administrative expense Net operating income The company's contribution margin ratio is closest to: NOTE: The answer is in percentage form, write in this format: 25 NOT 25%. 220,000 $924,000 $297,000 $280,000 $165,000 $82,000 $100,000arrow_forward

- The Regal Cycle Company manufactures three types of bicycles-a dirt bike, a mountain bike, and a racing bike. Data on sales and expenses for the past quarter follow: Sales Variable manufacturing and selling expenses Contribution margin Fixed expenses: Advertising, traceable Depreciation of special equipment Salaries of product-line managers Allocated common fixed expenses* Total fixed expenses Net operating income (loss) *Allocated on the basis of sales dollars. Total Dirt Bikes $ 922,000 483,000 439,000 $ 263,000 119,000 144,000 Mountain Bikes $ 406,000 208,000 Racing Bikes $ 253,000 156,000 198,000 97,000 70,100 8,900 40,400 20,800 44,200 21,000 7,300 15,900 115,500 40,900 38,300 36,300 184,400 52,600 81,200 50,600 414,200 123,400 167,200 123,600 $ 24,800 $ 20,600 $ 30,800 $ (26,600) Management is considering discontinuing the racing bikes. The special equipment used to produce racing bikes has no resale value and does not wear out. Required: 1. What is the financial advantage…arrow_forwardThe Regal Cycle Company manufactures three types of bicycles—a dirt bike, a mountain bike, and a racing bike. Data on sales and expenses for the past quarter follow: Total DirtBikes Mountain Bikes RacingBikes Sales $ 918,000 $ 264,000 $ 403,000 $ 251,000 Variable manufacturing and selling expenses 455,000 110,000 191,000 154,000 Contribution margin 463,000 154,000 212,000 97,000 Fixed expenses: Advertising, traceable 70,600 9,000 40,900 20,700 Depreciation of special equipment 44,000 20,900 7,700 15,400 Salaries of product-line managers 116,000 40,500 38,700 36,800 Allocated common fixed expenses* 183,600 52,800 80,600 50,200 Total fixed expenses 414,200 123,200 167,900 123,100 Net operating income (loss) $ 48,800 $ 30,800 $ 44,100 $ (26,100) *Allocated on the basis of sales dollars. Management is…arrow_forwardMemanarrow_forward

- Required information Use the following information for the Exercise below. (Algo) [The following information applies to the questions displayed below.] Barnes Company reports the following for its product for its first year of operations. Direct materials Direct labor Variable overhead Fixed overhead Variable selling and administrative expenses Fixed selling and administrative expenses $ 36 per unit $ 26 per unit $12 per unit $ 70,000 per year $3 per unit $ 28,000 per year Exercise 6-5 (Algo) Computing gross profit at different production levels LO P2 The company sells its product for $140 per unit. Compute gross profit using absorption costing assuming the company (a) produces and sells 2,800 units and (b) produces 3,500 units and sells 2,800 units. (a) 2,800 Units Produced Gross profit using absorption costing and 2,800 Units Sold Sales Cost of goods sold Gross profit (b) 3,500 Units Produced and 2,800 Units Soldarrow_forwardShown below is a segmented income statement for Hickory Company's three wooden flooring product lines: Strip Plank Parquet Total Sales revenue $400,000 $200,000 $300,000 $900,000 Less: Variable expenses 225,000 120,000 250,000 595,000 Contribution margin $175,000 $ 80,000 $ 50,000 $305,000 Less direct fixed expenses: Machine rent (5,000) (20,000) (30,000) (55,000) Supervision (15,000) (10,000) (5,000) (30,000) Depreciation (35,000) (10,000) (25,000) (70,000) Segment margin $120,000 $ 40,000 $ (10,000) $150,000 Hickory's management is deciding whether to keep or drop the parquet product line. Hickory's parquet flooring product line has a contribution margin of $50,000 (sales of $300,000 less total variable costs of $250,000). All variable costs are relevant. Relevant fixed costs associated with this line include 80% of parquet's machine rent and all of parquet's supervision salaries. In addition, assume that dropping the parquet product line would reduce sales of the strip line by 27%…arrow_forwardThe Regal Cycle Company manufactures three types of bicycles-a dirt bike, a mountain bike, and a racing bike. Data on sales and expenses for the past quarter follow: Sales Variable manufacturing and selling expenses Contribution margin Fixed expenses: Advertising, traceable Depreciation of special equipment Salaries of product-line managers Allocated common fixed expenses* Total fixed expenses es Net operating income (loss) "Allocated on the basis of sales dollars. Total $ 924,000 469,000 Dirt Bikes 455,000 $ 266,000 116,000 150,000 Mountain Bikes $ 408,000 195,000 213,000 Racing Bikes $ 250,000 158,000 92,000 69,400 8,300 40,300 20,800 42,900 20,200 7,300 15,400 115,200 40,900 38,400 35,900 184,800 53,200 81,600 50,000 412,300 122,600 167,600 122,100 $ 42,700 $ 27,400 $ 45,400 $ (30,100) Management is concerned about the continued losses shown by the racing bikes and wants a recommendation as to whether or not the line should be discontinued. The special equipment used to produce…arrow_forward

- Vishanoarrow_forwardSubject : - Accountingarrow_forwardThe Regal Cycle Company manufactures three types of bicycles-a dirt bike, a mountain bike, and a racing bike. Data on sales and expenses for the past quarter follow: Sales Variable manufacturing and selling expenses Contribution margin Fixed expenses: Advertising, traceable Depreciation of special equipment Salaries of product-line managers Allocated common fixed expenses* Total fixed expenses Net operating income (loss) *Allocated on the basis of sales dollars. Total $ 928,000 472,000 456,000 69,400 44,500 116, 100 185,600 415,600 $ 40,400 Required 1 Complete this question by entering your answers in the tabs below. Required 2 Dirt Bikes $ 268,000 116,000 152,000 Mountain Bikes $ 403,000 200,000 203,000 Management is considering discontinuing the racing bikes. The special equipment used to produce racing bikes has no resale value and does not wear out. Required: 1. What is the financial advantage (disadvantage) per quarter of discontinuing the Racing Bikes? 2. Should the production…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education