FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

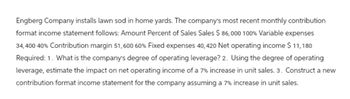

Transcribed Image Text:Engberg Company installs lawn sod in home yards. The company's most recent monthly contribution

format income statement follows: Amount Percent of Sales Sales $ 86,000 100% Variable expenses

34,400 40% Contribution margin 51,600 60% Fixed expenses 40, 420 Net operating income $ 11,180

Required: 1. What is the company's degree of operating leverage? 2. Using the degree of operating

leverage, estimate the impact on net operating income of a 7% increase in unit sales. 3. Construct a new

contribution format income statement for the company assuming a 7% increase in unit sales.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps with 3 images

Knowledge Booster

Similar questions

- Whirly Corporation's contribution format income statement for the most recent month is shown below: Total Per Unit Sales (7,800 units) Variable expenses $ 273,000 148, 200 $ 35.00 19.00 Contribution margin 124,800 $ 16.00 Fixed expenses 55,300 Net operating income $ 69,500 Required: (Consider each case independently): 1. What would be the revised net operating income per month if the sales volume increases by 70 units? 2. What would be the revised net operating income per month if the sales volume decreases by 70 units? 3. What would be the revised net operating income per month if the sales volume is 6,800 units? 1. Revised net operating income 2. Revised net operating income 3. Revised net operating incomearrow_forwardThe following income statement applies to Finch Company for the current year: Income Statement Sales revenue (480 units × $30) $ 14,400 Variable cost (480 units × $15) (7,200 ) Contribution margin 7,200 Fixed cost (4,000 ) Net income $ 3,200 Required a. Use the contribution margin approach to calculate the magnitude of operating leverage. b. Use the operating leverage measure computed in Requirement a to determine the amount of net income that Fincharrow_forward1) Ehrlich Enterprises prepared the following contribution format income statement based on a sales volume of 3,000 units (the relevant range of production is 1,000 units to 5,000 units): Contribution Margin Income Statement Sales $ 48,000 Variable expenses 30,000 Contribution margin 18,000 Fixed expenses 10,000 Net operating Income $ 8,000 If sales decline to 1,300 units, what would be the net operating income (loss)? If the selling price increases by $3 per unit and the sales volume decreases by 100 units, what would be the net operating income? What is the break-even point in unit sales? What is the break-even point in dollar sales?arrow_forward

- ces Olongapo Sports Corporation distributes two premium golf balls-Flight Dynamic and Sure Shot. Monthly sales and the contribution margin ratios for the two products follow: Sales CM ratio Fixed expenses total $183,750 per month. Flight Dynamic $ 150,000 Required 1 Product Required 2 Required 3 80% Required: 1. Prepare a contribution format income statement for the company as a whole. 2. What is the company's break-even point in dollar sales based on the current sales mix? 3. If sales increase by $100,000 a month, by how much would you expect the monthly net operating income to increase? Break-even point in dollar sales Sure Shot $ 250,000 36% Complete this question by entering your answers in the tabs below. Total $ 400.000 > What is the company's break-even point in dollar sales based on the current sales mix? Note: Do not round intermediate calculations.arrow_forwardSubject : - Accountingarrow_forwardRefer to the data in requirement 5. Assume the new plant is built and that next year the company manufactures and sells 32,000 balls (the same number as sold last year). Prepare a contribution format income statement and compute the degree of operating leverage. Note: Round "Degree of operating leverage" to 2 decimal places. Show less Northwood Company Contribution Income Statement 0 $0 Degree of operating leveragearrow_forward

- McGrath electric is a service firm with current service sales of 4,794,549 and a 57% contribution margin. It’s fixed costs are 1,217,297. If there is a 13% in sales, compute the percentage of net increase in operating income for McGrath. Round to the nearest hundred, two decimals.arrow_forwardOperating Leverage Cartersville Co. reports the following data: Sales $485,800 Variable costs 291,500 Contribution margin $194,300 Fixed costs 156,200 Income from operations $38,100 Determine Cartersville Company's operating leverage. Round your answer to one decimal place.arrow_forwardOperating Leverage Cartersville Co. reports the following data: Sales $455,200 Variable costs (250,400) Contribution margin $204,800 Fixed costs (146,300) Operating income $58,500 Determine Cartersville Co.’s operating leverage. Round your answer to one decimal place.arrow_forward

- Help please provide Solutionsarrow_forwardEngberg Company installs lawn sod in home yards. The company’s most recent monthly contribution format income statement follows: Amount Percent of Sales Sales $ 134,000 100 % Variable expenses 53,600 40 % Contribution margin 80,400 60 % Fixed expenses 15,000 Net operating income $ 65,400 Required: 1. What is the company’s degree of operating leverage? 2. Using the degree of operating leverage, estimate the impact on net operating income of a 14% increase in sales. 3. Construct a new contribution format income statement for the company assuming a 14% increase in sales.arrow_forwardSarratt Corporation's contribution margin ratio is 70% and its fixed monthly expenses are $38,000. Assume that the company's sales for May are expected to be $97,000. Required: Estimate the company's net operating income for May, assuming that the fixed monthly expenses do not change. Net operating incomearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education