FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

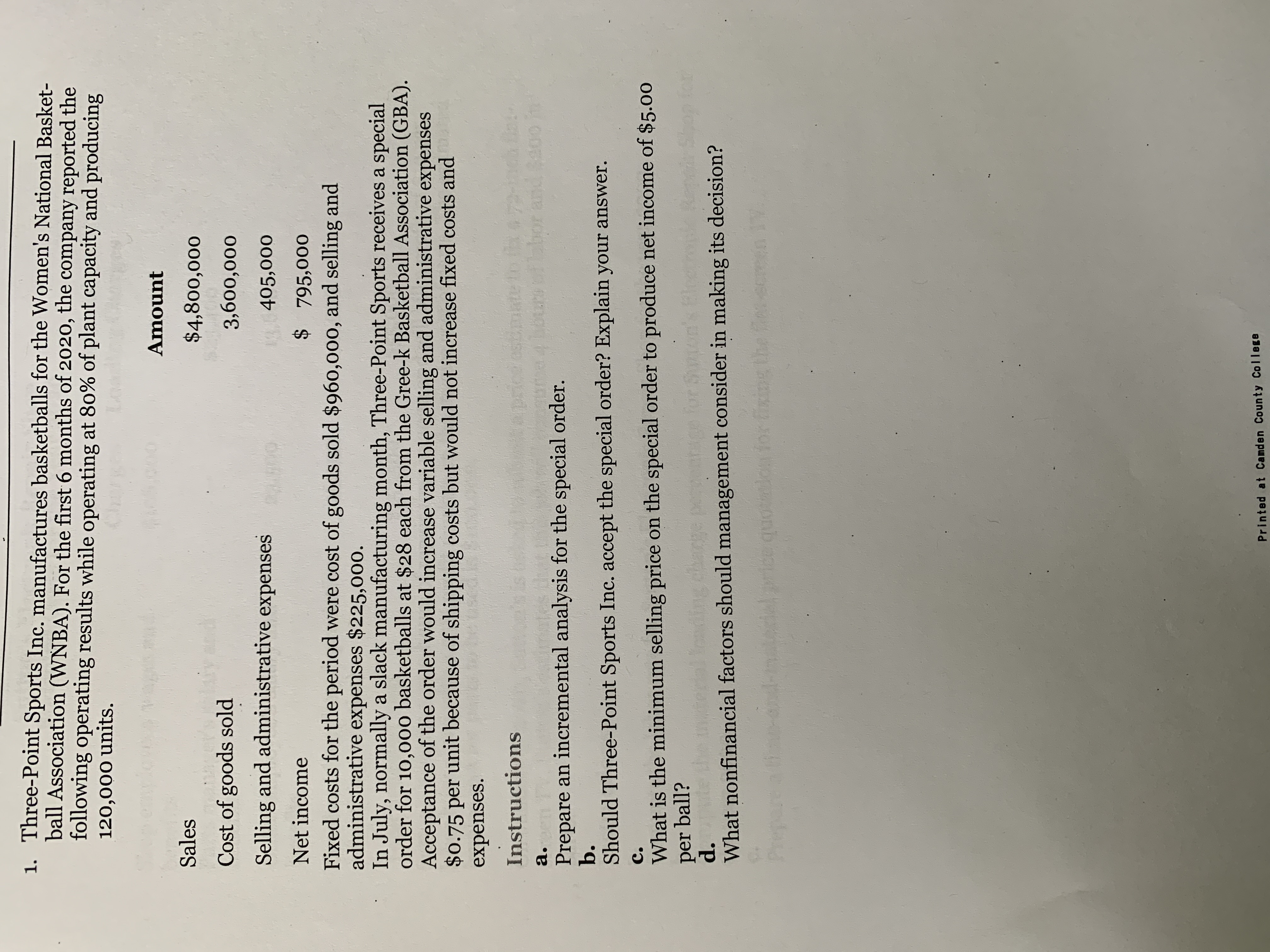

Transcribed Image Text:1. Three-Point Sports Inc. manufactures basketballs for the Women's National Basket-

ball Association (WNBA). For the first 6 months of 2020, the company reported the

following operating results while operating at 80% of plant capacity and producing

120,000 units.

Amount

Sales

$4,800,000

बंतरा

Cost of goods sold

3,600,000

Selling and administrative expenses

405,000

Net income

$ 795,000

Fixed costs for the period were cost of goods sold $960,000, and selling and

administrative expenses $225,000.

In July, normally a slack manufacturing month, Three-Point Sports receives a special

order for 10,000 basketballs at $28 each from the Gree-k Basketball Association (GBA).

Acceptance of the order would increase variable selling and administrative expenses

$0.75 per unit because of shipping costs but would not increase fixed costs and

expenses.

Instructions

bbor and a00 in

a.

Prepare an incremental analysis for the special order.

b.

Should Three-Point Sports Inc. accept the special order? Explain your answer.

C.

What is the minimum selling price on the special order to produce net income of $5.00

per ball?

d.

Shop for

for

What nonfinancial factors should management consider in making its decision?

qu

otioa for fixing

Printed at Camden County College

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Similar questions

- Johnson Stores produce and sell face powder called the 'Success' in cases. Each case is sold for $80. The following information relates to the product in the autumn and summer of 2020: Sales Production Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead Fixed selling expenses Variable selling expenses Variable administrative expenses are 10% of sales value Fixed administrative expenses are 25% of sales value Autumn 23,400 units 28,500 units $136,800 $133,950 $71,250 $120,000 $25,500 $42,750 Summer 35,700 units 30,600 units $146,880 $143,820 $76,500 $122,000 $25,500 $45,900 Normal capacity for the year was 117,600 cases to be produced evenly throughout the year with a budgeted cost of $470,400. Assume that there will be no inventory held on January 1, 2020. Required: (1) Prepare profit statement for each of the two quarters using absorption and variable costing techniques. (2) Compute and reconcile the differences in the operating incomes of both…arrow_forwardSims Company, a manufacturer of tablet computers, began operations on January 1, 2019. Its cost and sales information for this year follows. Manufacturing costs $ 30 per unit Direct materials Direct labor $ 50 per unit Overhead costs Variable $ Fixed 40 per unit. $6,600,000 (per year) Selling and administrative costs for the year Variable Fixed $ 775,000 $5,000,000 Production and sales for the year Units produced 110,000 units Units sold Sales price per unit 80,000 units 360 per unit $ 1. Prepare an income statement for the year using variable costing. 2. Prepare an income statement for the year using absorption costing. Complete this question by entering your answers in the tabs below. Required 1 Required 2 O 21arrow_forwardManila Company manufactures one main product and two by-products, A and B. The following are data from the month of May:arrow_forward

- Rowe Tool and Die (RTD) produces metal fittings as a supplier to various manufacturing firms in the area. The following is the forecasted income statement for the next quarter, which is the typical planning horizon used at RTD. RTD expects to sell 47,000 units during the quarter. RTD carries no inventories. Sales revenue Costs of fitting produced Gross profit Administrative costs Operating profit Amount $ 1,250, 200 958, 800 $ 291,400 220,900 $ 70,500 Per Unit $ 26,60 20.40 $6.20 4.70 $ 1.50 Fixed costs included in this income statement are $305,500 for depreciation on plant and machinery and miscellaneous factory operations and $95,500 for administrative costs. RTD has received a request for 10,000 fittings to be produced in the next quarter from Endicott Manufacturing. Endicott has never purchased from RTD, although they have been a local company for many years. Endicott has offered to pay $20.20 per unit. RTD can easily produce the 10,000 units with its existing capacity. Production…arrow_forwardA company produces several product lines. One of those lines generates the following annual cost and production data: The company adds 40% to its production cost in selling to the retailer. The retailer in turn adds a 50% profit margin when selling to its customers. How much would it cost a retailer to buy 100 units of the product? (a) $4800 (b) $6720 (c) $7200 (d) $1008arrow_forwardSuper Bike Manufacturing Company presents the following data for year 2022: Opening inventory: 0 Units Sales: 8,000 Units Production: 10,000 Units • Closing inventory: 2,000 Units Direct materials: $240 • Direct labor: $280 • Variable manufacturing overhead expenses: $100 • Variable selling and administrative expenses: $40 • Fixed manufacturing overhead expenses: $1200,000 • Fixed selling and administrative expenses: $800,000 Required: Using the data given above, compute the unit product cost of one bike under: 1. absorption costing system. 2. variable costing system.arrow_forward

- Kyonggi Machine Corporation in Suwon reports the following operating results for the month of June in 2020. KYONGGI MACHINE CORPORATION CVP Income Statement For the Month Ended June 30, 2020 (Currency Unit: Korean Won, ₩) Total Per Unit Sales (5,000 units) ₩300,000,000 ₩60,000 Variable costs 180,000,000 36,000 Contribution margin 120,000,000 ₩24,000 Fixed expenses 100,000,000 Net income ₩ 20,000,000 To increase net income, management is considering reducing the selling price by 10%, with no changes to unit variable costs or fixed costs. Management is confident that this change will increase unit sales by 25%. (Instructions) Compute the break-even point in units and…arrow_forwardHightech Sdn Bhd (HSB) produces knee guards for recreational activity, which are marketed throughout Malaysia. Selected cost and operating data relating to the product for two years are given below: Year 2020 Year 2021 Units in beginning inventory 0 ? Units produced during the year 18,000 10,800 Units sold during the year 14,400 14,400 Units in ending inventory 3,600 0 RM Selling price per unit 54 Manufacturing costs: Variable per unit produced: Direct materials 11 Direct labour 6 Variable overhead 5 Fixed per year 162,000 Selling and…arrow_forwardThe Hame Company manufactures trendy, good-looking, moderately priced umbrellas. The following data are for the year ended December 31, 2020: 100,000 units Beginning inventory, January 1, 2020 50,000 units Ending inventory, December 31, 2020 2020 Sales 400,000 units Selling price $25 per unit Variable manufacturing cost per unit, including direct materials $6 per unit Variable selling & admin. cost per unit sold S2 per unit sold Fixed manufacturing costs $1,625,000 Fixed selling & admin. costs $1,100,000 Required: Assume standard costs per unit are the same for units in beginning inventory and units produced during the year. Also, assume no price, spending, or efficiency variances. Prepare income statement under variable costing for the year ended December 31, 2020.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education