FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

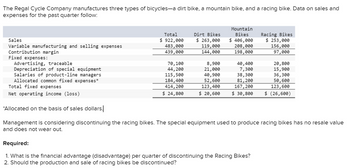

Transcribed Image Text:The Regal Cycle Company manufactures three types of bicycles-a dirt bike, a mountain bike, and a racing bike. Data on sales and

expenses for the past quarter follow:

Sales

Variable manufacturing and selling expenses

Contribution margin

Fixed expenses:

Advertising, traceable

Depreciation of special equipment

Salaries of product-line managers

Allocated common fixed expenses*

Total fixed expenses

Net operating income (loss)

*Allocated on the basis of sales dollars.

Total

Dirt Bikes

$ 922,000

483,000

439,000

$ 263,000

119,000

144,000

Mountain

Bikes

$ 406,000

208,000

Racing Bikes

$ 253,000

156,000

198,000

97,000

70,100

8,900

40,400

20,800

44,200

21,000

7,300

15,900

115,500

40,900

38,300

36,300

184,400

52,600

81,200

50,600

414,200

123,400

167,200

123,600

$ 24,800

$ 20,600

$ 30,800 $ (26,600)

Management is considering discontinuing the racing bikes. The special equipment used to produce racing bikes has no resale value

and does not wear out.

Required:

1. What is the financial advantage (disadvantage) per quarter of discontinuing the Racing Bikes?

2. Should the production and sale of racing bikes be discontinued?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- The Regal Cycle Company manufactures three types of bicycles-a dirt bike, a mountain bike, and a racing bike. Data on sales and expenses for the past quarter follow: Sales Variable manufacturing and selling expenses Contribution margin Fixed expenses: Advertising, traceable Depreciation of special equipment Salaries of product-line managers Allocated common fixed expenses* Total fixed expenses Net operating income (loss) *Allocated on the basis of sales dollars. Total Dirt Bikes $ 920,000 469,000 451,000 $ 266,000 111,000 155,000 Mountain Bikes $ 402,000 200,000 Racing Bikes $ 252,000 158,000 202,000 94,000 69,200 8,400 40,400 20,400 44,000 21,000 7,700 15,300 114,700 40,300 38,600 35,800 184,000 53,200 80,400 50,400 411,900 122,900 167,100 121,900 $ 39,100 $ 32,100 $ 34,900 $ (27,900) Management is considering discontinuing the racing bikes. The special equipment used to produce racing bikes has no resale value and does not wear out. Required: 1. What is the financial advantage…arrow_forwardThe following costs result from the production and sale of 1,000 drum sets manufactured by Tight Drums Company for the year ended December 31. The drum sets sell for $500 each. Variable costs Plastic for casing Wages of assembly workers Drum stands Sales commissions Fixed costs Taxes on factory Factory maintenance Factory machinery depreciation Lease of equipment for sales staff Accounting staff salaries Administrative salaries Required 1 Required 2 Required: 1. Prepare a contribution margin income statement for the year. 2. Compute contribution margin per unit and contribution margin ratio. 3. For each dollar of sales, how much is left to cover fixed costs and contribute to income? Sales Variable costs: Complete this question by entering your answers in the tabs below. Contribution margin Fixed costs $ 17,000 82,000 Required 3 Income 26,000 15,000 Prepare a contribution margin income statement for the year. TIGHT DRUMS COMPANY Contribution Margin Income Statement For Year Ended…arrow_forwardJake's Roof Repair has provided the following data concerning its costs: Fixed Cost Cost per per Month Repair-Hour Wages and salaries Parts and supplies $ 21,400 $ 15.00 $ 7.20 Equipment depreciation $ 2,740 $ 0.55 Truck operating expenses Rent $ 5,720 $ 1.70 $ 4,660 $ 3,880 $ 0.70 Administrative expenses For example, wages and salaries should be $21,400 plus $15.00 per repair-hour. The company expected to work 2,700 repair-hours in May, but actually worked 2,600 repair-hours. The company expects its sales to be $47.00 per repair-hour. Required: Compute the company's activity variances for May. Note: Indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (i.e., zero variance). Input all amounts as positive values. Revenue Expenses: Jake's Roof Repair Activity Variances For the Month Ended May 31 Wages and salaries Parts and supplies Equipment depreciation Truck operating expenses Rent Administrative expenses Total expense Net…arrow_forward

- Crane Trivia Co. manufactures and sells two trivia products, the Square Trivia Game and the Round Trivia Game. Last quarter's operating profits, by product, and for the company as a whole, were as follows: Square Round Total Sales revenue $11,000 $6,860 $17,860 Variable expenses 5,000 2,910 7,910 Contribution margin 6,000 3,950 9,950 Fixed expenses 2,750 4,200 6,950 Operating income $ 3,250 $(250) $ 3,000 Forty percent of the Round Game's fixed costs could have been avoided if the game had not been produced or sold. If the Round Game had been discontinued before the last quarter, what would operating income have been for the company as a whole? Operating income without round $arrow_forwardThe Regal Cycle Company manufactures three types of bicycles-a dirt bike, a mountain bike, and a racing bike. Data on sales and expenses for the past quarter follow: Sales Variable manufacturing and selling expenses Contribution margin Fixed expenses: Advertising, traceable Depreciation of special equipment Salaries of product-line managers Allocated common fixed expenses* Total fixed expenses Net operating income (loss) *Allocated on the basis of sales dollars. Total $ 917,000 470,000 447,000 70,400 43,500 114,500 183,400 411,800 $ 35,200 Dirt Bikes $ 265,000 116,000 149,000 8,700 20,300 40,100 53,000 122,100 $ 26,900 Mountain Bikes $ 400,000 202,000 198,000 40,800 7,800 38,200 80,000 166,800 $ 31,200 Racing Bikes $ 252,000 152,000 100,000 Required: 1. What is the financial advantage (disadvantage) per quarter of discontinuing the Racing Bikes? 2. Should the production and sale of racing bikes be discontinued? 20,900 15,400 36,200 50,400 122,900 $ (22,900) Management is concerned…arrow_forwardThe Regal Cycle Company manufactures three types of bicycles-a dirt bike, a mountain bike, and a racing bike. Data on sales and expenses for the past quarter follow: Sales Variable manufacturing and selling expenses Contribution margin Fixed expenses: Advertising, traceable Depreciation of special equipment Salaries of product-line managers Allocated common fixed expenses* Total fixed expenses Net operating income (loss) *Allocated on the basis of sales dollars. Total $ 935,000 467,000 468,000 69,800 43,800 114,300 187,000 414,900 $ 53,100 Dirt Bikes $ 269,000 115,000 154,000 8,800 20, 300 40, 600 Mountain Bikes $ 408,000 200,000 208,000 40,800 8,000 38,200 53,800 81,600 123,500 168,600 $ 30,500 $ 39,400 Racing Bikes $ 258,000 152,000 106,000 Required: 1. What is the financial advantage (disadvantage) per quarter of discontinuing the Racing Bikes? 2. Should the production and sale of racing bikes be discontinued? 20, 200 15,500 35,500 51,600 122,800 $ (16,800) Management is considering…arrow_forward

- Tike Industries is an apparel company that makes and sells both casual wear and sportswear. Here are data for the current year: Sales revenue Variable costs Contribution margin Traceable fixed costs Segment margin Common fixed costs Operating income Total $ 1,000,000 745,000 $255.000 (80,000) $175,000 (90,000) $85,000 Casual wear $ 450,000 388,000 $62,000 (25,000) $37,000 (42,000) S(5,000) Sportswear 5 pts $ 550,000 357,000 $193,000 (55,000) $138,000 (48,000) $90,000 Tike's accountant allocated the common fixed costs between the product lines based on sales revenue. Tike plans to discontinue the production of casual wear and use the freed-up capacity to triple the production and sale of sportswear. Although this will eliminate the traceable fixed costs for casual wear, the traceable fixed costs for sportswear will double. If Tike discontinues the casual wear product line, what would be the amount of the increase in Tike's operating income? Round to the nearest whole dollar and do not…arrow_forwardThe Regal Cycle Company manufactures three types of bicycles-a dirt bike, a mountain bike, and a racing bike. Data on sales and expenses for the past quarter follow: Sales Variable manufacturing and selling expenses Contribution margin Fixed expenses: Advertising, traceable Depreciation of special equipment Salaries of product-line managers Allocated common fixed expenses* Total fixed expenses Net operating income (loss) *Allocated on the basis of sales dollars. Total $ 300,000 120,000 180,000 30,000 23,000 35,000 60,000 148,000 $ 32,000 Dirt Bikes $ 90,000 27,000 63,000 Complete this question by entering your answers in the tabs below. Required 1 10,000 6,000 12,000 18,000 46,000 $ 17,000 Mountain Bikes $ 150,000 60,000 90,000 14,000 9,000 13,000 30,000 66,000 $ 24,000 Required 2 Required 3 What is the financial advantage (disadvantage) per quarter of discontinuing the Racing Bikes? Racing Bikes $ 60,000 33,000 27,000 Management is concerned about the continued losses shown by the…arrow_forwardVinubhaiarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education