FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

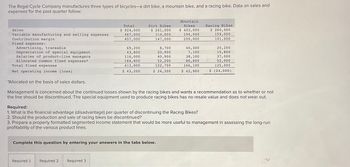

Transcribed Image Text:The Regal Cycle Company manufactures three types of bicycles-a dirt bike, a mountain bike, and a racing bike. Data on sales and

expenses for the past quarter follow:

Sales

Variable manufacturing and selling expenses

Contribution margin

Fixed expenses:

Advertising, traceable

Depreciation of special equipment

Salaries of product-line managers

Allocated common fixed expenses*

Total fixed expenses

Net operating income (loss)

*Allocated on the basis of sales dollars.

Total

$ 924,000

467,000

457,000

Dirt Bikes

$ 261,000

114,000

147,000

Mountain

Bikes

$ 403,000

194,000

Racing Bikes

$ 260,000

159,000

209,000

101,000

69,200

8,700

40,300

20,200

43,800

20,900

7,100

15,800

116,000

40,900

38,100

37,000

184,800

52,200

80,600

52,000

413,800

122,700

166,100

125,000

$ 43,200

$ 24,300

$ 42,900

$ (24,000)

Management is concerned about the continued losses shown by the racing bikes and wants a recommendation as to whether or not

the line should be discontinued. The special equipment used to produce racing bikes has no resale value and does not wear out.

Required:

1. What is the financial advantage (disadvantage) per quarter of discontinuing the Racing Bikes?

2. Should the production and sale of racing bikes be discontinued?

3. Prepare a properly formatted segmented income statement that would be more useful to management in assessing the long-run

profitability of the various product lines.

Complete this question by entering your answers in the tabs below.

Required 1

Required 2 Required 3

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- The Regal Cycle Company manufactures three types of bicycles—a dirt bike, a mountain bike, and a racing bike. Data on sales and expenses for the past quarter follow: Total DirtBikes Mountain Bikes RacingBikes Sales $ 920,000 $ 267,000 $ 401,000 $ 252,000 Variable manufacturing and selling expenses 464,000 118,000 191,000 155,000 Contribution margin 456,000 149,000 210,000 97,000 Fixed expenses: Advertising, traceable 69,600 8,600 40,200 20,800 Depreciation of special equipment 44,300 20,900 7,800 15,600 Salaries of product-line managers 114,100 40,000 38,300 35,800 Allocated common fixed expenses* 184,000 53,400 80,200 50,400 Total fixed expenses 412,000 122,900 166,500 122,600 Net operating income (loss) $ 44,000 $ 26,100 $ 43,500 $ (25,600) *Allocated on the basis of sales dollars. Management is…arrow_forwardShown below is a segmented income statement for Hickory Company's three wooden flooring product lines: Strip Plank Parquet Total Sales revenue $400,000 $200,000 $300,000 $900,000 Less: Variable expenses 225,000 120,000 250,000 595,000 Contribution margin $175,000 $ 80,000 $ 50,000 $305,000 Less direct fixed expenses: Machine rent (5,000) (20,000) (30,000) (55,000) Supervision (15,000) (10,000) (5,000) (30,000) Depreciation (35,000) (10,000) (25,000) (70,000) Segment margin $120,000 $ 40,000 $ (10,000) $150,000 Hickory's management is deciding whether to keep or drop the parquet product line. Hickory's parquet flooring product line has a contribution margin of $50,000 (sales of $300,000 less total variable costs of $250,000). All variable costs are relevant. Relevant fixed costs associated with this line include 80% of parquet's machine rent and all of parquet's supervision salaries. In addition, assume that dropping the parquet product line would reduce sales of the strip line by 27%…arrow_forwardThe Regal Cycle Company manufactures three types of bicycles-a dirt bike, a mountain bike, and a racing bike. Data on sales and expenses for the past quarter follow: Sales Variable manufacturing and selling expenses Contribution margin Fixed expenses: Advertising, traceable Depreciation of special equipment Salaries of product-line managers Allocated common fixed expenses* Total fixed expenses es Net operating income (loss) "Allocated on the basis of sales dollars. Total $ 924,000 469,000 Dirt Bikes 455,000 $ 266,000 116,000 150,000 Mountain Bikes $ 408,000 195,000 213,000 Racing Bikes $ 250,000 158,000 92,000 69,400 8,300 40,300 20,800 42,900 20,200 7,300 15,400 115,200 40,900 38,400 35,900 184,800 53,200 81,600 50,000 412,300 122,600 167,600 122,100 $ 42,700 $ 27,400 $ 45,400 $ (30,100) Management is concerned about the continued losses shown by the racing bikes and wants a recommendation as to whether or not the line should be discontinued. The special equipment used to produce…arrow_forward

- Tabouk’s Manufacturing Company has two divisions: Garden Division and Farm Division. The following report is for the most recent operating period of 2019: Total Company Garden Division Farm Division Sales revenue $390,000 $270,000 $120,000 Variable expenses 95,400 59,400 36,000 Contribution margin 294,600 210,600 84,000 Traceable fixed expenses 223,000 165,000 58,000 Division profit margin 71,600 $45,600 $26,000 Common fixed expense 46,800 Net operating income $24,800 As a manager at the company your responsibilities are planning and directing the company, you are required to: 1-What would be the company's overall net operating income if the company operated at its two division's break-even points?arrow_forwardVishanoarrow_forwardThe Regal Cycle Company manufactures three types of bicycles-a dirt bike, a mountain bike, and a racing bike. Data on sales and expenses for the past quarter follow: Sales Variable manufacturing and selling expenses Contribution margin Fixed expenses: Advertising, traceable Depreciation of special equipment Salaries of product-line managers Allocated common fixed expenses* Total fixed expenses Net operating income (loss) *Allocated on the basis of sales dollars. Total $ 928,000 472,000 456,000 69,400 44,500 116, 100 185,600 415,600 $ 40,400 Required 1 Complete this question by entering your answers in the tabs below. Required 2 Dirt Bikes $ 268,000 116,000 152,000 Mountain Bikes $ 403,000 200,000 203,000 Management is considering discontinuing the racing bikes. The special equipment used to produce racing bikes has no resale value and does not wear out. Required: 1. What is the financial advantage (disadvantage) per quarter of discontinuing the Racing Bikes? 2. Should the production…arrow_forward

- Bed & Bath, a retailing company, has two departments-Hardware and Linens. The company's most recent monthly contribution format income statement follows: Sales Variable expenses Contribution margin Net operating income (loss) Fixed expenses Total $ 4,150,000 1,406,000 2,744,000 2,320,000 $ 424,000 Hardware $ 3,150,000 Department Linens $ 1,000,000 409,000 591,000 890,000 $ (299,000) 997,000 2,153,000 1,430,000 $ 723,000 A study indicates that $373,000 of the fixed expenses being charged to Linens are sunk costs or allocated costs that will continue even if the Linens Department is dropped. In addition, the elimination of the Linens Department will result in a 13% decrease in the sales of the Hardware Department. Required: What is the financial advantage (disadvantage) of discontinuing the Linens Department?arrow_forwardHaresharrow_forwardShaw Company produces and sells two packaged products—Z-Bikes and y Bikes. Revenue and cost information relating to the products follow: Product Z Bikes Y Bikes Selling price per unit $ 175.00 $ 200.00 Variable expenses per unit $ 85.00 $ 105.00 Traceable fixed expenses per year $ 200,000 $ 75.00 Common fixed expenses in the company total $110 annually. Last year the company produced and sold 50,000 units of Z Bikes and 30,000 units of Y Bikes. Required: Prepare a contribution format income statement segmented by product lines.arrow_forward

- The Regal Cycle Company manufactures three types of bicycles-a dirt bike, a mountain bike, and a racing bike. Data on sales and expenses for the past quarter follow: Sales Variable manufacturing and selling expenses Contribution margin Fixed expenses: Total $ 917,000 460,000 457,000 Dirt Bikes $ 264,000 111,000 153,000 Advertising, traceable Depreciation of special equipment Salaries of product-line managers Allocated common fixed expenses* Total fixed expenses Net operating income (loss) *Allocated on the basis of sales dollars. Management is concerned about the continued losses shown by the racing bikes and wants a recommendation as to whether or not the line should be discontinued. The special equipment used to produce racing bikes has no resale value and does not wear out. 70,000 44,400 115,700 183,400 413,500 $ 43,500 Required 1 38,700 80,400 167,800 $ 43,200 Racing Bikes $ 251,000 158,000 93,000 20,600 15,600 36,400 50, 200 122,800 $ (29,800)arrow_forwardSheridan Company recorded operating data for its shoe division for the year as follows: Sales $15840000 Contribution margin 990000 Controllable fixed costs 150000 Average total operating assets 1980000 What is the controllable margin for the year?arrow_forwardA cement manufacturer has supplied the following data: Tons of cement produced and sold Sales revenue 240,000 Variable manufacturing expense Fixed manufacturing expense Variable selling and administrative expense Fixed selling and administrative expense Net operating income $ 944,000 $ 225,000 $ 292,000 $ 105,400 $ 86,000 $ 235,600 The company's contribution margin ratio is closest to:arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education