What are Manufacturing Costs?

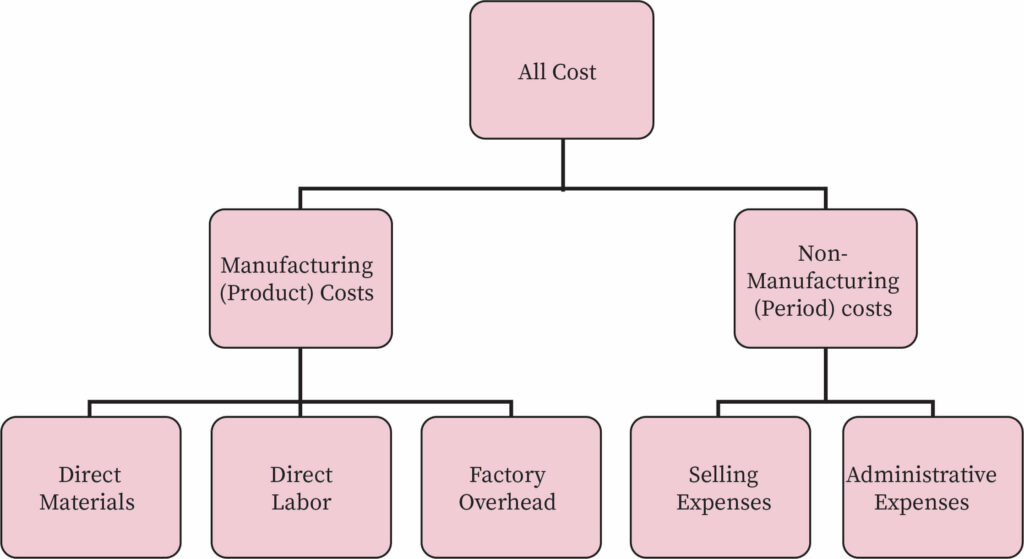

Manufacturing cost is the total cost of procuring or producing a product. In other words, the manufacturing cost is the cost that an individual or business owner undertakes for the manufacturing of goods.

Manufacturing costs are comprised of several different components. These include the cost of direct labor, the cost of direct materials and, most importantly, the cost of manufacturing overhead. In this article, we will cover these types of manufacturing costs, as well as other indirect costs of manufacturing.

Cost of Direct Labor

The cost of direct labor is the expense incurred by the company for the labor needed to carry out the manufacturing process. The direct labor cost is basically the wages or salaries being paid to those individuals who are a part of the production process. This is one of the most important components of overall manufacturing costs.

Cost of Direct Material

The cost of direct material is the expense undertaken by the manufacturer to procure the raw materials needed to produce the end product. In other words, direct materials are the raw materials which are required for the manufacturing process of various kinds of goods or products. Manufacturing is the intermediary process that transforms the raw materials into finished goods for consumption. The cost of direct material is the cost incurred for the purchase of raw materials that are needed in a manufacturing process.

Manufacturing Overhead

The third type of manufacturing cost is manufacturing overhead costs. These are expenses which are neither direct labor nor direct material but which are important for supporting the entire manufacturing process. The cost or expense of manufacturing overhead is extremely important because it acts as a support system for the entire manufacturing process that the owner undertakes for the production of goods or products. There are various components that comprise the total expense of manufacturing overhead. They are:

Indirect cost of labor

Indirect labor costs include the wages or salaries of company employees who do not directly take part in the manufacturing process but form a support system so that the manufacturing process goes on in a smooth manner. For example, the wages provided to the head of the manufacturing team, the supervisor of the manufacturing process, or administrative staff who keep production running smoothly may be considered indirect labor costs. This can also include the costs incurred when hiring and training team members who oversee the manufacturing process but do not directly participate in it. These employees are indirectly related with the production process. Thus, such expense comes under the indirect cost of labor.

Cost of indirect materials

Indirect materials include all those materials which are not exactly raw materials but are still an integral part of the manufacturing process of goods or products. For example, the lubricant used in the machine that produces a certain kind of product would be an indirect material cost. Such expenses are included under the cost of indirect materials.

Indirect Cost of Manufacturing

The indirect cost of manufacturing includes all kind of expenses which are necessary for the manufacturing process or the production process to be carried on in a smooth way. Such expenses include:

- Depreciation of machinery

- Rent

- Fixed costs of production

- And so on

Manufacturing overhead costs, the literal overhead costs that are undertaken by the owner of the business in order to support the operating of the manufacturing process, are also considered indirect costs. These costs are not directly related with the manufacturing process but are crucial for the production process to function. Therefore, the cost of indirect material, the cost of indirect labor and other indirect manufacturing overhead costs are also included under this category.

Calculating Total Manufacturing Costs

Manufacturing costs are the total of the production costs, which include:

- Salaries of the participants of the production process

- Non-manufacturing costs

- Period costs

- Conversion cost, which is included in the cost of direct material that basically converts the raw material into finished goods

The calculation of total manufacturing cost is important for a business to run and also important for the maintenance of the manufacturing process.

The calculation of total manufacturing costs is extremely important in the accounting aspect of the company because based on these production costs, the future costing of the business is predicted. This includes the direct costs and the indirect costs as well.

The formula for the calculation of manufacturing costs is:

Context and Applications

This topic is significant in the professional exams for both undergraduate and graduate courses, especially for

B. Com

M.Com

Want more help with your accounting homework?

*Response times may vary by subject and question complexity. Median response time is 34 minutes for paid subscribers and may be longer for promotional offers.

Search. Solve. Succeed!

Study smarter access to millions of step-by step textbook solutions, our Q&A library, and AI powered Math Solver. Plus, you get 30 questions to ask an expert each month.

Manufacturing Costs Homework Questions from Fellow Students

Browse our recently answered Manufacturing Costs homework questions.

Search. Solve. Succeed!

Study smarter access to millions of step-by step textbook solutions, our Q&A library, and AI powered Math Solver. Plus, you get 30 questions to ask an expert each month.