FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

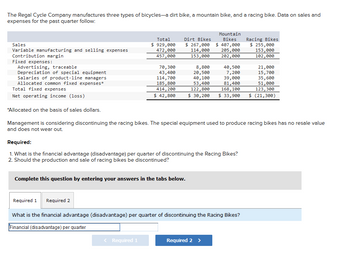

Transcribed Image Text:The Regal Cycle Company manufactures three types of bicycles-a dirt bike, a mountain bike, and a racing bike. Data on sales and

expenses for the past quarter follow:

Sales

Variable manufacturing and selling expenses

Contribution margin

Fixed expenses:

Advertising, traceable

Depreciation of special equipment

Salaries of product-line managers

Allocated common fixed expenses*

Total fixed expenses.

Net operating income (loss)

Total

$ 929,000

472,000

457,000

70,300

43,400

114,700

185,800

414, 200

$ 42,800

Required 1 Required 2

Dirt Bikes

$ 267,000

Mountain

Bikes

$ 407,000

114,000 205,000

153,000 202,000

Complete this question by entering your answers in the tabs below.

< Required 1

Required:

1. What is the financial advantage (disadvantage) per quarter of discontinuing the Racing Bikes?

2. Should the production and sale of racing bikes be discontinued?

8,800

20,500

40,100

53,400

122,800

$ 30,200 $ 33,900

40,500

7,200

39,000

81,400

168, 100

*Allocated on the basis of sales dollars.

Management is considering discontinuing the racing bikes. The special equipment used to produce racing bikes has no resale value

and does not wear out.

What is the financial advantage (disadvantage) per quarter of discontinuing the Racing Bikes?

Financial (disadvantage) per quarter

Required 2 >

Racing Bikes

$ 255,000

153,000

102,000

21,000

15,700

35,600

51,000

123,300

$ (21,300)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The Regal Cycle Company manufactures three types of bicycles-a dirt bike, a mountain bike, and a racing bike. Data on sales and expenses for the past quarter follow: Sales Variable manufacturing and selling expenses Contribution margin Fixed expenses: Advertising, traceable Depreciation of special equipment Salaries of product-line managers Allocated common fixed expenses* Total fixed expenses Net operating income (loss) *Allocated on the basis of sales dollars. Total Dirt Bikes $ 920,000 469,000 451,000 $ 266,000 111,000 155,000 Mountain Bikes $ 402,000 200,000 Racing Bikes $ 252,000 158,000 202,000 94,000 69,200 8,400 40,400 20,400 44,000 21,000 7,700 15,300 114,700 40,300 38,600 35,800 184,000 53,200 80,400 50,400 411,900 122,900 167,100 121,900 $ 39,100 $ 32,100 $ 34,900 $ (27,900) Management is considering discontinuing the racing bikes. The special equipment used to produce racing bikes has no resale value and does not wear out. Required: 1. What is the financial advantage…arrow_forwardBed & Bath, a retailing company, has two departments-Hardware and Linens. The company's most recent monthly contribution format income statement follows: Sales Variable expenses Contribution margin Fixed expenses Net operating income (loss) Total $4,250,000 1,215,000 3,035,000 2,330,000 $ 705,000 Department Hardware $ 3,100,000 803,000 2,297,000 1,480,000 $ 817,000 Required: What is the financial advantage (disadvantage) of discontinuing the Linens Department? Linens $1,150,000 412,000 738,000 850,000 $ (112,000) A study indicates that $372.000 of the fixed expenses being charged to Linens are sunk costs or allocated costs that will continue even if the Linens Department is dropped. In addition, the elimination of the Linens Department will result in a 18% decrease in the sales of the Hardware Department.arrow_forwardJake's Roof Repair has provided the following data concerning its costs: Fixed Cost Cost per per Month Repair-Hour Wages and salaries Parts and supplies $ 21,400 $ 15.00 $ 7.20 Equipment depreciation $ 2,740 $ 0.55 Truck operating expenses Rent $ 5,720 $ 1.70 $ 4,660 $ 3,880 $ 0.70 Administrative expenses For example, wages and salaries should be $21,400 plus $15.00 per repair-hour. The company expected to work 2,700 repair-hours in May, but actually worked 2,600 repair-hours. The company expects its sales to be $47.00 per repair-hour. Required: Compute the company's activity variances for May. Note: Indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (i.e., zero variance). Input all amounts as positive values. Revenue Expenses: Jake's Roof Repair Activity Variances For the Month Ended May 31 Wages and salaries Parts and supplies Equipment depreciation Truck operating expenses Rent Administrative expenses Total expense Net…arrow_forward

- The Regal Cycle Company manufactures three types of bicycles-a dirt bike, a mountain bike, and a racing bike. Data on sales and expenses for the past quarter follow: Sales Variable manufacturing and selling expenses Contribution margin Fixed expenses: Advertising, traceable Depreciation of special equipment Salaries of product-line managers Allocated common fixed expenses* Total fixed expenses Net operating income (loss) *Allocated on the basis of sales dollars. Total $ 917,000 470,000 447,000 70,400 43,500 114,500 183,400 411,800 $ 35,200 Dirt Bikes $ 265,000 116,000 149,000 8,700 20,300 40,100 53,000 122,100 $ 26,900 Mountain Bikes $ 400,000 202,000 198,000 40,800 7,800 38,200 80,000 166,800 $ 31,200 Racing Bikes $ 252,000 152,000 100,000 Required: 1. What is the financial advantage (disadvantage) per quarter of discontinuing the Racing Bikes? 2. Should the production and sale of racing bikes be discontinued? 20,900 15,400 36,200 50,400 122,900 $ (22,900) Management is concerned…arrow_forwardThalassines Kataskeves, S.A., of Greece makes marine equipment. The company has been experiencing losses on its bilge pump product line for several years. The most recent quarterly contribution format income statement for the bilge pump product line follows: Thalassines Kataskeves, S.A.Income Statement—Bilge PumpFor the Quarter Ended March 31 Sales $ 470,000 Variable expenses: Variable manufacturing expenses $ 124,000 Sales commissions 41,000 Shipping 19,000 Total variable expenses 184,000 Contribution margin 286,000 Fixed expenses: Advertising (for the bilge pump product line) 23,000 Depreciation of equipment (no resale value) 118,000 General factory overhead 40,000* Salary of product-line manager 125,000 Insurance on inventories 10,000 Purchasing department 44,000† Total fixed expenses 360,000 Net operating loss $ (74,000) *Common costs allocated on the basis of machine-hours. †Common costs allocated on the…arrow_forwardA company, has two departments—Hardware and Linens. The company’s most recent monthly contribution format income statement follows: Total Department Hardware Linens Sales $ 4,070,000 $ 3,000,000 $ 1,070,000 Variable expenses 1,350,000 950,000 400,000 Contribution margin 2,720,000 2,050,000 670,000 Fixed expenses 2,320,000 1,470,000 850,000 Net operating income (loss) $ 400,000 $ 580,000 $ (180,000) A study indicates $379,000 of the fixed expenses being charged to Linens are sunk costs or allocated costs that will continue even if the Linens Department is dropped. In addition, the elimination of the Linens Department will result in a 20% decrease in the sales of the Hardware Department. Required: What is the financial advantage (disadvantage) of discontinuing the Linens Department?arrow_forward

- The Regal Cycle Company manufactures three types of bicycles-a dirt bike, a mountain bike, and a racing bike. Data on sales and expenses for the past quarter follow: Sales Variable manufacturing and selling expenses Contribution margin Fixed expenses: Advertising, traceable Depreciation of special equipment Salaries of product-line managers Allocated common fixed expenses* Total fixed expenses Net operating income (loss) *Allocated on the basis of sales dollars. Total $ 935,000 467,000 468,000 69,800 43,800 114,300 187,000 414,900 $ 53,100 Dirt Bikes $ 269,000 115,000 154,000 8,800 20, 300 40, 600 Mountain Bikes $ 408,000 200,000 208,000 40,800 8,000 38,200 53,800 81,600 123,500 168,600 $ 30,500 $ 39,400 Racing Bikes $ 258,000 152,000 106,000 Required: 1. What is the financial advantage (disadvantage) per quarter of discontinuing the Racing Bikes? 2. Should the production and sale of racing bikes be discontinued? 20, 200 15,500 35,500 51,600 122,800 $ (16,800) Management is considering…arrow_forwardTike Industries is an apparel company that makes and sells both casual wear and sportswear. Here are data for the current year: Sales revenue Variable costs Contribution margin Traceable fixed costs Segment margin Common fixed costs Operating income Total $ 1,000,000 745,000 $255.000 (80,000) $175,000 (90,000) $85,000 Casual wear $ 450,000 388,000 $62,000 (25,000) $37,000 (42,000) S(5,000) Sportswear 5 pts $ 550,000 357,000 $193,000 (55,000) $138,000 (48,000) $90,000 Tike's accountant allocated the common fixed costs between the product lines based on sales revenue. Tike plans to discontinue the production of casual wear and use the freed-up capacity to triple the production and sale of sportswear. Although this will eliminate the traceable fixed costs for casual wear, the traceable fixed costs for sportswear will double. If Tike discontinues the casual wear product line, what would be the amount of the increase in Tike's operating income? Round to the nearest whole dollar and do not…arrow_forwardThe Regal Cycle Company manufactures three types of bicycles-a dirt bike, a mountain bike, and a racing bike. Data on sales and expenses for the past quarter follow: Sales Variable manufacturing and selling expenses Contribution margin Fixed expenses: Advertising, traceable Depreciation of special equipment Salaries of product-line managers Allocated common fixed expenses* Total fixed expenses Net operating income (loss) *Allocated on the basis of sales dollars. Total $ 300,000 120,000 180,000 30,000 23,000 35,000 60,000 148,000 $ 32,000 Dirt Bikes $ 90,000 27,000 63,000 Complete this question by entering your answers in the tabs below. Required 1 10,000 6,000 12,000 18,000 46,000 $ 17,000 Mountain Bikes $ 150,000 60,000 90,000 14,000 9,000 13,000 30,000 66,000 $ 24,000 Required 2 Required 3 What is the financial advantage (disadvantage) per quarter of discontinuing the Racing Bikes? Racing Bikes $ 60,000 33,000 27,000 Management is concerned about the continued losses shown by the…arrow_forward

- Vinubhaiarrow_forwardBed & Bath, a retailing company, has two departments-Hardware and Linens. The company's most recent monthly contribution format income statement follows: Sales Variable expenses Contribution margin Fixed expenses Net operating income (loss) Total $ 4,310,000 1,313,000 2,997,000 2,200,000 $ 797,000 Department Hardware $ 3,130,000 901,000 2,229,000 1,360,000 $ 869,000 Linens $ 1,180,000 412,000 768,000 840,000 $ (72,000) A study indicates that $377,000 of the fixed expenses being charged to Linens are sunk costs or allocated costs that will continue even if the Linens Department is dropped. In addition, the elimination of the Linens Department will result in a 11% decrease in the sales of the Hardware Department. Required: What is the financial advantage (disadvantage) of discontinuing the Linens Department? Financial (disadvantage)arrow_forwardA company manufactures three types of bicycles—a dirt bike, a mountain bike, and a racing bike. Data on sales and expenses for the past quarter follow: Total Dirt Bikes Mountain Bikes Racing Bikes Sales $ 917,000 $ 262,000 $ 404,000 $ 251,000 Variable manufacturing and selling expenses 462,000 116,000 194,000 152,000 Contribution margin 455,000 146,000 210,000 99,000 Fixed expenses: Advertising, traceable 69,700 8,500 41,000 20,200 Depreciation of special equipment 44,300 20,900 7,800 15,600 Salaries of product-line managers 116,000 40,100 39,000 36,900 Allocated common fixed expenses* 183,400 52,400 80,800 50,200 Total fixed expenses 413,400 121,900 168,600 122,900 Net operating income (loss) $ 41,600 $ 24,100 $ 41,400 $ (23,900) *Allocated on the basis of sales dollars. Management is considering discontinuing the racing bikes. The special equipment used to produce racing bikes has no resale value and does not wear out. Required: What is the…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education