Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN: 9781305970663

Author: Don R. Hansen, Maryanne M. Mowen

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

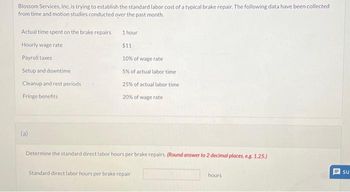

Transcribed Image Text:Blossom Services, Inc. is trying to establish the standard labor cost of a typical brake repair. The following data have been collected

from time and motion studies conducted over the past month.

Actual time spent on the brake repairs

Hourly wage rate

Payroll taxes

Setup and downtime

Cleanup and rest periods

Fringe benefits

(a)

1 hour

$11

10% of wage rate

5% of actual labor time

25% of actual labor time

20% of wage rate

Determine the standard direct labor hours per brake repairs. (Round answer to 2 decimal places, e.g. 1.25.)

Standard direct labor hours per brake repair

hours

1

SU

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Subject: acountingarrow_forwardThe controller of further industries..accounting questionarrow_forwardJake's Roof Repair has provided the following data concerning its costs: Cost per Repair-Hour Fixed Cost per Month $ Wages and salaries Parts and supplies Equipment depreciation $ Truck operating expenses $ Rent $ Administrative expenses $ 21,100 2,750 5,780 4,660 3,840 $ 16.00 $ 7.20 $ 0.55 $ 1.70 $ 0.40 For example, wages and salaries should be $21,100 plus $16.00 per repair-hour. The company expected to work 2,600 repair-hours in May, but actually worked 2,500 repair-hours. The company expects its sales to be $48.00 per repair-hour. Required: Compute the company's activity variances for May. (Indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (i.e., zero variance). Input all amounts as positive values.) Need to make sure my notes coincide with this example problem from video. please include how you calculated each part. Thank youarrow_forward

- need help solvingarrow_forwardJake's Roof Repair has provided the following data concerning its costs: Fixed Cost per Month Cost per Repair-Hour $ Wages and salaries Parts and supplies Equipment depreciation $ Truck operating expenses $ $ Administrative expenses $ Rent 21,200 2,770 5,760 4,680 3,840 $ 15.00 $ 7.80 $ 0.55 $ 1.50 $ 0.70 For example, wages and salaries should be $21,200 plus $15.00 per repair-hour. The company expected to work 2,500 repair-hours in May, but actually worked 2,400 repair-hours. The company expects its sales to be $50.00 per repair-hour. Required: Compute the company's activity variances for May. (Indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (i.e., zero variance). Input all amounts as positive values.)arrow_forwardEngines Done Right Co. is trying to establish the standard labor cost of a typical engine tune-up. The following data have been collected from time and motion studies conducted over the past month. Actual time spent on the tune-up 1.0 hour Hourly wage rate $16 Payroll taxes 10% of wage rate Setup and downtime 10% of actual labor time Cleanup and rest periods 20% of actual labor time Fringe benefits 25% of wage rate Determine the standard direct labor hours per tune-up, the standard direct labor hourly rate, the standard direct labor cost per tune-up (standard direct labor cost per oil change).arrow_forward

- The controller of Hall Industries has collected the following monthly expense data for use in analyzing the cost behavior of maintenance costs. Month TotalMaintenance Costs TotalMachine Hours January $2,817 3,734 February 3,201 4,268 March 3,841 6,402 April 4,801 8,429 May 3,414 5,335 June 4,930 8,536 Determine the variable-cost components using the high-low method. (Round variable cost to 2 decimal places e.g. 12.25.) Variable cost per machine hour $ eTextbook and Media Determine the fixed cost components using the high-low method. (Round answer to 0 decimal places e.g. 2,520.) Fixed costs $arrow_forwardPlease give me answer the questionarrow_forwardThe expected costs for the Maintenance Department of Stazler, Inc., for the coming year include: Fixed costs (salaries, tools): 64,900 per year Variable costs (supplies): 1.35 per maintenance hour Estimated usage by: Actual usage by: Required: 1. Calculate a single charging rate for the Maintenance Department. 2. Use this rate to assign the costs of the Maintenance Department to the user departments based on actual usage. Calculate the total amount charged for maintenance for the year. 3. What if the Assembly Department used 4,000 maintenance hours in the year? How much would have been charged out to the three departments?arrow_forward

- Please use the information from this problem for these calculations. After grouping cost pools and estimating overhead and activities, Box Springs determined these rates: It estimates there will be five orders in the next year, and those jobs will involve: What is the total cost of the jobs?arrow_forwardPlease use the information from this problem for these calculations. After grouping cost pools and estimating overhead and activities, Box Springs determined these rates: Box Springs estimates there will be four orders in the next year, and those jobs will involve: What is the total cost of the jobs?arrow_forwardHicks Contracting collects and analyzes cost data in order to track the cost of installing decks on new home construction jobs. The following are some of the costs that they incur. Classify these costs as fixed or variable costs and as product or period costs. Lumber used to construct decks ($12.00 per square foot) Carpenter labor used to construct decks ($10 per hour) Construction supervisor salary ($45,000 per year) Depreciation on tools and equipment ($6,000 per year) Selling and administrative expenses ($35,000 per year) Rent on corporate office space ($34,000 per year) Nails, glue, and other materials required to construct deck (varies per job)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College