FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

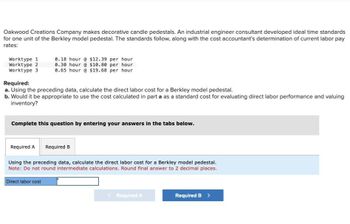

Transcribed Image Text:Oakwood Creations Company makes decorative candle pedestals. An industrial engineer consultant developed ideal time standards

for one unit of the Berkley model pedestal. The standards follow, along with the cost accountant's determination of current labor pay

rates:

Worktype 1

Worktype 2

Worktype 3

Required:

0.18 hour @ $12.39 per hour

0.30 hour @ $10.80 per hour

0.65 hour @ $19.68 per hour

a. Using the preceding data, calculate the direct labor cost for a Berkley model pedestal.

b. Would it be appropriate to use the cost calculated in part a as a standard cost for evaluating direct labor performance and valuing

inventory?

Complete this question by entering your answers in the tabs below.

Required A

Required B

Using the preceding data, calculate the direct labor cost for a Berkley model pedestal.

Note: Do not round intermediate calculations. Round final answer to 2 decimal places.

Direct labor cost

<Required A

Required B >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Use the information below on Direct Labor costs to answer question#33. GIVEN: Management at the Best Ceramic Vase Company wishes to analyze its Direct Labor costs. During September, company management noted that it used 3,400 hours of Direct Labor at a cost of $76,500 to produce 2,300 vases. The company set the following Direct Labor standard. 1.5 hours of Direct Labor per unit at an hourly wage rate of $22.00 33) Determine the actual wage rate (using the Given information above). A) $15.00 B) $22.00 C) $22.18 D) $22.50arrow_forwardPlease help me with show all calculation thankuarrow_forwardThe managing director of a consulting group has the accompanying monthly data on total overhead costs and professional labor hours to bill to clients. Complete parts a through c. Click the icon to view the monthly data. a. Develop a simple linear regression model between billable hours and overhead costs. Overhead Costs = +xBillable Hours X Monthly Overhead Costs and Billable Hours Data (Round the constant to one decimal place as needed. Round the coefficient to four decimal places as needed. Do not include the $ symbol in your answers.) Overhead Costs Billable Hours 0 $315,000 3,000 $365,000 4,000 $395,000 5,000 $447,000 6,000 $530,000 7,000 $550,000 8,000arrow_forward

- Rex Industries has identified three different activities as cost drivers: machine setups, machine hours, and inspections. The overhead and estimated usage are: Compute the overhead rate for each activity. Round your answers to two decimal places. Overhead Overhead Annual Rate per Activity per Activity Usage Activity Machine Setups $157,850 4,100 $ Machine Hours 324,622 14,114 2$ Inspections 119,000 3,400arrow_forwardBrannon Company manufactures ceiling fans and uses an activity-based costing system. Each ceiling fan consists of 20 separate parts totaling $95 in direct materials, and requires 2.5 hours of machine time to produce. Additional information follows: Cost Pool Allocation Base Overhead Rate Materials handling Number of parts $.08 Machining Machine hours $7.20 Assembling Number of parts $.35 Packaging Number of finished units $2.70 What is the cost of machining per ceiling fan? Brannon Company manufactures ceiling fans and uses an activity-based costing system. Each ceiling fan consists of 20 separate parts totaling $95 in direct materials, and requires 2.5 hours of machine time to produce. Additional information follows: Cost Pool Allocation Base Overhead Rate Materials handling Number of parts $.08 Machining Machine hours $7.20 Assembling Number of parts $.35 Packaging Number of finished units $2.70 What is the cost of machining per ceiling fan? $144.00 $18.00 $180.00 $30.00arrow_forwardErie Company manufactures a mobile fitness device called the Jogging Mate. The company uses standards to control its costs. The labor standards that have been set for one Jogging Mate are as follows: Standard Hours 27 minutes Standard Rate per Hour $6.00 During August, 9,540 hours of direct labor time were needed to make 19,600 units of the Jogging Mate. The direct labor cost totaled $56,286 for the month. Required: 1. What is the standard labor-hours allowed (SH) to makes 19,600 Jogging Mates? 2. What is the standard labor cost allowed (SH x SR) to make 19,600 Jogging Mates? 3. What is the labor spending variance? Standard Cost $2.70 4. What is the labor rate variance and the labor efficiency variance? 5. The budgeted variable manufacturing overhead rate is $4.50 per direct labor-hour. During August, the company incurred $47,700 in variable manufacturing overhead cost. Compute the variable overhead rate and efficiency variances for the month. (For requirements 3 through 5, indicate…arrow_forward

- Labour data for making one unit of finished product in Waterway Company are as follows: (1) Price-hourly wage rate $10.00, payroll taxes $0.80, and fringe benefits $1.60. (2) Quantity-actual production time 1.40 hours, rest periods and cleanup 0.50 hours, and set-up and downtime 0.40 hours. Calculate the following: (Round calculations and final answers to 2 decimal places, e.g. 15.25.) a. Standard direct labour rate per hour $enter a dollar amount rounded to 2 decimal places b. Standard direct labour hours per unit enter a number of hours rounded to 2 decimal places hours c. Standard labour cost per unit Senter a dollar amount rounded to 2 decimal placesarrow_forwardBatCo makes baseball bats. Each bat requires 1.00 pounds of wood at $18 per pound and 0.35 direct labor hour at $30 per hour. Overhead is assigned at the rate of $60 per direct labor hour.arrow_forwardPlease help me with D, E, and F. Thank you!arrow_forward

- Sunland Co. gathered the following information on power costs and factory machine usage for the last six months: Power Cost Factory Machine Hours $28,390 15,800 36,069 21,400 32,895 18,700 ITT 26,235 15,100 23,890 13,500 20,700 Month January February March April May June Using the high-low method of analyzing costs, answer the following questions and show computations to support your answers. (a) Your answer is correct. What is the estimated variable portion of power costs per factory machine hour? (Round answer to 2 decimal places, e.g. 15.25.) Variable power costs $ (b) eTextbook and Media * Your answer is incorrect. 10.500 Fixed power costs What is the estimated fixed power cost each month? High 1.41 per factory machine hour 20,683 $ Low Attempts: 1 of 5 usedarrow_forwardPharoah Co. has identified an activity cost pool to which it has allocated estimated overhead of $10212000. It has determined the expected use of cost drivers for that activity to be 851000 inspections. Widgets require 217000 inspections, Gadgets 167000 inspections, and Targets 467000 inspections. How much is the overhead assigned to each product? O Widgets $3404000, Gadgets $3404000, Targets $3404000 O Widgets $217000, Gadgets $167000, Targets $467000 O Widgets $3404000, Gadgets $1702000, Targets $5106000 O Widgets $2604000, Gadgets $2004000, Targets $5604000arrow_forwardDirections: Answer the following questions by the due date. Use numerical calculations (if needed) to support your argument. Submit your answers through uploading a Microsoft Word file, Excel file or PDF. Tread-Force Fitness, Inc. assembles and sells elliptical machines. All activity costs are related to labor. Management must remove $2.00 of activity cost from the product in order for it to remain competitive. Activity-based product information for each elliptical machine is as follows: (Hrs per unit) Activity Activity Based Usage x Activity rate / hr = Activity Cost Moving 0.20 $15 $3.00 Motor Assembly 1.50 $20 $30.00 Final Assembly…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education