Principles of Accounting Volume 2

19th Edition

ISBN: 9781947172609

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Question

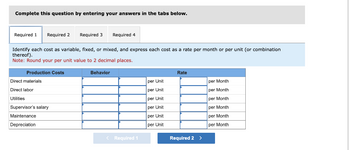

Transcribed Image Text:Complete this question by entering your answers in the tabs below.

Required 1 Required 2

Production Costs

Identify each cost as variable, fixed, or mixed, and express each cost as a rate per month or per unit (or combination

thereof).

Note: Round your per unit value to 2 decimal places.

Behavior

Direct materials

Direct labor

Utilities

Required 3

Supervisor's salary

Maintenance

Depreciation

Required 4

< Required 1

per Unit

per Unit

per Unit

per Unit

per Unit

per Unit

Rate

Required 2 >

per Month

per Month

per Month

per Month

per Month

per Month

![Required information

[The following information applies to the questions displayed below.]

Morning Dove Company manufactures one model of birdbath, which is very popular. Morning Dove sells all units it

produces each month. The relevant range is 0 to 1,500 units, and monthly production costs for the production of 500 units

follow. Morning Dove's utilities and maintenance costs are mixed with the fixed components shown in parentheses.

Production Costs

Direct materials

Direct labor

Utilities ($100 fixed)

Supervisor's salary

Maintenance ($280 fixed)

Depreciation

Total Cost

$ 1,500

7,500

650

3,000

480

800

Required:

1. Identify each cost as variable, fixed, or mixed, and express each cost as a rate per month or per unit (or combination thereof).

2. Determine the total fixed cost per month and the variable cost per unit for Morning Dove.

3. State Morning Dove's linear cost equation for a production level of 0 to 1,500 units. Enter answer as an equation in the form of y= a

+ bx.

4. Calculate Morning Dove's expected total cost if production increased to 1,200 units per month. Enter answer as an equation in the

form of y= a + bx.](https://content.bartleby.com/qna-images/question/3c90f5cc-8ea9-4bf1-b535-7c9325023ef2/a198dbe9-4873-4e3d-9973-4886a5d43be0/mmep2ic_thumbnail.png)

Transcribed Image Text:Required information

[The following information applies to the questions displayed below.]

Morning Dove Company manufactures one model of birdbath, which is very popular. Morning Dove sells all units it

produces each month. The relevant range is 0 to 1,500 units, and monthly production costs for the production of 500 units

follow. Morning Dove's utilities and maintenance costs are mixed with the fixed components shown in parentheses.

Production Costs

Direct materials

Direct labor

Utilities ($100 fixed)

Supervisor's salary

Maintenance ($280 fixed)

Depreciation

Total Cost

$ 1,500

7,500

650

3,000

480

800

Required:

1. Identify each cost as variable, fixed, or mixed, and express each cost as a rate per month or per unit (or combination thereof).

2. Determine the total fixed cost per month and the variable cost per unit for Morning Dove.

3. State Morning Dove's linear cost equation for a production level of 0 to 1,500 units. Enter answer as an equation in the form of y= a

+ bx.

4. Calculate Morning Dove's expected total cost if production increased to 1,200 units per month. Enter answer as an equation in the

form of y= a + bx.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 6 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Bobcat uses a traditional cost system and estimates next years overhead will be $800.000, as driven by the estimated 25,000 direct labor hours. It manufactures three products and estimates the following costs: If the labor rate is $30 per hour, what is the per-unit cost of each product?arrow_forwardBox Springs, Inc., makes two sizes of box springs: twin and double. The direct material for the twin is $25 per unit and $40 s used in direct labor, while the direct material for the double is $40 per unit, and the labor cost is $50 per unit. Box Springs estimates it will make 5,000 twins and 9,000 doubles in the next year. It estimates the overhead for each cost pool and cost driver activities as follows: How much does each unit cost to manufacture?arrow_forwardBox Springs. Inc., makes two sizes of box springs: queen and king. The direct material for the queen is $35 per unit and $55 is used in direct labor, while the direct material for the king is $55 per unit, and the labor cost is $70 per unit. Box Springs estimates it will make 4,300 queens and 3,000 kings in the next year. It estimates the overhead for each cost pool and cost driver activities as follows: How much does each unit cost to manufacture?arrow_forward

- Roper Furniture manufactures office furniture and tracks cost data across their process. The following are some of the costs that they incur. Classify these costs as fixed or variable costs, and as product costs or period costs. Wood used to produce desks ($125,00 per desk) Production labor used to produce desks ($15 per hour) Production supervisor salary ($45,000 per year) Depreciation on factory equipment ($60,000 per year) Selling and administrative expenses ($45,000 per year) Rent on corporate office ($44,000 per year) Nails, glue, and other materials required to produce desks (varies per desk) Utilities expenses for production facility Sales staff commission (5% of gross sales)arrow_forwardPlease help me. Thankyou.arrow_forwardHararrow_forward

- Morning Dove Company manufactures one model of birdbath, which is very popular. Morning Dove sells all units it produces each month. The relevant range is 0 to 1,800 units, and monthly production costs for the production of 1,400 units follow. Morning Dove's utilities and maintenance costs are mixed with the fixed components shown in parentheses. Production Costs Direct materials Direct labor Utilities ($110 fixed) Supervisor's salary Maintenance ($350 fixed) Depreciation Required: 1. Identify each cost as variable, fixed, or mixed, and express each cost as a rate per month or per unit (or combination thereof). 2. Determine the total fixed cost per month and the variable cost per unit for Morning Dove. 3. State Morning Dove's linear cost equation for a production level of 0 to1,800 units. Enter answer as an equation in the form of y= a + bx. 4. Calculate Morning Dove's expected total cost if production increased to 1,600 units per month. Enter answer as an equation in the form of y= a…arrow_forwardI keep getting this question wrong and trying to see how to work itarrow_forwardMorning Dove Company manufactures one model of birdbath, which is very popular. Morning Dove sells all units it produces each month. The relevant range is 0-1,900 units, and monthly production costs for the production of 1,600 units follow. Morning Dove's utilities and maintenance costs are mixed with the fixed components shown in parentheses. Suppose it sells each birdbath for $24. Calculate the unit contribution margin and contribution margin ratio for each birdbath sold. Complete the contribution margin income statement assuming that Morning Dove produces and sells 1,800 units.arrow_forward

- Rundle Electronics currently produces the shipping containers it uses to deliver the electronics products it sells. The monthly cost of producing 9,300 containers follows. Unit-level materials. Unit-level labor Unit-level overhead Product-level costs* Allocated facility-level costs One-third of these costs can be avoided by purchasing the containers. Russo Container Company has offered to sell comparable containers to Rundle for $2.60 each. Required a. Calculate the total relevant cost. Should Rundle continue to make the containers? b. Rundle could lease the space it currently uses in the manufacturing process. If leasing would produce $11,600 per month, calculate the total avoidable costs. Should Rundle continue to make the containers? Answer is complete but not entirely correct. $ a. Total relevant cost a. Should Rundle continue to make the containers? b. Total avoidable cost b. Should Rundle continue to make the containers? 190.650,000 Yes $24,180,000 $ 5,200 6,100 4,000 7,800…arrow_forwardplease help me to solve this problemarrow_forwardThis Little Light, Inc. is a manufacturer of lamps. Little Light makes 40,000 units per year of a part that it uses in the manufacturing of each lamp. At this activity level, the unit production cost is $7.17. Of this amount, $4.71 is for unit variable production costs. The remainder is for fixed production costs and equals $98,400. Little Light has identified an outsider supplier who sells the needed part. If the part is purchased from the outsider supplier, 15% of Little Light's fixed manufacturing costs will be eliminated. Assume Little Light will need 50,000 of the part next year and that the freed up capacity can be rented out to another company for $31,740. At what purchase price will Little Light be economically indifferent between making the part and buying the part? $4.70 $4.86 $5.97 $5.50 $5.64arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College