FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

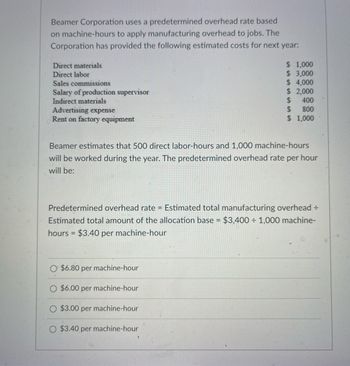

Transcribed Image Text:Beamer Corporation uses a predetermined overhead rate based

on machine-hours to apply manufacturing overhead to jobs. The

Corporation has provided the following estimated costs for next year:

Direct materials

Direct labor

Sales commissions

Salary of production supervisor

Indirect materials

Advertising expense

Rent on factory equipment

$ 1,000

$ 3,000

$ 4,000

$ 2,000

S

400

$

800

$ 1,000

Beamer estimates that 500 direct labor-hours and 1,000 machine-hours

will be worked during the year. The predetermined overhead rate per hour

will be:

Predetermined overhead rate = Estimated total manufacturing overhead =

Estimated total amount of the allocation base = $3,400 1,000 machine-

hours = $3.40 per machine-hour

$6.80 per machine-hour

$6.00 per machine-hour

$3.00 per machine-hour

O $3.40 per machine-hour

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- [The following information applies to the questions displayed below.] Delph Company uses job-order costing with a plantwide predetermined overhead rate based on machine-hours. At the beginning of the year, the company estimated that 54,000 machine-hours would be required for the period’s estimated level of production. It also estimated $1,000,000 of fixed manufacturing overhead cost for the coming period and variable manufacturing overhead of $4.00 per machine-hour. Because Delph has two manufacturing departments—Molding and Fabrication—it is considering replacing its plantwide overhead rate with departmental rates that would also be based on machine-hours. The company gathered the following information to enable calculating departmental overhead rates: Molding Fabrication Total Machine-hours 23,000 31,000 54,000 Fixed manufacturing overhead cost $ 760,000 $ 240,000 $ 1,000,000 Variable manufacturing overhead cost per machine-hour $ 4.00 $ 1.00 During the year, the…arrow_forwardRequired information [The following information applies to the questions displayed below.] Delph Company uses job-order costing with a plantwide predetermined overhead rate based on machine-hours. At the beginning of the year, the company estimated that 55,000 machine-hours would be required for the period's estimated level of production. It also estimated $980,000 of fixed manufacturing overhead cost for the coming period and variable manufacturing overhead of $3.00 per machine-hour. Because Delph has two manufacturing departments-Molding and Fabrication-it is considering replacing its plantwide overhead rate with departmental rates that would also be based on machine-hours. The company gathered the following information to enable calculating departmental overhead rates: Machine-hours Fixed manufacturing overhead cost Variable manufacturing overhead cost per machine-hour Job D-70 Direct materials cost Direct labor cost Machine-hours Job C-200 Direct materials cost Direct labor cost…arrow_forward[The following information applies to the questions displayed below.] Delph Company uses job-order costing with a plantwide predetermined overhead rate based on machine-hours. At the beginning of the year, the company estimated that 54,000 machine-hours would be required for the period’s estimated level of production. It also estimated $1,000,000 of fixed manufacturing overhead cost for the coming period and variable manufacturing overhead of $4.00 per machine-hour. Because Delph has two manufacturing departments—Molding and Fabrication—it is considering replacing its plantwide overhead rate with departmental rates that would also be based on machine-hours. The company gathered the following information to enable calculating departmental overhead rates: Molding Fabrication Total Machine-hours 23,000 31,000 54,000 Fixed manufacturing overhead cost $ 760,000 $ 240,000 $ 1,000,000 Variable manufacturing overhead cost per machine-hour $ 4.00 $ 1.00 During the year, the…arrow_forward

- Eli Lilly Corporation has their headquarters in Indiana. Lilly uses a predetermined overhead rate based on direct labor-hours to apply manufacturing overhead to jobs. Lilly has provided the following estimated costs for next year: Direct Materials Direct Labor Rent on Factory Building Sales Salaries Depreciation on Factory Equipment Indirect Labor Production Supervisor's Salary Lilly estimates that 20,000 direct labor-hours will be worked during the year. The predetermined overhead rate per hour will be: Multiple Choice O O $4.18 $2.88 $1.95 $7,000 $21,000 $16,000 $26,000 $9,500 $13,500 $18,500 $2.40arrow_forwardGrib Corporation uses a predetermined overhead rate based on direct labor cost to apply manufacturing overhead to jobs. The predetermined overhead rates for the year are 200% of direct labor cost for Department A and 50% of direct labor cost for Department B. Job 436, started and completed during the year, was charged with the following costs: Dept. A Dept. B Direct materials $ 50,000 $ 10,000 Direct labor ? $ 60,000 Manufacturing overhead $ 80,000 ? The total manufacturing cost assigned to Job 436 was:arrow_forwardRichey Company uses an actual cost accounting system that applies overhead on the basis of direct labor hours. At the beginning of the year, management estimated that during the year, the company would work 26,000 direct labor hours and budgeted $1,300,000 for MOH. The company actually worked 24,000 direct labor hours and incurred the following actual manufacturing costs: Direct materials used in production $1,240,000 Direct labor 1,800,000 Indirect labor 300,000 Indirect materials 220,000 Insurance 150,000 Utilities 190,000 Repairs and Maintenance 180,000 Depreciation 320,000 Determine the amount of underapplied or overapplied overhead for the year.arrow_forward

- Delph Company uses job-order costing with a plantwide predetermined overhead rate based on machine-hours. At the beginning of the year, the company estimated that 54,000 machine-hours would be required for the period’s estimated level of production. It also estimated $1,000,000 of fixed manufacturing overhead cost for the coming period and variable manufacturing overhead of $4.00 per machine-hour. Because Delph has two manufacturing departments—Molding and Fabrication—it is considering replacing its plantwide overhead rate with departmental rates that would also be based on machine-hours. The company gathered the following information to enable calculating departmental overhead rates: Molding Fabrication Total Machine-hours 23,000 31,000 54,000 Fixed manufacturing overhead cost $ 760,000 $ 240,000 $ 1,000,000 Variable manufacturing overhead cost per machine-hour $ 4.00 $ 1.00 During the year, the company had no beginning or ending inventories and it started,…arrow_forwardDelph Company uses job-order costing with a plantwide predetermined overhead rate based on machine-hours. At the beginning of the year, the company estimated that 54,000 machine-hours would be required for the period's estimated level of production. It also estimated $1,040,000 of fixed manufacturing overhead cost for the coming period and variable manufacturing overhead of $5.00 per machine-hour. Because Delph has two manufacturing departments-Molding and Fabrication-it is considering replacing its plantwide overhead rate with departmental rates that would also be based on machine-hours. The company gathered the following information to enable calculating departmental overhead rates: Machine-hours Fixed manufacturing overhead cost Variable manufacturing overhead cost per machine-hour Job D-70 Direct materials cost Direct labor cost Machine-hours Job C-200 Direct materials cost Direct labor cost Machine-hours During the year, the company had no beginning or ending inventories and it…arrow_forwardRequired information [The following information applies to the questions displayed below.] Delph Company uses job-order costing with a plantwide predetermined overhead rate based on machine-hours. At the beginning of the year, the company estimated that 53,000 machine-hours would be required for the period's estimated level of production. It also estimated $1,080,000 of fixed manufacturing overhead cost for the coming period and variable manufacturing overhead of $3.00 per machine-hour. Because Delph has two manufacturing departments-Molding and Fabrication-it is considering replacing its plantwide overhead rate with departmental rates that would also be based on machine-hours. The company gathered the following information to enable calculating departmental overhead rates: Machine-hours Fixed manufacturing overhead cost Variable manufacturing overhead cost per machine-hour Job D-70 Direct materials cost Direct labor cost Machine-hours During the year, the company had no beginning or…arrow_forward

- please help me solve the requirementsarrow_forwardhe Thomlin Company forecasts that total overhead for the current year will be $11,385,000 with 164,000 total machine hours. Year to date, the actual overhead is $7,616,000 and the actual machine hours are 93,000 hours. If the Thomlin Company uses a predetermined overhead rate based on machine hours for applying overhead, as of this point in time (year to date), the overhead is Round the factory overhead rate to the nearest dollar before multiplying by the number of hours.arrow_forwardCollins Corporation uses a predetermined overhead rate based on direct labor cost to apply manufacturing overhead to jobs. The following information applies to the Collins Corporation for the current year: Direct Labor Hours Estimated for the Year 24,000 Actual Hours Worked 19,500 Direct Labor Cost Estimated for the Year 300,000 Actual Cost Incurred 210,000 Manufacturing Overhead Estimated for the Year 240,000 Actual Cost Incurred 185,000 The manufacturing overhead cost for the current year will be:arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education