FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

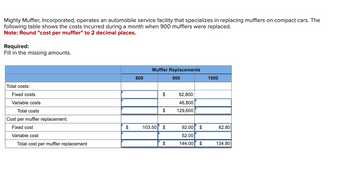

Transcribed Image Text:Mighty Muffler, Incorporated, operates an automobile service facility that specializes in replacing mufflers on compact cars. The

following table shows the costs incurred during a month when 900 mufflers were replaced.

Note: Round "cost per muffler" to 2 decimal places.

Required:

Fill in the missing amounts.

Total costs:

Fixed costs

Variable costs

Total costs

Cost per muffler replacement:

Fixed cost

Variable cost

Total cost per muffler replacement

$

800

Muffler Replacements

$

$

103.50 $

$

900

82,800

46,800

129,600

$

92.00

52.00

144.00 $

1000

82.80

134.80

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Please help me with show calculation thankuarrow_forwardEach year, Giada Company produces 20,000 units of a component part used in tablet computers. An outside supplier has offered to supply the part for $1.39. The unit cost is: Direct materials $0.83 Direct labor 0.34 Variable overhead 0.13 Fixed overhead 2.55 Total unit cost $3.85 1. What are the alternatives for Giada Company? a. Make the part in house b.Buy the part externally c.Make the part in house or buy the part externally d.None 2. Assume that none of the fixed cost is avoidable. List the relevant cost(s) of internal production. a.Direct materials, direct labor and variable and fixed overhead b.Direct materials, direct labor and variable overhead c.Direct materials, direct labor and fixed overhead d.None List the relevant cost(s) of external purchase. a.Purchase price b.Sales price c.Material price d.None 3. Which alternative is more cost effective and by how much? a. Making the part in house b. Buying the part from the external supplier by $___________ 4. What if…arrow_forwardMuffler Incorporated produces floor mats for cars and trucks. The owner, Kenneth Muffler, asked you to assist him in estimating his maintenance costs. Together, Mr. Muffler and you determined that the single best cost driver for maintenance costs was machine hours. Below are data from the previous fiscal year for maintenance expense and machine hours: Month 1 2 3 4 5 6 7 8 9 10 11 12 Multiple Choice O O о Maintenance Expense $ 3,440 O O Using the high-low method, total monthly fixed cost is calculated to be (Round final answer to full dollar amount with no decimal places): $212. $153. $520. $462. 3,630 3,810 3,940 3,940 4,320 3,930 $280. 3,740 3,460 3,080 2,940 3,200 Machine Hours 2,360 2,460 2,560 2,590 2,440 2,600 2,580 2,550 2,370 2,240 1,670 2,230arrow_forward

- Please help me with show all calculation thankuarrow_forwardLean Mfg: Vintage Audio Incarrow_forwardClassify Costs Following is a list of various costs incurred in producing replacement automobile parts. With respect to the production and sale of these auto parts, classify each cost as variable, fixed, or mixed. 1. Cost of labor for hourly workers Fixed 2. Factory cleaning costs, $6,000 per month Mixed 3. Hourly wages of machine operators Variable 4. Computer chip (purchased from a vendor) 5. Electricity costs, $0.20 per kilowatt-hour 6. Metal 7. Salary of plant manager 8. Property taxes, $165,000 per year on factory building and equipment 9. Plastic 10. Oil used in manufacturing equipment 11. Rent on warehouse, $10,000 per month plus $25 per square foot of storage used 12. Property insurance premiums, $3,600 per month plus $0.01 for each dollar of property over $1,200,000 13. Straight-line depreciation on the production equipment 14. Pension cost, $1.00 per employee hour on the job 15. Packagingarrow_forward

- Zion Manufacturing had always made its components in-house. However, Bryce Component Works had recently offered to supply one component, K2, at a price of $13 each. Zion uses 4,400 units of Component K2 each year. The cost per unit of this component is as follows: Direct materials Direct labor Variable overhead Fixed overhead Total $7.84 2.84 1.67 4.00 $16.35 The fixed overhead is an allocated expense; none of it would be eliminated if production of Component K2 stopped. Required: 1. What are the alternatives facing Zion Manufacturing with respect to production of Component K2? 2. List the relevant costs for each alternative. If required, round your answers to the nearest cent. Total Relevant Cost Make per unit Buy per unit Differential Cost to Make per unitarrow_forwardPlease help on all 3 requirementsarrow_forwardThe Regal Cycle Company manufactures three types of bicycles-a dirt bike, a mountain bike, and a racing bike. Data on sales and expenses for the past quarter follow: Total $ 932,000 471,000 461,000 Dirt Bikes $ 265,000 118,000 147,000 69,700 44,000 115,700 186,400 415,800 $ 45,200 Mountain Bikes Sales Variable manufacturing and selling expenses Contribution margin Fixed expenses: Advertising, traceable Depreciation of special equipment. Salaries of product-line managers. Allocated common fixed expenses* Total fixed expenses Net operating income (loss) *Allocated on the basis of sales dollars. Management is concerned about the continued losses shown by the racing bikes and wants a recommendation as to whether or not the line should be discontinued. The special equipment used to produce racing bikes has no resale value and does not wear out. $ 408,000 200,000 208,000 Racing Bikes $ 259,000 153,000 106,000 9,000 40,300 20,400 20,900 8,000 15,100 40,700 38,400 36,600 53,000 81,600 51,800…arrow_forward

- Laser Cast Inc. manufactures color laser printers. Model J20 presently sells for $325 and has a product cost of $260, as follows: Line Item Description Amount Direct materials $190 Direct labor 50 Factory overhead 20 Total $260 It is estimated that the competitive selling price for color laser printers of this type will drop to $310 next year. Laser Cast has established a target cost to maintain its historical markup percentage on product cost. Engineers have provided the following cost-reduction ideas: 1. Purchase a plastic printer cover with snap-on assembly, rather than with screws. This will reduce the amount of direct labor by 9 minutes per unit.2. Add an inspection step that will add six minutes per unit of direct labor but reduce the materials cost by $7 per unit.3. Decrease the cycle time of the injection molding machine from four minutes to three minutes per part. Thirty percent of the direct labor and 45% of the factory overhead are related to running injection…arrow_forwardVandenberg, Inc., produces and sells two products: a ceiling fan and a table fan. Vandenbergplans to sell 30,000 ceiling fans and 70,000 table fans in the coming year. Product price and costinformation includes: Ceiling Fan Table FanPrice $60 $15Unit variable cost $12 $7Direct fixed cost $23,600 $45,000Common fixed selling and administrative expenses total $85,000.Required:1. What is the sales mix estimated for next year (calculated to the lowest whole number foreach product)?2. Using the sales mix from Requirement 1, form a package of ceiling fans and table fans.How many ceiling fans and table fans are sold at break-even?3. Prepare a contribution-margin-based income statement for Vandenberg, Inc., based on theunit sales calculated in Requirement 2.4. What if Vandenberg, Inc., wanted to earn operating income equal to $14,400? Calculate thenumber of ceiling fans and table…arrow_forwardRequired: Laguna Print makes advertising hangers that are placed on doorknobs. It charges $0.18 and estimates its variable cost to be $0.16 per hanger. Laguna's total fixed cost is $2,260 per month, which consists primarily of printer depreciation and rent. Calculate the number of advertising hangers that Laguna must sell in order to break even. Note: Round your intermediate calculation to 2 decimal places and final answer to the nearest whole number. Break-even Hangersarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education