Zubac Company is a large retail furniture company that operates in two adjacent warehouses. One warehouse is a showroom, and the other is used to store merchandise. On the night of April 22, 2014, a fire broke out in the storage warehouse and destroyed the merchandise stored there. Fortunately, the fire did not reach the showroom, so all the merchandise on display was saved.

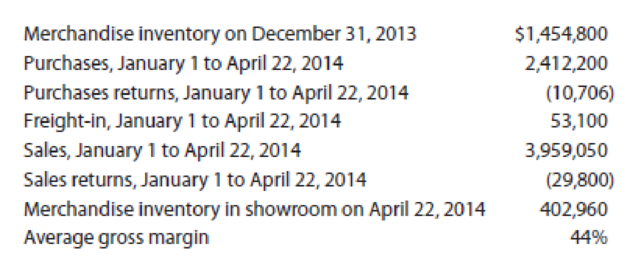

Although the company maintained a perpetual inventory system, its records were rather haphazard, and the last reliable physical inventory had been taken on December 31. In addition, there was no control of the flow of goods between the showroom and the warehouse. Thus, it was impossible to tell what goods should have been in either place. As a result, the insurance company required an independent estimate of the amount of loss. The insurance company examiners were satisfied when they received the following information:

REQUIRED

- 1. Prepare a schedule that estimates the amount of the inventory lost in the fire.

- 2. ACCOUNTING CONNECTION ▶ What are some other reasons management might need to estimate the amount of inventory?

Want to see the full answer?

Check out a sample textbook solution

Chapter 7 Solutions

Principles of Accounting

- At the end of the current period, a company checks its physical inventory against its records and discovers the following. . 1,700 units (products) were in the warehouse. . 23 of the 1,700 units in the warehouse were destroyed when a storage shelf collapsed. . 180 units were loaded in a trailer. The units are to be delivered to a customer, terms FOB destination. • 140 units were out on consignment to a retailer. Determine the number of units in the company's period-end inventory. Units in Ending Inventory Units of Product in warehouse: Add: Less: Total units in period-end inventory 1,700 units unitsarrow_forwardSouthern Distributors, Incorporated, supplies ice cream shops with various toppings for making sundaes. On November 17, 2024, a fire resulted in the loss of all of the toppings stored in one section of the warehouse. The company must provide its insurance company with an estimate of the amount of inventory lost. The following information is available from the company's accounting records: Inventory, January 1, 2024 Net purchases through November 17 Net sales through November 17 Historical gross profit ratio Ker Fruit Toppings Fruit Marshmallow Chocolate Toppings Toppings Toppings $ 29,000 $ 7,900 $ 3,900 195,000 Marshmallow Chocolate 245,000 15% Estimated cost of lost inventory 45,000 64,000 25% 1. Calculate the estimated cost of each of the toppings lost in the fire. 12,900 20,900 30%arrow_forwardSouthern Distributors, Incorporated, supplies ice cream shops with various toppings for making sundaes. On November 17, 2024, a fire resulted in the loss of all of the toppings stored in one section of the warehouse. The company must provide its insurance company with an estimate of the amount of inventory lost. The following information is available from the company's accounting records: Inventory, January 1, 2024 Net purchases through November 17 Net sales through November 17 Historical gross profit ratio Fruit Toppings Required: 1. Calculate the estimated cost of each of the toppings lost in the fire. Marshmallow Chocolate Fruit Toppings $ 24,000 170,000 220,000 Estimated cost of lost Inventory 20% Marshmallow Toppings $ 7,400 40,000 59,000 30% Chocolate Toppings $3,400 12,400 20,400 30%arrow_forward

- A fire destroyed the Churchhill Company's warehouse on March 15, 2014. Only goods with a normal selling price of $12,500 and a net realizable value of $5,000 were saved. The following information is available from the company's records : Inventory in warehouse, 01/01/2014 $250,000 Purchases 01/01/14- 03/15/14 $620,000 Purchase returns $9,500 Freight-in $14,000 $850,000 Sales, 01/01/13 - 03/15/14 Sales Return $20,000 For the period from 2009 - 2013, Churchill had a gross profit of $2,100,000 on net sales of $6,000,000. Estimate Churchill's inventory loss from the fire using the Gross Profit method.arrow_forwardMuller Computers stores its inventory in a warehouse that burned to the ground in late November, 2018. Their sales office was at a different location. In order to file a claim with their insurance, the owners ask you to estimate the inventory that was in the warehouse. The following information is available: Beginning inventory Purchases through November 30 Net sales revenue through November 30 $375,500 470,250 793,000 The company's gross profit has historically been 40% of net sales revenue. Estimate the value of the inventory destroyed in the fire using the gross profit method. a. $388,450 b. $410,000 c. $369,950 d. $528,550arrow_forwardA fire destroyed a warehouse of the Goren Group, Inc., on May 4, 2016. Accounting records on that date indicated the following: Merchandise inventory, January 1, 2016 Purchases to date $1,900,000 5,800,000 Freight-in Sales to date 400,000 8,200,000 The gross profit ratio has averaged 20% of sales for the past four years. Required: Use the gross profit cost of the inventory destroyed in the fire. hod to estimatearrow_forward

- Sandoval needs to determine its year-end inventory. The warehouse contains 23,000 units, of which 3,300 were damaged by flood and are not sellable. Another 2,300 units were purchased from Markor Company, FOB shipping point, and are currently in transit. The company also consigns goods and has 4,300 units at a consignee's location. How many units should Sandoval include in its year-end inventory?arrow_forwardOn April 10, 2023, a fire damaged the office and warehouse of Sill Company. Most of the accounting records were destroyed, but the following account balances were determined as of March 31, 2023: Sales Revenue (January 1-March 31, 2023), $180,000; Purchases (January 1- March 31, 2023), $94,000. The company's fiscal year ends on December 31. It uses a periodic inventory system. From an analysis of the April bank statement, you discover cancelled checks of $4,200 for cash purchases during the period April 1-10. Deposits during the same period totaled $18,500. Of that amount, 60% were collections on accounts receivable related to sales made in prior periods, and the balance was cash sales. Correspondence with the company's principal suppliers revealed $12,400 of purchases on account from April 1 to April 10. Of that amount, $1,600 was for merchandise in transit on April 10 that was shipped FOB destination. Correspondence with the company's principal customers produced acknowledgments of…arrow_forwardQuiz Sandoval needs to determine its year-end inventory. The warehouse contains 22,000 units, of which 3,200 were damaged by flood and are not sellable. Another 2,200 units were purchased from Markor Company, FOB shipping point, and are currently in transit. The company also consigns goods and has 4,200 units at a consignee's location. How many units should Sandoval include in its year-end inventory? Multiple Choice 23,000 31,600 20,800 25,200 28,400arrow_forward

- Southern Distributors, Incorporated, supplies ice cream shops with various toppings for making sundaes. On November 17, 2024, a fire resulted in the loss of all of the toppings stored in one section of the warehouse. The company must provide its insurance company with an estimate of the amount of inventory lost. The following information is available from the company's accounting records: Fruit Toppings Marshmallow Toppings Chocolate Toppings Inventory, January 1, 2024 $ 20,000 $ 7,000 $ 3,000 Net purchases through November 17 150,000 36,000 12,000 Net sales through November 17 200,000 55,000 20,000 Historical gross profit ratio 20% 30% 35% Required: 1. Calculate the estimated cost of each of the toppings lost in the fire.arrow_forwardOn September 22, 2021, a flood destroyed the entire merchandise inventory on hand in a warehouse owned by the Rocklin Sporting Goods Company. The following information is available from the records of the company’s periodic inventory system: Inventory, January 1, 2021 $ 140,000 Net purchases, January 1 through September 22 370,000 Net sales, January 1 through September 22 550,000 Gross profit ratio 25 % Required:Complete the below table to estimate the cost of inventory destroyed in the flood using the gross profit method. Beginning inventory Plus: Net purchases Cost of goods available for sale Less: Cost of goods sold: Net sales Less: Estimated gross profit Estimated cost of goods sold Estimated cost of inventory destroyedarrow_forwardA substantial portion of inventory owned by Prentiss Sporting Goods was recently destroyed when the roof collapsed during a rainstorm. Prentiss also lost some of its accounting records. Prentiss must estimate the loss from the storm for insurance reporting and financial statement purposes. Prentiss uses the periodic inventory system. The following accounting information was recovered from the damaged records. Beginning inventory Purchases to date of storm $203,400 398,400 599,700 Sales to date of storm The value of undamaged inyentory counted was $135,125. Historically, Prentiss' gross margin percentage has been approximately 25 percent of sales. Required Estimate the following: a. Gross margin in dollars. b. Cost of goods sold in dollars. c. Ending inventory. d. Amount of lost inventory. Gross margin a b. Cost of goods sold C. Estimated ending inventory d. Inventory lostarrow_forward

- Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage