Century 21 Accounting Multicolumn Journal

11th Edition

ISBN: 9781337679503

Author: Gilbertson

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

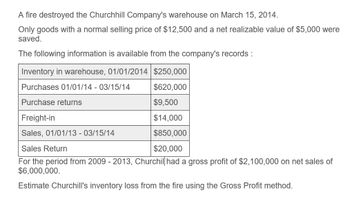

Transcribed Image Text:A fire destroyed the Churchhill Company's warehouse on March 15, 2014.

Only goods with a normal selling price of $12,500 and a net realizable value of $5,000 were

saved.

The following information is available from the company's records :

Inventory in warehouse, 01/01/2014 $250,000

Purchases 01/01/14- 03/15/14

$620,000

Purchase returns

$9,500

Freight-in

$14,000

$850,000

Sales, 01/01/13 - 03/15/14

Sales Return

$20,000

For the period from 2009 - 2013, Churchill had a gross profit of $2,100,000 on net sales of

$6,000,000.

Estimate Churchill's inventory loss from the fire using the Gross Profit method.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- A fire destroyed a warehouse of the Goren Group, Inc., on May 4, 2016. Accounting records on that date indicated the following: Merchandise inventory, January 1, 2016 Purchases to date $1,900,000 5,800,000 Freight-in Sales to date 400,000 8,200,000 The gross profit ratio has averaged 20% of sales for the past four years. Required: Use the gross profit cost of the inventory destroyed in the fire. hod to estimatearrow_forwardplease provide correct answerarrow_forwardA fire destroys all of the merchandise of Assante Companyon February 10, 2017. Presented below is informationcompiled up to the date of the fire.Inventory, January 1, 2017 $ 400,000Sales revenue to February 10, 2017 1,950,000Purchases to February 10, 2017 1,140,000Freight-in to February 10, 2017 60,000Rate of gross profi t on selling price 40%What is the approximate inventory on February 10, 2017?arrow_forward

- Calculate the estimated lossarrow_forwardprovide required answer with calculationarrow_forwardQuestion: On November 21, 2013, a fire at Hodge Company's warehouse caused severe damage to its entire inventory of Product Tex. Hodge estimates that all usable damaged goods can be sold for $12,000. The following information was available from Hodge's accounting records for Product Tex: Inventory at November 1, 2013: $104,000 Purchases from November 1, 2013, to date of fire : 143,000 Net sales from November 1, 2013, to date of fire : 236,000 Based on recent history, Hodge had a gross margin (profit) on Product Tex of 30% of net sales. Prepare a schedule to calculate the estimated loss on the inventory in the fire, using the gross profit method.arrow_forward

- The Star Company's inventory was partially destroyed on July 4, 2004, when its warehouse caught on fire early in the morning. Inventory that had a cost of $8,500 was saved. The accounting records, which were located in a fireproof vault, contained the following information. Sales (1/1/04 through 7/3/04) $225,000 Purchases (1/1704 through 7/3/04) 180,000 Inventory (1/1/04) 45,000 Gross Profit Ratio 25% of cost Using the gross profit method, what is the estimated cost of the inventory destroyed by the fire? a. $17,500b. $25,000c. $30,000d. $36,500arrow_forwardWant help to solve this questionarrow_forwardQUESTION: ON NOVEMBER 21, 2016, A FIRE AT HODGE COMPANY'S WAREHOUSE CAUSED SEVERE DAMAGE TO ITS ENTIRE INVENTORY OF PRODUCT TEX. HODGE ESTIMATES THAT ALL USABLE DAMAGED GOODS CAN BE SOLD FOR $17,000. THE FOLLOWING INFORMATION WAS AVAILABLE FROM THE RECORDS OF HODGE'S PERIODIC INVENTORY SYSTEM: INVENTORY, NOVEMBER 1 $ 125,000 NET PURCHASES FROM NOVEMBER 1, TO THE DATE OF THE FIRE 145,000 NET SALES FROM NOVEMBER 1, TO THE DATE OF THE FIRE 225,000 BASED ON RECENT HISTORY, HODGE'S GROSS PROFIT RATIO ON PRODUCT TEX IS 40% OF NET SALES. REQUIRED: CALCULATE THE ESTIMATED LOSS ON THE INVENTORY FROM THE FIRE, USING THE GROSS PROFIT METHOD.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:9781337679503

Author:Gilbertson

Publisher:Cengage