Introduction To Managerial Accounting

8th Edition

ISBN: 9781259917066

Author: BREWER, Peter C., Garrison, Ray H., Noreen, Eric W.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 4, Problem 5E

Assigning

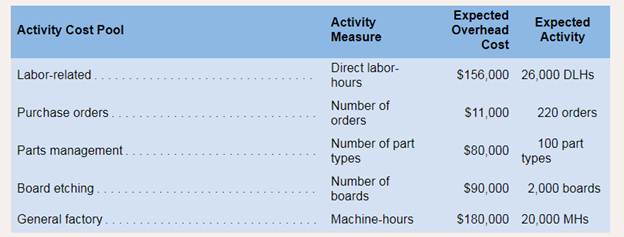

Sultan Company uses an activity-based costing system.

At the beginning of the year, the company made the following estimates of cost and activity for its five activity cost pools:

Required:

1. Compute the activity rate for each of the activity cost pools.

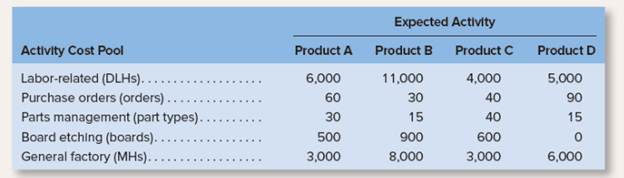

2. The expected activity for the year was distributed among the company’s four products as follows:

Using the ABC data, determine the total amount of overhead cost assigned to each product.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Draus Products Company uses activity-based costing to compute product costs for external reports. The company has three activity cost pools and applies overhead using predetermined overhead rates for each activity cost pool. Estimated costs and activities for the current year are presented below for the three activity cost pools.

estimated overhead

expected activity

activity#1

$60,048

4800

activity#2

$58,656

2400

activity#3

$130,324

4400

Actual costs and activities for the current year were as follows.

actual overhead cost

actual activity

acrivity#1

$59,798

4830

activity#2

$58,476

2370

activity#3

$130,234

4450

The total amount of overhead applied during the year was closest to:

1. $248,508

2. $248,988

3. $250,155

4. $251,334

Suki Company uses activity-based costing to compute product costs for external reports. The company has three activity cost pools

and applies overhead using predetermined overhead rates for each activity cost pool. Estimated costs and activities for the current

year are presented below for the three activity cost pools:

Estimated Overhead Cost

Activity 1

Activity 2

Activity 3

Actual activity for the current year was as follows:

Actual Activity

Activity 1

Activity 2

Activity 3

$34,300

$20,520

$36,112

O a. $30,026.50

O b. $36,112.00

OC. $36,107.00

O d. $35,773.45

1,415

1,805

1,585

0

Expected Activity

1,400

1,800

1,600

The amount of overhead applied for Activity 3 during the year was closest to:

Ø

a) Compute the predetermined overhead rate under the current method of allocation and determine the unit

product cost of each product for the current year

b) The company's overhead costs can be attributed to four major activities. These activities and the amount of

overhead cost attributable to each for the current year are given below. Using the data below and an activity-based

costing approach, determine the unit product cost of each product for the current year.

Expected Activity

Activity Cost

Estimated

Product B

Product H

Total

Pools

Overhead

Costs

Machine

setups

required

Purchase

orders issued

$180,000

600

1,200

1,800

38,382

500

100

600

Machine-

92,650

6,800

10,200

17,000

hours

required

Maintenance

138.968

693

907

1,600

requests

ued

$450,000

Chapter 4 Solutions

Introduction To Managerial Accounting

Ch. 4 - What are the three common approaches for assigning...Ch. 4 - Why does activity-based costing appeal to some...Ch. 4 - Why do departmental overheadrates something result...Ch. 4 - What are the four hierarchical levels of activity...Ch. 4 - Why activity-based costing is described as a...Ch. 4 - Why do overhead costs often shift from high-volume...Ch. 4 - What are the three major ways in which...Ch. 4 - What are the major limitations of activity-based...Ch. 4 - Prob. 1AECh. 4 - Prob. 2AE

Ch. 4 - Change the data in red so that the Data area looks...Ch. 4 - Prob. 1F15Ch. 4 - Prob. 2F15Ch. 4 - Prob. 3F15Ch. 4 - Greenvood Company manufactures two products14,000...Ch. 4 - Prob. 5F15Ch. 4 - Prob. 6F15Ch. 4 - Greenvood Company manufactures two products14,000...Ch. 4 - Prob. 8F15Ch. 4 - Greenwood Company manufactures two products14,000...Ch. 4 - Prob. 10F15Ch. 4 - Prob. 11F15Ch. 4 - Greenwood Company manufactures two products14,000...Ch. 4 - Prob. 13F15Ch. 4 - Prob. 14F15Ch. 4 - Greenwood Company manufactures two products14,000...Ch. 4 - ABC Cost Hierarchy L041 The following activities...Ch. 4 - Compute Activity Rates L042 Rustafson Corporation...Ch. 4 - Compute ABC Product Costs L043 Lamer Corporation...Ch. 4 - Contrast ABC and Conventional Product Costs L044...Ch. 4 - Assigning Overhead to Products in ABC L042, L043...Ch. 4 - Cost Hierarchy and Activity Measures L041 Various...Ch. 4 - Contrast ABC and Conventional Product Costs L042,...Ch. 4 - Prob. 8ECh. 4 - Prob. 9ECh. 4 - Rocky Mountain Corporation makes two types of...Ch. 4 - Contrasting Activity-Based Costing and...Ch. 4 - Contrasting ABC and Conventional Product cost...Ch. 4 - ABC Cost Hierarchy L041 Mitchell Corporation...Ch. 4 - Prob. 14PCh. 4 - Prob. 15PCh. 4 - Contrasting ABC and Conventional Product Costs...Ch. 4 - Contrast Activity-Based Costing and Conventional...Ch. 4 - Adria Company recently implemented an...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Patterson Company produces wafers for integrated circuits. Data for the most recent year are provided: aCalculated using number of dies as the single unit-level driver. bCalculated by multiplying the consumption ratio of each product by the cost of each activity. Required: 1. Using the five most expensive activities, calculate the overhead cost assigned to each product. Assume that the costs of the other activities are assigned in proportion to the cost of the five activities. 2. Calculate the error relative to the fully specified ABC product cost and comment on the outcome. 3. What if activities 1, 2, 5, and 8 each had a cost of 650,000 and the remaining activities had a cost of 50,000? Calculate the cost assigned to Wafer A by a fully specified ABC system and then by an approximately relevant ABC approach. Comment on the implications for the approximately relevant approach.arrow_forwardCushing, Inc., costs products using a normal costing system. The following data are available for last year: Overhead is applied on the basis of direct labor hours. What was last years per unit product cost? a. 1.39 b. 4.40 c. 4.43 d. 3.01arrow_forwardCicleta Manufacturing has four activities: receiving materials, assembly, expediting products, and storing goods. Receiving and assembly are necessary activities; expediting and storing goods are unnecessary. The following data pertain to the four activities for the year ending 20x1 (actual price per unit of the activity driver is assumed to be equal to the standard price): Required: 1. Prepare a cost report for the year ending 20x1 that shows value-added costs, non-value-added costs, and total costs for each activity. 2. Explain why expediting products and storing goods are non-value-added activities. 3. What if receiving cost is a step-fixed cost with each step being 1,500 orders whereas assembly cost is a variable cost? What is the implication for reducing the cost of waste for each activity?arrow_forward

- The following product costs are available for Kellee Company on the production of eyeglass frames: direct materials, $32,125; direct labor, $23.50; manufacturing overhead, applied at 225% of direct labor cost; selling expenses, $22,225; and administrative expenses, $31,125. The direct labor hours worked for the month are 3,200 hours. A. What are the prime costs? B. What are the conversion costs? C. What is the total product cost? D. What is the total period cost? E. If 6.425 equivalent units are produced, what is the equivalent material cost per unit? F. What is the equivalent conversion cost per unit?arrow_forwardPrimera Company produces two products and uses a predetermined overhead rate to apply overhead. Primera currently applies overhead using a plantwide rate based on direct labor hours. Consideration is being given to the use of departmental overhead rates where overhead would be applied on the basis of direct labor hours in Department 1 and on the basis of machine hours in Department 2. At the beginning of the year, the following estimates are provided: Actual results reported by department and product during the year are as follows: Required: 1. Compute the plantwide predetermined overhead rate and calculate the overhead assigned to each product. 2. Calculate the predetermined departmental overhead rates and calculate the overhead assigned to each product. 3. Using departmental rates, compute the applied overhead for the year. What is the under- or overapplied overhead for the firm? 4. Prepare the journal entry that disposes of the overhead variance calculated in Requirement 3, assuming it is not material in amount. What additional information would you need if the variance is material to make the appropriate journal entry?arrow_forwardThe following data appeared in the accounting records of Craig Manufacturing Inc., which uses the weighted average cost method: Case 1All materials are added at the beginning of the process, and labor and factory overhead are added evenly throughout the process. Case 2One-half of the materials are added at the start of the manufacturing process, and the balance of the materials is added when the units are one-half completed. Labor and factory overhead are applied evenly during the process. Make the following computations for each case: a. Unit cost of materials, labor, and factory overhead for the month b. Cost of the units finished and transferred during the month c. Cost of the units in process at the end of the montharrow_forward

- Rocks Industries has two products. They manufactured 12,539 units of product A and 8.254 units of product B. The data are: Â What is the activity rate for each cost pool?arrow_forwardMedical Tape makes two products: Generic and Label. It estimates it will produce 423,694 units of Generic and 652,200 of Label, and the overhead for each of its cost pools is as follows: It has also estimated the activities for each cost driver as follows: How much is the overhead allocated to each unit of Generic and Label?arrow_forwardRex Industries has two products. They manufactured 12,539 units of product A and 8.254 units of product B. The data are: What is the activity rate for each cost pool?arrow_forward

- Overhead costs are assigned to each product based on __________________. A. the proportion of that products use of the cost driver B. a predetermined overhead rate for a single cost driver C. price of the product D. machine hours per productarrow_forwardOn October 31, the end of the first month of operations, Maryville Equipment Company prepared the following income statement, based on the variable costing concept: Prepare an income statement under absorption costing.arrow_forwardActivity cost pools, activity rates, and product costs using activity-based costing Caldwell Home Appliances Inc. is estimating the activity cost associated with producing ovens and refrigerators. The indirect labor can be traced into four separate activity pools, based on time records provided by the employees. The budgeted activity cost and activity-base information are provided as follows: The estimated activity-base usage and unit information for two product lines was determined as follows: A. Determine the activity rate for each activity cost pool. B. Determine the activity-based cost per unit of each product.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College PubPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College PubPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

What is variance analysis?; Author: Corporate finance institute;https://www.youtube.com/watch?v=SMTa1lZu7Qw;License: Standard YouTube License, CC-BY