Comprehensive ABC implementation (Learning Objectives 2 & 3)

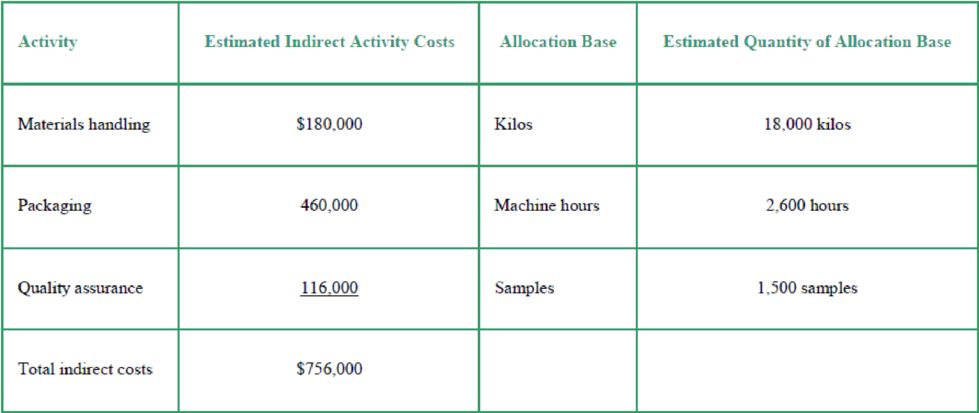

Percival Pharmaceuticals manufactures an over-the-counter allergy medication called Breathe. Percival is trying to win market share from Sudafed and Tylenol. The company has developed several different Breathe products tailored to specific markets. For example, the company sells large commercial containers of 1,000 capsules to health-care facilities and travel packs of 20 capsules to shops in airports, train stations, and hotels. Percival’s controller, Donna Swanson, has just returned from a conference on ABC. She asks Carol Yost, supervisor of the Breathe product line, to help her develop an ABC system. Swanson and Yost identify the following activities, related costs, and cost allocation bases:

The commercial-container Breathe product line had a total weight of 8,500 kilos, used 1,200 machine hours, and 240 required samples. The travel-pack line had a total weight of 6,000 kilos, used 400 machine hours, and required 340 samples. The company produced 2,500 commercial containers of Breathe and 80,000 travel packs.

Requirements

- 1. Compute the cost allocation rate for each activity.

- 2. Use the activity-based cost allocation rates to compute the indirect cost of each unit of the commercial containers and the travel packs. (Hint: Compute the total activity costs allocated to each product line and then compute the cost per unit.)

- 3. The company’s original single-allocation-based cost system allocated indirect costs to products at $350 per machine hour. Compute the total indirect costs allocated to the commercial containers and to the travel packs under the original system. Then, compute the indirect cost per unit for each product.

- 4. Compare the activity-based costs per unit to the costs from the simpler original system. How have the unit costs changed? Explain why the costs changed as they did.

Want to see the full answer?

Check out a sample textbook solution

Chapter 4 Solutions

Managerial Accounting (5th Edition)

- Jacks Apps Company researches, develops, and sells traditional applications (i.e., apps) for middle-aged mobile phone device users. In an attempt to tap into the large young adult app market to boost sales and advertising revenues. Jacks CFO, Daniel, is considering hiring students from area high schools and universities to drastically increase the innovativeness of the companys apps. Specifically, Daniel hopes that Jacks new student employee pool will make Jack's next wave of phone apps inventions popular with young adults by providing innovative services, such as exchanging payments for late-night food deliveries, arranging informal dating and other social gatherings, exchanging perspectives on different professors, and identifying unusual debit card purchase patterns to assist with early fraud detection notification. Based on cost estimates from Jacks finance team and surveys of its new target customers (i.e., New Customer Financial Survey), Daniel estimates that this new customer market would increase Jacks annual net income by 10,000,000. In addition to the New Customer Financial Survey. Jacks management team conducted a Business Sustainability Analysis. Specifically, the stakeholder engagement portion of the Business Sustainability Analysis revealed that four of Jacks most important stakeholder groups (advertisers, regulators, employees, and customers) would react stronglysome favorably and others unfavorablyto the decision to push its app business in the direction of the young adult market. Specifically, ten percent of its existing advertisers would drop Jacks as a client, thereby reducing its annual advertising revenue of 10,000,000. Also, confidential discussions with competitors suggest that the new fraud detection app would require sensitive customer information that Jacks would be unable to protect perfectly from data hackers, thereby resulting in annual fines of 1,500,000 from regulators. In addition, employee engagement meetings indicated that they would strongly favor the expansion into the young adult market. Daniel estimates that improved employee morale would significantly increase their productivity and creativity, thereby increasing annual sales revenue by 2,000,000. Finally, focus groups with existing customers revealed that they would highly value the increased workforce diversity of Jacks hiring a large number of talented young female employees with an expertise in technology. Daniel estimates that this positive customer sentiment would translate into an additional 3,000,000 in annual traditional apps sales. Required: 1. Using the New Customer Financial Survey and the Business Sustainability Analysis calculate the net change in Jacks Apps Companys net income that would be expected from pursuing the young adult app market. 2. Based on the calculation in Requirement 1, should Jacks Apps pursue the young adult app market? Explain your answer. 3. CONCEPTUAL CONNECTION Describe two additional considerations that Jacks Apps Company management might be wise to consider before making a final decision on whether or not to pursue the young adult apps market.arrow_forwardThe Shining Stars primary school was the recent recipient of a technology grant to source and implement a school management system. The school administrator is not technology savvy and therefore sought advice from three of the board members who were knowledgeable in the information systems and technology field. One director advised the administrator to purchase an off-the-shelf solution that would allow the school to get the system configured and up and running in a short period with reasonable costs. The second advised the administrator to invest in the development of a unique system to meet the custom requirements of the school’s administration. He suggested that this would create a closer fit to the school’s needs compared to purchasing software, but will cost more. The third director suggested using an open-source solution which would have little if any upfront costs but may require some customization. The school administrator must decide about which solution to go with.…arrow_forwardSuppose you decide (as did Steve Jobs and Mark Zuckerberg) to start a company. Your product is a software platform that integrates a wide range of media devices, including laptop computers, desktop computers, digital video recorders, and cell phones. Your initial market is the student body at your university. Once you have established your company and set up procedures for operating it, you plan to expand to other colleges in the area and eventually to go nationwide. At some point, hopefully sooner rather than later, you plan to go public with an IPO and then to buy a yacht and take off for the South Pacific to indulge in your passion for underwater photography. With these issues in mind, you need to answer for yourself, and potential investors, the following questions. 2. If you expanded and hired additional people to help you, might that give rise to agency problems? Explain your answerarrow_forward

- Suppose you decide (as did Steve Jobs and Mark Zuckerberg) to start a company. Your product is a software platform that integrates a wide range of media devices, including laptop computers, desktop computers, digital video recorders, and cell phones. Your initial market is the student body at your university. Once you have established your company and set up procedures for operating it, you plan to expand to other colleges in the area and eventually to go nationwide. At some point, hopefully sooner rather than later, you plan to go public with an IPO and then to buy a yacht and take off for the South Pacific to indulge in your passion for underwater photography. With these issues in mind, you need to answer for yourself, and potential investors, the following questions. a. What is an agency relationship? When you first begin operations, assuming you are the only employee and only your money is invested in the business, would any agency conflicts exist? Explain your answer. b. If you…arrow_forwardSuppose you decide (as did Steve Jobs and Mark Zuckerberg) to start a company. Your product is a software platform that integrates a wide range of media devices, including laptop computers, desktop computers, digital video recorders, and cell phones. Your initial market is the student body at your university. Once you have established your company and set up procedures for operating it, you plan to expand to other colleges in the area and eventually to go nationwide. At some point, hopefully sooner rather than later, you plan to go public with an IPO and then to buy a yacht and take off for the South Pacific to indulge in your passion for underwater photography. With these issues in mind, you need to answer for yourself, and potential investors, the following questions. 6. What is corporate governance? List five corporate governance provisions that are internal to a firm and under its control. What characteristics of the board of directors usually lead to effective corporate…arrow_forwardSuppose you decide (as did Steve Jobs and Mark Zuckerberg) to start a company. Your product is a software platform that integrates a wide range of media devices, including laptop computers, desktop computers, digital video recorders, and cell phones. Your initial market is the student body at your university. Once you have established your company and set up procedures for operating it, you plan to expand to other colleges in the area and eventually to go nationwide. At some point, hopefully sooner rather than later, you plan to go public with an IPO and then to buy a yacht and take off for the South Pacific to indulge in your passion for underwater photography. With these issues in mind, you need to answer for yourself, and potential investors, the following questions. 5. Suppose your company is very successful, and you cash out most of your stock and turn the company over to an elected board of directors. Neither you nor any other stockholders own a controlling interest (this is the…arrow_forward

- Mini Case Suppose you decide (as did Steve Jobs and Mark Zuckerberg) to start a company. Your product is a software platform that integrates a wide range of media devices, including laptop computers, desktop computers, digital video recorders, and cell phones. Your initial market is the student body at your university. Once you have established your company and set up procedures for operating it, you plan to expand to other colleges in the area and eventually to go nationwide. At some point, hopefully sooner rather than later, you plan to go public with an IPO and then to buy a yacht and take off for the South Pacific to indulge in your passion for underwater photography. With these issues in mind, you need to answer for yourself, and potential investors, the following questions. What is an agency relationship? When you first begin operations, assuming you are the only employee and only your money is invested in the business, would any agency conflicts exist? If you expanded and hired…arrow_forwardMini Case Suppose you decide (as did Steve Jobs and Mark Zuckerberg) to start a company. Your product is a software platform that integrates a wide range of media devices, including laptop computers, desktop computers, digital video recorders, and cell phones. Your initial client base is the student body at your university. Once you have established your company and set up procedures for operating it, you plan to expand to other colleges in the area and eventually to go nationwide. At some point, hopefully sooner rather than later, you plan to go public with an IPO and then to buy a yacht and take off for the South Pacific to indulge in your passion for underwater photography. With these plans in mind, you need to answer for yourself, and potential investors, the following questions: 1. Briefly describe the use of stock options in a compensation plan. What are some potential problems with stock options as a form of compensation? 2. Briefly explain how regulatory agencies and legal…arrow_forwardRequired information [The following information applies to the questions displayed below.] Johnson and Gomez, Inc., is a small firm involved in the production and sale of electronic business products. The company is well known for its attention to quality and innovation. During the past 15 months, a new product has been under development that allows users improved access to e-mail and video images. Johnson and Gomez code named the product the Wireless Wizard and has been quietly designing two models: Basic and Enhanced. Development costs have amounted to $201,000 and $282,000, respectively. The total market demand for each model is expected to be 53,000 units, and management anticipates being able to obtain the following market shares: Basic, 20 percent; Enhanced, 15 percent. Forecasted data follow. Projected selling price Per-unit production costs: Direct material Direct labor Variable overhead Marketing and advertising (fixed but avoidable) 208,000 Sales commissions* 15% Basic $…arrow_forward

- Harriet Moore is an accountant for New World Pharmaceuticals. Her duties include tracking research and development spending in the new product development division. Over the course of the past six months, Harriet has noticed that a great deal of funds have been spent on a particular project for a new drug. She hears “through the grapevine” that the company is about to patent the drug and expects it to be a major advance in antibiotics. Harriet believes that this new drug will greatly improve company performance and will cause the company’s stock to increase in value. Harriet decides to purchase shares of New World in order to benefit from this expected increase. Required What are Harriet’s ethical responsibilities, if any, with respect to the information she has learned through her duties as an accountant for New World Pharmaceuticals? What are the implications of her planned purchase of New World shares?arrow_forward1. Explain how the organizations culture would influence the design of a new Accounting Information system for a company. 2. An university has various schools and departments that offer various Degree and Diploma courses. The University has been offering courses through two modes of study that include the Full-Time classes and Evening Classes. The university management has been evaluating the possibility of introducing a new mode of study where the university will offer the students the option of selecting 100% online classes option. The University will deploy this 100% online classes option by using Zoom video conferencing software. Other software’s and platforms that the university will use for the 100% online classes mode like google classroom and other softwares. The university has invited you as an expert of accounting information systems to help in the design and implementation of a new revenue transaction cycle system that will be used for the new 100% online classes option mode…arrow_forward

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning  Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning