Compare traditional and ABC cost allocations at a pharmacy (Learning Objective 2)

Gracen Pharmacy, part of a large chain of pharmacies, fills a variety of prescriptions for customers. The complexity of prescriptions filled by Gracen varies widely; pharmacists can spend between five minutes and six hours on a prescription order. Traditionally, the pharmacy has allocated its

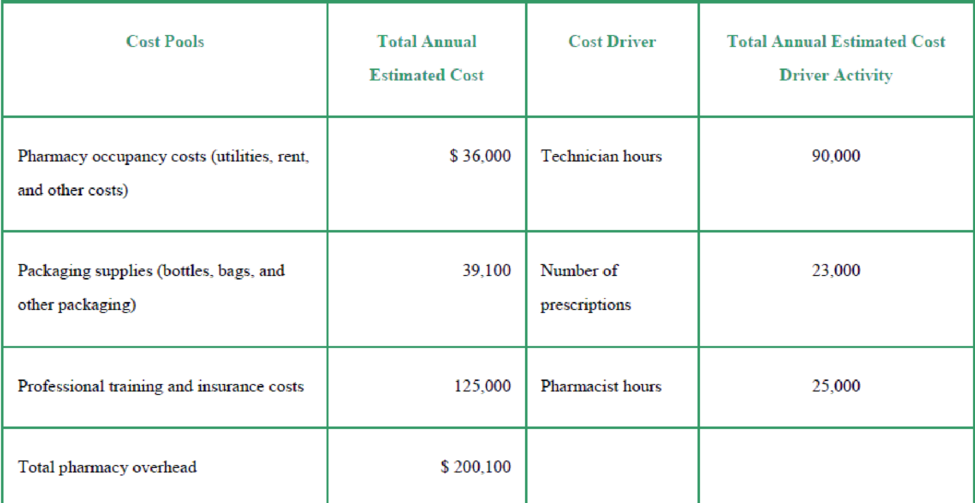

The pharmacy chain’s controller is exploring whether activity-based costing (ABC) may better allocate the pharmacy overhead costs to pharmacy orders. The controller has gathered the following information:

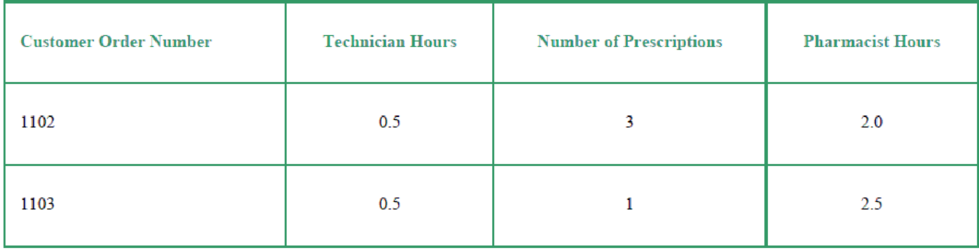

The clerk for Gracen Pharmacy has gathered the following information regarding two recent pharmacy orders:

Requirements

- 1. What is the traditional overhead rate based on the number of prescriptions?

- 2. How much pharmacy overhead would be allocated to customer order number 1102 if traditional overhead allocation based on the number of prescriptions is used?

- 1. How much pharmacy overhead would be allocated to customer order number 1103 if traditional overhead allocation based on the number of prescriptions is used?

- 2. What are the following cost pool allocation rates?

- a. Pharmacy occupancy costs

- b. Packing supplies

- c. Professional training and insurance costs

- 3. How much would be allocated to customer order number 1102 if activity-based costing (ABC) is used to allocate the pharmacy overhead costs?

- 4. How much would be allocated to customer order number 1103 if activity-based costing (ABC) is used to allocate the pharmacy overhead costs?

- 5. Which allocation method (traditional or activity-based costing) would produce a more accurate product cost? Explain your answer.

Want to see the full answer?

Check out a sample textbook solution

Chapter 4 Solutions

Managerial Accounting (5th Edition)

- Cost Identification Following is a list of cost terms described in the chapter as well as a list of brief descriptive settings for each item. Cost terms: a. Opportunity cost b. Period cost c. Product cost d. Direct labor cost e. Selling cost f. Conversion cost g. Prime cost h. Direct materials cost i. Manufacturing overhead cost j. Administrative cost Settings: 1. Marcus Armstrong, manager of Timmins Optical, estimated that the cost of plastic, wages of the technician producing the lenses, and overhead totaled 30 per pair of single-vision lenses. 2. Linda was having a hard time deciding whether to return to school. She was concerned about the salary she would have to give up for the next 4 years. 3. Randy Harris is the finished goods warehouse manager for a medium-sized manufacturing firm. He is paid a salary of 90,000 per year. As he studied the financial statements prepared by the local certified public accounting firm, he wondered how his salary was treated. 4. Jamie Young is in charge of the legal department at company headquarters. Her salary is 95,000 per year. She reports to the chief executive officer. 5. All factory costs that are not classified as direct materials or direct labor. 6. The new product required machining, assembly, and painting. The design engineer asked the accounting department to estimate the labor cost of each of the three operations. The engineer supplied the estimated labor hours for each operation. 7. After obtaining the estimate of direct labor cost, the design engineer estimated the cost of the materials that would be used for the new product. 8. The design engineer totaled the costs of materials and direct labor for the new product. 9. The design engineer also estimated the cost of converting the raw materials into their final form. 10. The auditor for a soft drink bottling plant pointed out that the depreciation on the delivery trucks had been incorrectly assigned to product cost (through overhead). Accordingly, the depreciation charge was reallocated on the income statement. Required: Match the cost terms with the settings. More than one cost classification may be associated with each setting; however, select the setting that seems to fit the item best. When you are done, each cost term will be used just once.arrow_forwardCalculating and Interpreting Activity-Based Costing Data Hiram’s Lakeside is a popular restaurant located on Lake Washington in Seattle. The owner of the restaurant has been trying to better understand costs at the restaurant and has hired a student intern to conduct an activity-based costing study. The intern, in consultation with the owner, identified three major activities and then completed the first-stage allocations of costs to the activity cost pools. The results appear below. The above costs include all of the costs of the restaurant except for organization-sustaining costs such as rent, property taxes, and top-management salaries. Some costs, such as the cost of cleaning the linens that cover the restaurant’s tables, vary with the number of parties served. Other costs, such as washing plates and glasses, depend on the number of diners served or the number of drinks served. Prior to the activity-based costing study, the owner knew very little about the costs of the restaurant.…arrow_forwardTechPro offers instructional courses in e-commerce website design. The company holds classes in a building that it owns. Identify each of TechPro’s costs below as (a) variable or fixed and (b) direct or indirect by selecting the appropriate dropdowns. Assume the cost object is an individual class. Variable or Fixed Direct or Indirect 1. Instructional manuals for students 2. Advertising Fixed Indirect 3. Salesperson salary 4. Sales commissions 5. Computer printer ink 6. Depreciation on classroom buildingarrow_forward

- Chapter 2 (Continued): Basic Cost Management Concepts College offers students a number of different majors and disciplines. These majors and disciplines have department chairpersons who are responsible for the department budget preparation. Please define direct costs and indirect costs and then prepare a list of three direct and three indirect costs for the Accounting Department at College. Hint: See Exercise 10 in Chapter 2 of your eText.arrow_forwardMatch each of the following cost items with the value chain business function where you would expect the cost to be incurred: Cost Item 1. Labor time to repair products under warranty 2. Radio commercials 3. Labor costs of delivering customer orders 4. Testing of competitor's product 5. Direct manufacturing labor costs 6. Development of order tracking system for online sales 7. Design cost of new product brochures 8. Hours spent designing childproof bottles 9. Training costs for representatives to staff the customer call center 10. Installation of robotics equipment in manufacturing plant Business Functionarrow_forwardMaloney Pharmaceuticals manufacturers an over-the-counter allergy medication. The company sells both large commercial containers of 1,000 capsules to health care facilities and travel packs of 20 capsules to shops in airports, train stations, and hotels. The following information has been developed to determine if an activity-based costing system would be beneficial: LOADING... (Click the icon to view the information.) Read the requirements LOADING... . Requirement 1. Maloney's original single plantwide overhead allocation rate costing system allocated indirect costs to products at $154.88 per machine hour. Compute the total indirect costs allocated to the commercial containers and to the travel packs under the original system. Then compute the indirect cost per unit for each product. Round to two decimal places. Select the formula, and then enter the amounts to compute the indirect cost per unit for each product.…arrow_forward

- Executional Cost Drivers: Internet Retailer Assume that you are a consultant for a start-upinternet retailer, Bikers.com, which provides a variety of bicycle parts and accessories in a convenient and effective customer service approach. The firm operates from an office building and nearbywarehouse located in Danville, Virginia. Currently, the firm has 10 permanent administrative staff;6 customer service representatives who respond to customer inquiries; and 12 employees who pick,pack, and ship customer orders. All orders are placed over the firm’s website. A toll-free telephonenumber is available for customer service. The firm’s sales increased at about 20% per year in the lasttwo years, a decline from the 50% rate in its first three years of operation. Management is concernedthat the decline will delay the firm’s first expected profit, which had been projected to occur in thenext two years. The firm is privately held and has been financed with a combination of bank loans,personal…arrow_forwardJob costing; variation on actual, normal, and variation from normal costing. Creative Solutions designs Web pages for clients in the education sector. The company’s job-costing system has a single direct cost category (Web-designing labor) and a single indirect cost pool composed of all overhead costs. Overhead costs are allocated to individual jobs based on direct labor-hours. The company employs six Web designers. Budgeted and actual information regarding Creative Solutions follows:arrow_forwardPlease solve the task by reading attached pictures of background knowledge. Christine wants to improve the profit situation of her company - and learn more about the profit per product for the past month. Christine is a follower of a full costing approach. Therefore all the costs should be allocated to the products. Perform this calculation by calculating three alternatives for the distribution of fixed overheads:? •Distribution in equal parts? •Distribution proportional to sales ? •Distribution proportional to sales. All three allocation keys are common allocation routes in practice. Which one should Christine prefer?arrow_forward

- Time-Driven Activity-Based Costing Saratoga Company manufactures jobs to customer specifications. The company is conducting a time-driven activity-based costing study in its Purchasing Department to better understand how Purchasing Department labor costs are consumed by individual jobs. To aid the study, the company provided the following data regarding its Purchasing Department and three of its many jobs: Required: 1. Calculate the cost per minute of the resource supplied in the Purchasing Department. 2. Calculate the time-driven activity rate for each of Saratoga’s three activities. 3. Calculate the total purchasing labor costs assigned to Job X, Job Y, and Job Z.arrow_forwardMed Max buys surgical supplies from a variety of manufacturers and then resells and delivers these supplies to dozens of hospitals. In the face of declining profits, Med Max decided to implement an activity-based costing system to improve its understanding of the costs incurred to serve each hospital. The company broke its selling and administrative expenses into four activities as shown below: Activity Cost Pool Customer deliveries Manual order processing Activity Measure Number of deliveries Number of manual orders Number of electronic orders Number of line items picked Electronic order processing Line item picking Total selling and administrative expenses Med Max gathered the data below for two of the many hospitals that it serves-City General and County General: Activity City General 10 0 10 100 Required 1 Required 2 County General Activity Cost Pool 20 40 Required: 1. Compute the activity rate for each activity cost pool. 2. Compute the total activity costs that would be assigned…arrow_forwardApplying Excel - Data Visualization: Exercise (Part 2 of 2) On the Data Visualization - Student tab in your Excel spreadsheet, update the price per unit for all four products for Office Warehouse Inc. with the data below: Products Available Paper Pens Sticky Notes Envelopes Required: Create a Pivot Table and determine the following information while analyzing the data: 2. Which product has the highest total units ordered and the highest total sales? (Enter your Units Ordered to the nearest whole unit and your Total Sales to 2 decimal places.) Units Ordered Total Sales Price per Unit $20.00 per case: $ 9.00 per box $9.00 per package $ 4.50 per box Product Totalarrow_forward

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning