Apply activity cost allocation rates (Learning Objective 2)

SUSTAINABILITY

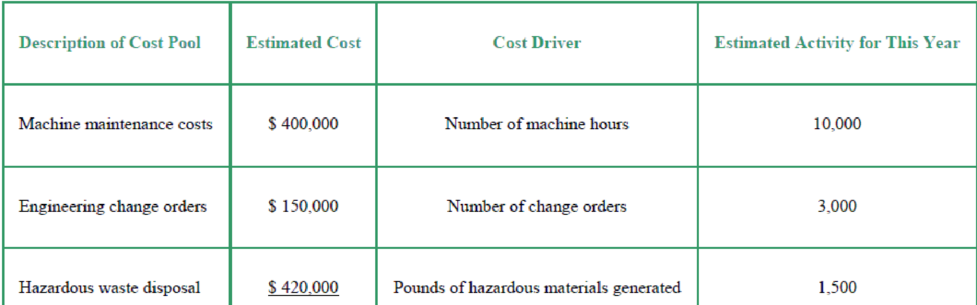

Holiday Industries manufactures a variety of custom products. The company has traditionally used a plantwide manufacturing

Up to this point, hazardous waste disposal fees have been absorbed into the plantwide manufacturing overhead rate and allocated to all products as part of the manufacturing overhead process. Recently, the company has been experiencing significantly increased waste-disposal fees for hazardous waste generated by certain products, and as a result, profit margins on all products have been negatively impacted. Company management wants to implement an activity-based costing system so that managers know the cost of each product, including its hazardous waste disposal costs.

Expected usage and

During the year, Job 356 is started and completed. Usage for this job follows:

| 290 pounds of direct materials at $35 per pound |

| 20 direct labor hours used at $20 per labor hour |

| 60 machine hours used |

| 9 change orders |

| 60 pounds of hazardous waste generated |

Requirements

- 1. Calculate the cost of Job 356 using the traditional plantwide manufacturing overhead rate based on machine hours.

- 2. Calculate the cost of Job 356 using activity-based costing.

- 3. If you were a manager, which cost estimate would provide you more useful information? How might you use this information?

Want to see the full answer?

Check out a sample textbook solution

Chapter 4 Solutions

Managerial Accounting (5th Edition)

- Bordner Company manufactures HVAC (heating, ventilation, and air conditioning) systems for commercial buildings. For each new design, Bordner faces a 90 percent learning rate. On average, the first unit of a new design takes 600 hours. Direct labor is paid 25 per hour. Required: 1. Set up a table with columns showing: the cumulative number of units, cumulative average time per unit in hours, and cumulative total time in hours. Show results by row for total production of one unit, two units, four units, eight units, and sixteen units. (Round hour answers to two significant digits.) 2. What is the total labor cost if Bordner makes the following number of units: one, four, sixteen? What is the average cost per system for the following number of systems: one, four, or sixteen? (Round your answers to the nearest dollar.) 3. Using the logarithmic function, set up a table with columns showing: the cumulative number of units, cumulative average time per unit in hours, cumulative total time in hours, and the time for the last unit. Show results by row for each of units one through eight. (Round answers to two significant digits.)arrow_forwardHarriman Industries manufactures engines for the aerospace industry. It has completed manufacturing the first unit of the new ZX-9 engine design. Management believes that the 1,000 labor hours required to complete this unit are reasonable and is prepared to go forward with the manufacture of additional units. An 80 percent cumulative average-time learning curve model for direct labor hours is assumed to be valid. Data on costs are as follows: Required: 1. Set up a table with columns for cumulative number of units, cumulative average time per unit in hours, and the cumulative total time in hours. Complete the table for 1, 2, 4, 8, 16, and 32 units. (Round hours to one significant digit.) 2. What are the total variable costs of producing 1, 2, 4, 8, 16, and 32 units? What is the variable cost per unit for 1, 2, 4, 8, 16, and 32 units?arrow_forwardFisher Fixtures manufactures three types of lighting fixtures, with model names of Silver, Gold, and Platinum. It applies all indirect costs according to an annual predetermined rate based on direct labor-hours. The plant controller has recommended that the company switch to an activity-based costing system. The controller's staff prepared the following cost estimates for next year (year 2) for the recommended cost drivers. Activity Recommended Cost Driver Estimated Cost Estimated Cost Driver Activity Purchasing material Number of purchase orders $ 130,800 240 purchase orders Receiving material Direct materials cost 238,400 $ 2,980,000 Setting up equipment Number of production runs 231,840 120 runs Machine depreciation and maintenance Machine-hours 80,260 16,052 hours Ensuring regulatory compliance Number of inspections 459,000 54 inspections Shipping Number of units shipped 1,087,200 604,000 units Total estimated cost $ 2,227,500 In addition, management…arrow_forward

- I have the following information: direct materials $250 and total manufacturing cost $700. Overhead applied to jobs at a rate of 200% of direct labor cost. This is for Chapter 2 job costing in managerial accounting. I am supposed to figure out conversion cost, direct labor cost, and manufacturing overhead. I know the formula for conversion cost= direct labor + manufacturing OH Prime cost= direct labor + direct materials How do I figure out direct labor cost with the given information? The learning objective states calcualte predetermined overhead rate, but I do not have estimated manufacturing cost and estimated labor. Can you please help? Thanks, Erica Gordonarrow_forwardActivity-Based Costing Slack Corporation has the following predicted indirect costs and cost drivers for the year for the given activity cost pools: Maintenance Materials handling Machine setups Inspections Machine hours Material moves Machine setups Inspection hours Fabrication Department Finishing Department Cost Driver Machine hours Material moves Direct materials cost Direct labor cost Machine hours (Fabrication) Machine hours (Finishing) Materials moves Machine setups Inspection hours $150,000 The following activity predictions were also made for the year: Fabrication Department Finishing Department Direct materials Direct labor $50,000 30,000 70,000 It is assumed that the cost per unit of activity for a given activity does not vary between departments. Slack's president, Charles Slack, is trying to evaluate the company's product mix strategy regarding two of its five product models, ZX300 and SL500. The company has been using a company- wide overhead rate based on machine hours…arrow_forwardAsteroid produces and sells mountain bikes and has four keys products. this year, for the first time,it is operating an activity based costing system in parallel with its long-standing traditional costing system (which absorbs overheads on a machine hour basis). the planned production activity-based cost pools and cost driver activity levels for all the output for the year are as follow: Activity Cost Pool Activity Level Purchasing materials 750.000 5000 purchase orders Storing materials 800.000 1600 issue notes Setting up machinery 600.000 600 set-ups Running machinery 990.000 10.000 machine hours Total production overheads 3140.000 An analysis of actual production output for its two star products shows the following figures: Activity Tour Giro Units produced 1500 800 Purchase orders 1500 500 Store issue notes 800 400 Set-ups 235 100 Machine Hours 4000 3000 furthermore, cost in euro for direct material and hour for these two models are as follow:…arrow_forward

- Churchill Products is considering updating its cost system to an activity-based costing system and is interested in understanding the effects. The company’s cost accountant has identified three overhead cost pools along with appropriate cost drivers for each pool. Cost Pools Costs Activity Drivers Utilities $ 310,000 62,000 machine-hours Scheduling and setup $ 290,000 580 setups Material handling $ 795,000 1,590,000 pounds of material The company manufactures three models of water basins (Oval, Round, and Square). The plans for production for the next year and the budgeted direct costs and activity by product line are as follows. Products Oval Round Square Total direct costs (material and labor) $80,000 $80,000 $70,000 Total machine-hours 30,000 10,000 22,000 Total number of setups 60 300 220 Total pounds of material 490,000 290,000 810,000 Total direct labor-hours 3,500 2,000 4,500 Number of units produced 4,400 2,000 6,000 Required: (Do not…arrow_forwardOriole Stairs Co. designs and builds factory-made premium wooden stairways for homes. The manufactured stairway components (spindles, risers, hangers, hand rails) permit installation of stairways of varying lengths and widths. All are of white oak wood. Budgeted manufacturing overhead costs for the year 2025 are as follows. Purchasing Handling materials Production (cutting, milling, finishing) Setting up machines Inspecting Inventory control (raw materials and finished goods) Utilities Overhead Cost Pools Total budgeted overhead costs Activity Cost Pools Purchasing Handling materials. Production (cutting, milling, finishing) Setting up machines Inspecting Inventory control (raw materials and finished goods) Utilities Machine hours For the last 4 years, Oriole Stairs Co. has been charging overhead to products on the basis of machine hours. For the year 2025, 100,000 machine hours are budgeted. Direct materials Direct labor Jeremy Nolan, owner-manager of Oriole Stairs Co., recently…arrow_forwardOriole Stairs Co.designs and builds factory-made premium wooden stairways for homes. The manufactured stairway components (spindles, risers, hangers, hand rails) permit installation of stairways of varying lengths and widths. All are of white oak wood. Budgeted manufacturing overhead costs for the year 2025 are as follows. Overhead Cost Pools Purchasing Handling materials Production (cutting, milling, finishing) Setting up machines Inspecting Inventory control (raw materials and finished goods) Utilities Total budgeted overhead costs Activity Cost Pools Purchasing Handling materials Production (cutting, milling, finishing) Setting up machines. For the last 4 years, Oriole Stairs Co. has been charging overhead to products on the basis of machine hours. For the year 2025, 100,000 machine hours are budgeted. Inspecting Inventory control (raw materials and finished goods) Utilities Jeremy Nolan, owner-manager of Oriole Stairs Co., recently directed his accountant, Bill Seagren, to…arrow_forward

- Learning CurveBordner Company manufactures HVAC (heating, ventilation, and air conditioning) systems for commercial buildings. For each new design, Bordner faces a 90 percent learning rate. On aver-age, the first unit of a new design takes 600 hours. Direct labor is paid $25 per hour. Required:1. Set up a table with columns showing: the cumulative number of units, cumulative average time per unit in hours, and cumulative total time in hours. Show results by row for total pro-duction of one unit, two units, four units, eight units, and sixteen units. (Round hour answers to two significant digits.) 2. What is the total labor cost if Bordner makes the following number of units: one, four, sixteen? What is the average cost per system for the following number of systems: one, four, or sixteen? (Round your answers to the nearest dollar.) 3. Using the logarithmic function, set up a table with columns showing: the cumulative number of units, cumulative average time per unit in hours,…arrow_forwardNUBD manufactures specialty components for the electronics industry in a highly labor intensive environment. ABC Electronics has asked Lake to bid on a component that NUBD made for ABC last month. The previous order was for 80 units and required 160 hours of direct labor to manufacture. ABC would now like 560 additional components. NUBD experiences an 80% learning curve on all of its jobs. The number of direct labor hours needed for NUBD to complete the 560 additional components is?arrow_forwardFisher Fixtures manufactures three types of lighting fixtures, with model names of Silver, Gold, and Platinum. It applies all indirect costs according to an annual predetermined rate based on direct labor-hours. The plant controller has recommended that the company switch to an activity-based costing system. The controller's staff prepared the following cost estimates for next year (year 2) for the recommended cost drivers. Activity Purchasing material Receiving material Setting up equipment Machine depreciation and maintenance Ensuring regulatory compliance Shipping Total estimated cost Number of units produced Direct labor-hours In addition, management estimated 45,000 direct labor-hours for year 2. Assume that the following cost-driver volumes occurred in January, year 2: Number of purchase orders Direct materials costs Number of production runs Machine-hours Number of inspections Units shipped Recommended Cost Driver Number of purchase orders Direct materials cost Number of…arrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning